E12.6 (LO 1) (Payroll Tax Entries) The payroll of YellowCard Company for September 2025 is as follows. Total payroll was $480,000, of which $110,000 is exempt from Social Security tax because it represented amounts paid in excess of $142,800 to certain employees. The amount paid to employees in excess of $7,000 (the maximum for both federal and state unemployment taxes) was $400,000. Income taxes in the amount of $80,000 were withheld, as was $9,000 in union dues. The state unemployment tax is 3.5%, but Yellow Card Company is allowed a credit of 2.3% by the state for its unemployment experience. Also, assume that the current FICA tax is 7.65% on an employee's wages to $142,800 and 1.45% in excess of $142,800. The federal unemployment tax rate is 0.8% after state credit. Instructions Prepare the necessary journal entries if the wages and salaries paid and the employer payroll taxes are recorded separately.

E12.6 (LO 1) (Payroll Tax Entries) The payroll of YellowCard Company for September 2025 is as follows. Total payroll was $480,000, of which $110,000 is exempt from Social Security tax because it represented amounts paid in excess of $142,800 to certain employees. The amount paid to employees in excess of $7,000 (the maximum for both federal and state unemployment taxes) was $400,000. Income taxes in the amount of $80,000 were withheld, as was $9,000 in union dues. The state unemployment tax is 3.5%, but Yellow Card Company is allowed a credit of 2.3% by the state for its unemployment experience. Also, assume that the current FICA tax is 7.65% on an employee's wages to $142,800 and 1.45% in excess of $142,800. The federal unemployment tax rate is 0.8% after state credit. Instructions Prepare the necessary journal entries if the wages and salaries paid and the employer payroll taxes are recorded separately.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 9DQ: LO.2 Osprey Corporation, an accrual basis taxpayer, had taxable income for 2019 and paid 40,000 on...

Related questions

Question

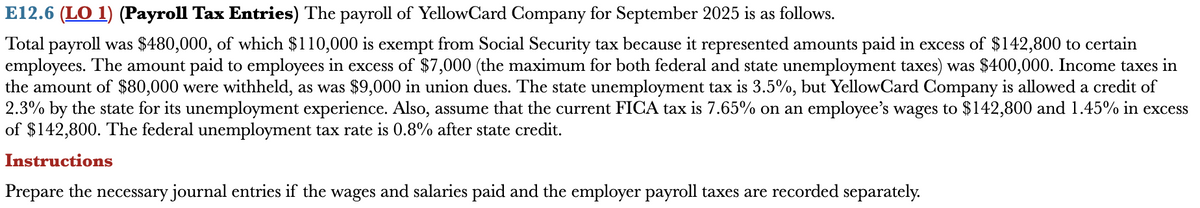

Transcribed Image Text:E12.6 (LO 1) (Payroll Tax Entries) The payroll of YellowCard Company for September 2025 is as follows.

Total payroll was $480,000, of which $110,000 is exempt from Social Security tax because it represented amounts paid in excess of $142,800 to certain

employees. The amount paid to employees in excess of $7,000 (the maximum for both federal and state unemployment taxes) was $400,000. Income taxes in

the amount of $80,000 were withheld, as was $9,000 in union dues. The state unemployment tax is 3.5%, but YellowCard Company is allowed a credit of

2.3% by the state for its unemployment experience. Also, assume that the current FICA tax is 7.65% on an employee's wages to $142,800 and 1.45% in excess

of $142,800. The federal unemployment tax rate is 0.8% after state credit.

Instructions

Prepare the necessary journal entries if the wages and salaries paid and the employer payroll taxes are recorded separately.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning