e. Suppose that the Argentine government places a tax on the exports of beef to keep domestic food prices low. Specifically, for every one unit of beef sold internationally, the government takes 1/4 of a unit of beef. What is the effective (i.e. taxes included) world relative price those in Argentina face? How will real wages (in units of manufactures) change in response to the tax? How do you think vegetarians (who do not care about the price of beef) in Argentina feel about this policy?

e. Suppose that the Argentine government places a tax on the exports of beef to keep domestic food prices low. Specifically, for every one unit of beef sold internationally, the government takes 1/4 of a unit of beef. What is the effective (i.e. taxes included) world relative price those in Argentina face? How will real wages (in units of manufactures) change in response to the tax? How do you think vegetarians (who do not care about the price of beef) in Argentina feel about this policy?

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter32: Macroeconomic Policy Around The World

Section: Chapter Questions

Problem 27CTQ: Explain what will happen in a nation that tries to solve a structural unemployment problem using...

Related questions

Question

Please do only the last one (and please not that beef profuction = 8 as it says in the problem)

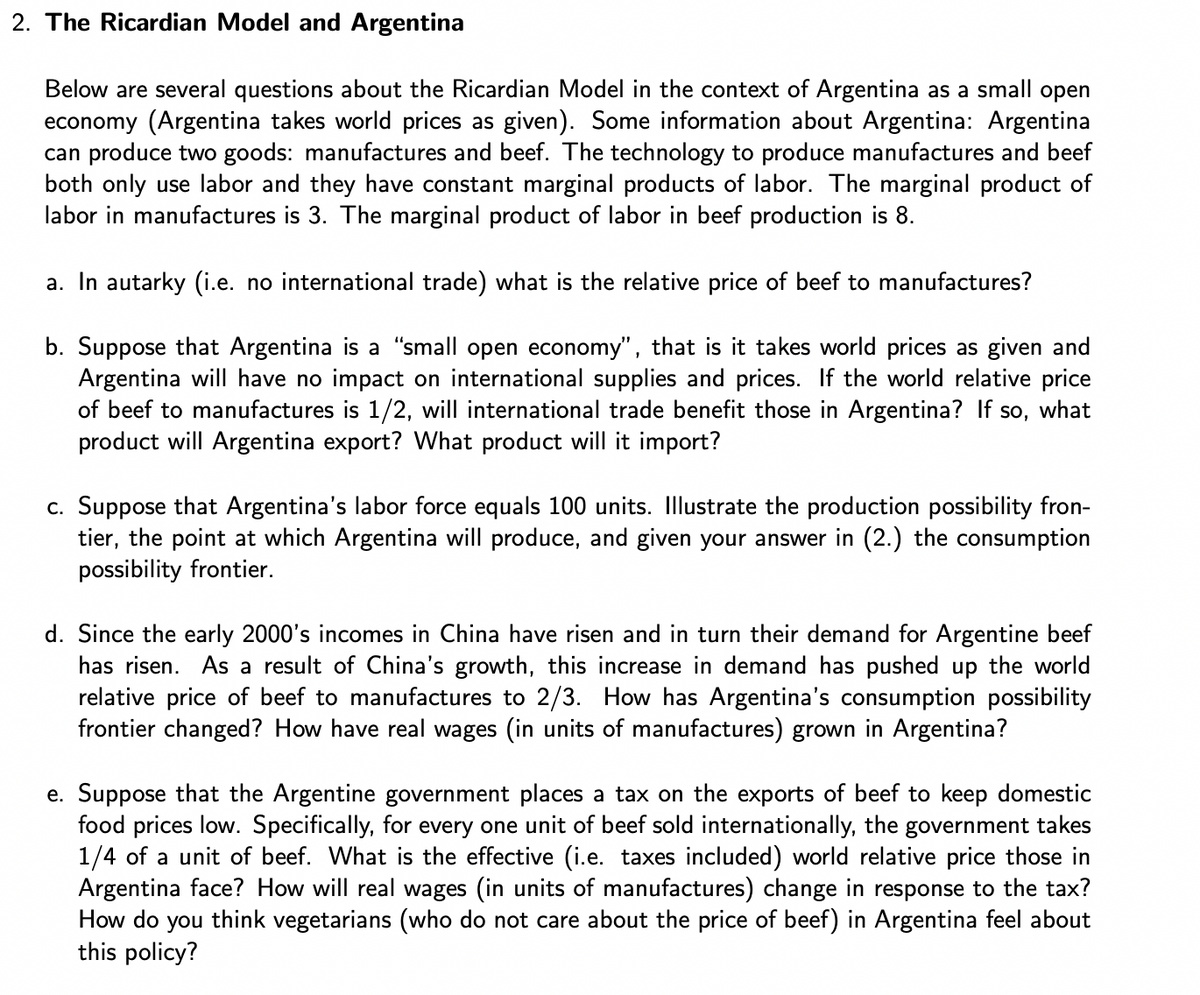

Transcribed Image Text:2. The Ricardian Model and Argentina

Below are several questions about the Ricardian Model in the context of Argentina as a small open

economy (Argentina takes world prices as given). Some information about Argentina: Argentina

can produce two goods: manufactures and beef. The technology to produce manufactures and beef

both only use labor and they have constant marginal products of labor. The marginal product of

labor in manufactures is 3. The marginal product of labor in beef production is 8.

a. In autarky (i.e. no international trade) what is the relative price of beef to manufactures?

b. Suppose that Argentina is a "small open economy", that is it takes world prices as given and

Argentina will have no impact on international supplies and prices. If the world relative price

of beef to manufactures is 1/2, will international trade benefit those in Argentina? If so, what

product will Argentina export? What product will it import?

c. Suppose that Argentina's labor force equals 100 units. Illustrate the production possibility fron-

tier, the point at which Argentina will produce, and given your answer in (2.) the consumption

possibility frontier.

d. Since the early 2000's incomes in China have risen and in turn their demand for Argentine beef

has risen. As a result of China's growth, this increase in demand has pushed up the world

relative price of beef to manufactures to 2/3. How has Argentina's consumption possibility

frontier changed? How have real wages (in units of manufactures) grown in Argentina?

e. Suppose that the Argentine government places a tax on the exports of beef to keep domestic

food prices low. Specifically, for every one unit of beef sold internationally, the government takes

1/4 of a unit of beef. What is the effective (i.e. taxes included) world relative price those in

Argentina face? How will real wages (in units of manufactures) change in response to the tax?

How do you think vegetarians (who do not care about the price of beef) in Argentina feel about

this policy?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning