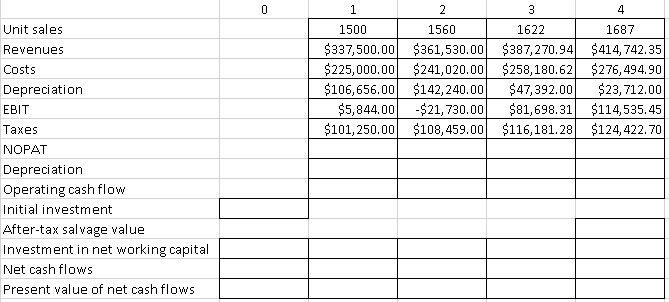

wagger Manufacturing Corporation (SMC) is planning to invest in new machinery to produce a new product line. The invoice price of the machinery is $320,000. It would require $10,000 in shipping expenses and $20,000 in installation costs. The machinery falls in MACRS 3-year class with depreciation rates of 33.33% for the first year, 44.45% for the second year, 14.81% for the third year, and 7.41% for the fourth year. SMC plans to use the new machinery for four years and it is expected to have a salvage value of $75,000 after four years of use. SMC expects the new machinery to generate sales of 1,500 units in the first year. Unit growth is expected to be 4% after the first year. The company estimates that the new product will sell for $225 per unit in the first year with a cost of $150 per unit, excluding depreciation. Management projects that both the sale price and the cost per unit will increase by 3% per year due to inflation. Net working capital is projected to be 15% of next year’s sales. The firm’s marginal tax rate is 30%. Investment-related cash flow forecasts: Invoice price of the machinery = $320,000 Shipping charges = $10,000 Installation cost = $20,000 Salvage value = $75,000 Investment in net working capital = 15% of next year’s sales MACRS depreciation rates: Year 1: 0.3333 Year 2: 0.4445 Year 3: 0.1481 Year 4: 0.0741 Operating cash flow forecasts: Project’s economic life = 4 years Year 1 unit sales = 1,500 units Unit growth = 4% Year 1 price per unit = $225.00/unit Year 1 cost per unit = $150.00/unit Inflation rate = 3%

Swagger Manufacturing Corporation (SMC) is planning to invest in new machinery to produce a new product line. The invoice price of the machinery is $320,000. It would require $10,000 in shipping expenses and $20,000 in installation costs. The machinery falls in MACRS 3-year class with

SMC expects the new machinery to generate sales of 1,500 units in the first year. Unit growth is expected to be 4% after the first year. The company estimates that the new product will sell for $225 per unit in the first year with a cost of $150 per unit, excluding depreciation. Management projects that both the sale price and the cost per unit will increase by 3% per year due to inflation. Net working capital is projected to be 15% of next year’s sales. The firm’s marginal tax rate is 30%.

Investment-related cash flow

Invoice price of the machinery = $320,000

Shipping charges = $10,000

Installation cost = $20,000

Salvage value = $75,000

Investment in net working capital = 15% of next year’s sales

MACRS depreciation rates:

Year 1: 0.3333

Year 2: 0.4445

Year 3: 0.1481

Year 4: 0.0741

Operating cash flow forecasts:

Project’s economic life = 4 years

Year 1 unit sales = 1,500 units

Unit growth = 4%

Year 1 price per unit = $225.00/unit

Year 1 cost per unit = $150.00/unit

Inflation rate = 3%

Trending now

This is a popular solution!

Step by step

Solved in 2 steps