vision for warranty Deposits received in advance Carrying amount $150 000

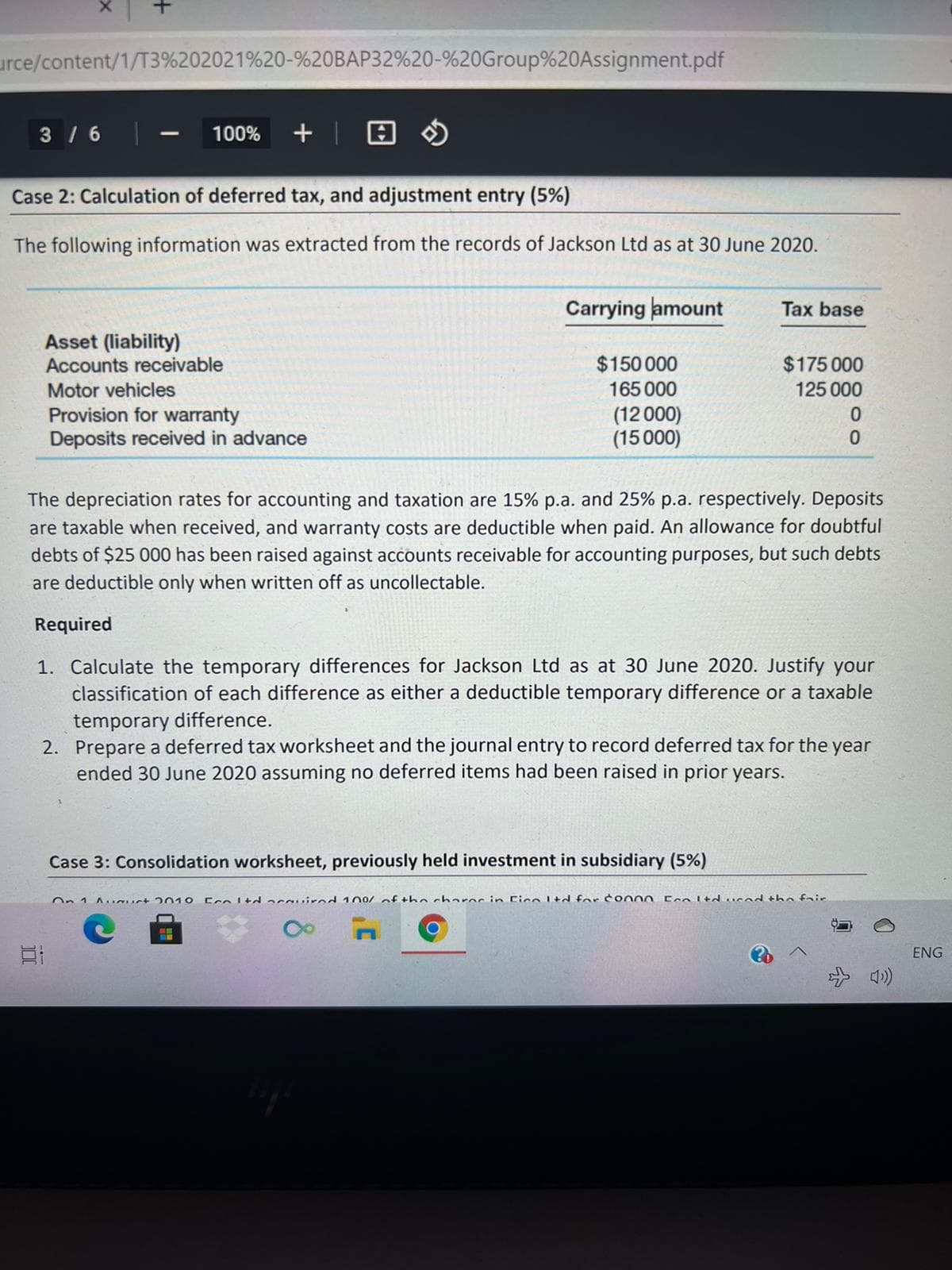

The following information was extracted from the records of Jackson Ltd as at 30 June 2020.

Asset (liability)

Motor vehicles

Provision for warranty

Deposits received in advance

Carrying amount

$150 000

165 000

(12 000)

(15 000)

Tax base

$175 000

125 000

0

0

The

are taxable when received, and warranty costs are deductible when paid. An allowance for doubtful

debts of $25 000 has been raised against accounts receivable for accounting purposes, but such debts

are deductible only when written off as uncollectable.

Required

1. Calculate the temporary differences for Jackson Ltd as at 30 June 2020. Justify your

classification of each difference as either a deductible temporary difference or a taxable

temporary difference.

2. Prepare a

ended 30 June 2020 assuming no deferred items had been raised in prior years.

Step by step

Solved in 3 steps with 4 images