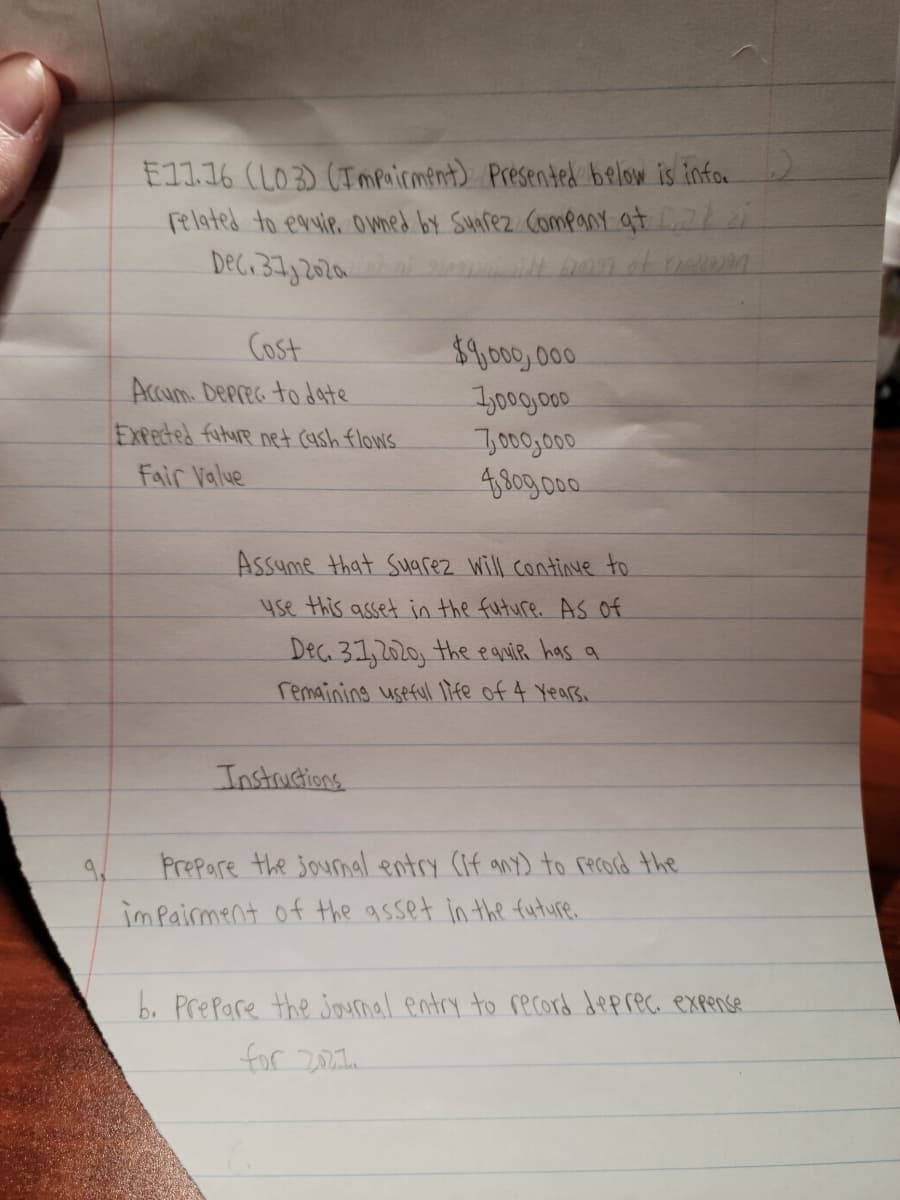

E11.16 (LO3) (Tmpairment) Presented below is infor related to evie o wned by Suarez Company at 22 2 Cost $9000, 000 Accum DepreG to date EXPected future net cash flows T,000,000 4809.000 Fair Value Assume that Sua rez will continye to 4se this asset in the future. AS of Dec 31,2020, the equiR has a remaining useful ife of 4 Years. Instructions Prepare the sournal entry (if any) to record the imPairment of the asset in the future. b. PrePare the jounal entry to record deprec expense for 2011a

E11.16 (LO3) (Tmpairment) Presented below is infor related to evie o wned by Suarez Company at 22 2 Cost $9000, 000 Accum DepreG to date EXPected future net cash flows T,000,000 4809.000 Fair Value Assume that Sua rez will continye to 4se this asset in the future. AS of Dec 31,2020, the equiR has a remaining useful ife of 4 Years. Instructions Prepare the sournal entry (if any) to record the imPairment of the asset in the future. b. PrePare the jounal entry to record deprec expense for 2011a

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

I need help with that Accounting Question given.

Transcribed Image Text:E11.16 (LO3) (Tmpairment) Presented below is infor

related to evvie o wned by Suarez Company at

Dec.37g2020

Cost

$9000,000

Accum Deerec to date

EXPected future net Cash flows

T,o00g00

Fair Value

480g.000

Assume that Suarez Will continue to

yse this asset in the future. AS of

Dec 31,2020 the eauir has a

remaining useful ife of 4 Years.

Instrutions

Prepare the sournal entry (if any) to record the

im Pairment of the asset in the future.

b. PrePare the joumal entry to record deprec expense

for 201ta

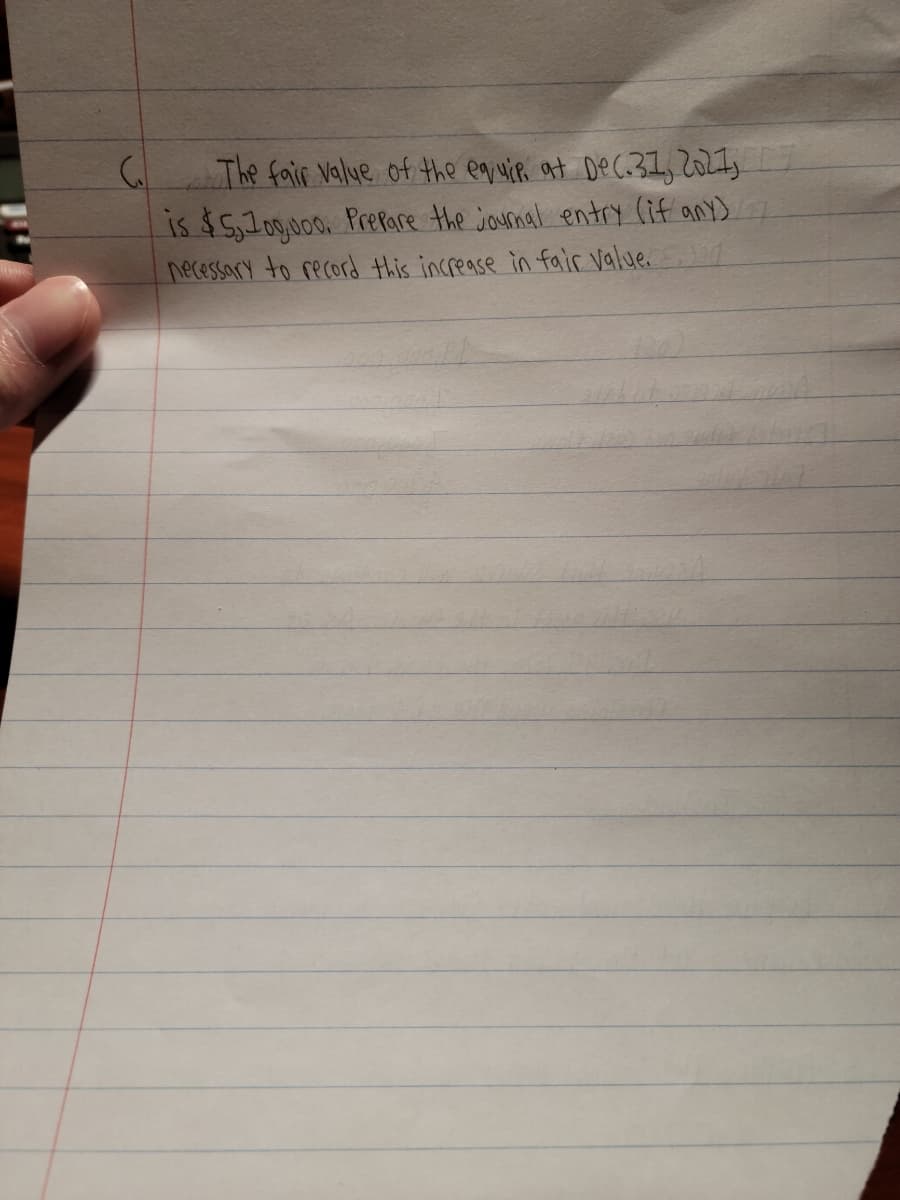

Transcribed Image Text:The fair Value of the eqiuir at Dec.3I, 20ty

is $5,109.000. PrePace the jourmal entry (if any)

necessary to record this increase in fair value. :7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education