E9-1 (Algo) Identifying Current Liabilities, Computing Working Capital, and Explaining Working Capital LO 9-1, 9-4, 9-5 Diane Corporation is preparing its year-end balance sheet. The company records show the following selected amounts at the end of the year: Total assets Total noncurrent assets Liabilities: Notes payable (8%, due in 5 years) Accounts payable Income taxes payable. Liability for withholding taxes Rent revenue collected in advance. Bonds payable (due in 15 years) Wages payable Property taxes payable Note payable ( 10%, due in 6 months) Interest payable Common stock Required: 1-a. What is the amount of current liabilities? Current liabilities 1-b. Compute working capital. Working capital $590,000 360,000 O Yes O No 24,000 54,000 12,000 2,000 9,000 120,000 9,000 5,000 14,000 600 170,000 2. Would your computation be different if the company reported $310,000 worth of contingent liabilities in the notes to its financial statements?

E9-1 (Algo) Identifying Current Liabilities, Computing Working Capital, and Explaining Working Capital LO 9-1, 9-4, 9-5 Diane Corporation is preparing its year-end balance sheet. The company records show the following selected amounts at the end of the year: Total assets Total noncurrent assets Liabilities: Notes payable (8%, due in 5 years) Accounts payable Income taxes payable. Liability for withholding taxes Rent revenue collected in advance. Bonds payable (due in 15 years) Wages payable Property taxes payable Note payable ( 10%, due in 6 months) Interest payable Common stock Required: 1-a. What is the amount of current liabilities? Current liabilities 1-b. Compute working capital. Working capital $590,000 360,000 O Yes O No 24,000 54,000 12,000 2,000 9,000 120,000 9,000 5,000 14,000 600 170,000 2. Would your computation be different if the company reported $310,000 worth of contingent liabilities in the notes to its financial statements?

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 47P

Related questions

Topic Video

Question

100%

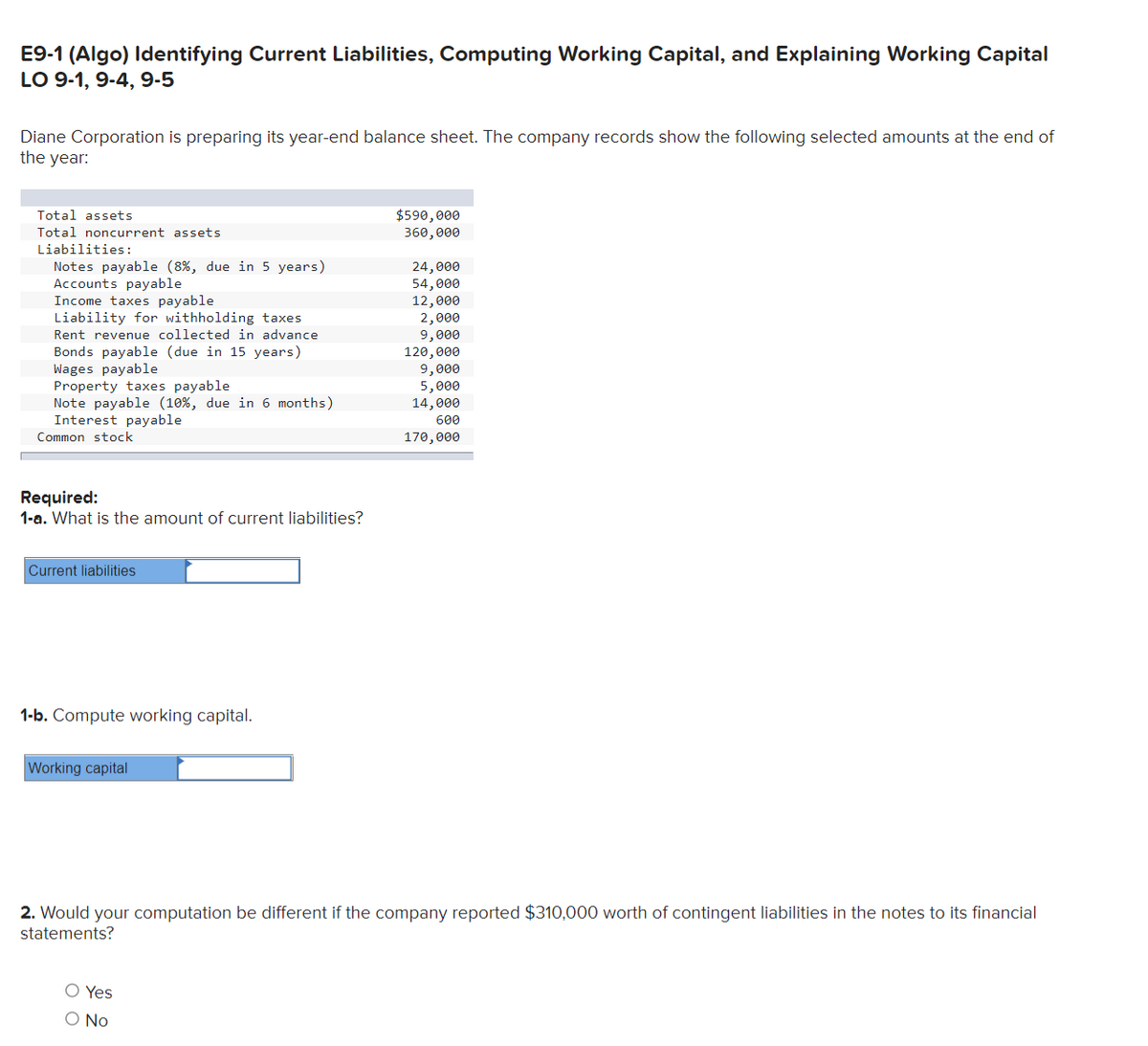

Transcribed Image Text:E9-1 (Algo) Identifying Current Liabilities, Computing Working Capital, and Explaining Working Capital

LO 9-1, 9-4, 9-5

Diane Corporation is preparing its year-end balance sheet. The company records show the following selected amounts at the end of

the year:

Total assets

Total noncurrent assets

Liabilities:

Notes payable (8%, due in 5 years)

Accounts payable

Income taxes payable

Liability for withholding taxes

Rent revenue collected in advance

Bonds payable (due in 15 years)

Wages payable

Property taxes payable.

Note payable (10%, due in 6 months)

Interest payable

Common stock

Required:

1-a. What is the amount of current liabilities?

Current liabilities

1-b. Compute working capital.

Working capital

$590,000

360,000

O Yes

O No

24,000

54,000

12,000

2,000

9,000

120,000

9,000

5,000

14,000

600

170,000

2. Would your computation be different if the company reported $310,000 worth of contingent liabilities in the notes to its financial

statements?

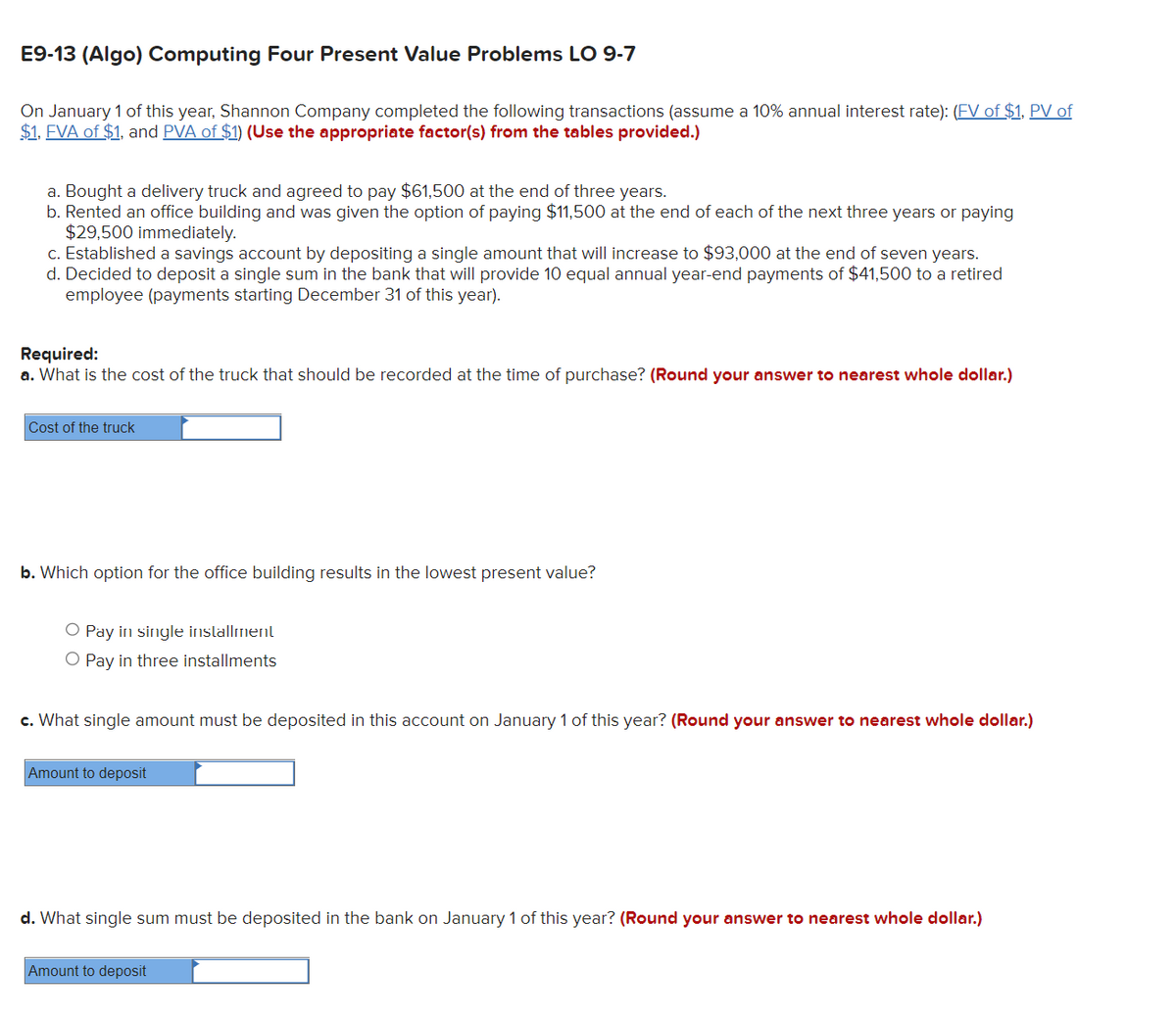

Transcribed Image Text:E9-13 (Algo) Computing Four Present Value Problems LO 9-7

On January 1 of this year, Shannon Company completed the following transactions (assume a 10% annual interest rate): (FV of $1. PV of

$1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.)

a. Bought a delivery truck and agreed to pay $61,500 at the end of three years.

b. Rented an office building and was given the option of paying $11,500 at the end of each of the next three years or paying

$29,500 immediately.

c. Established a savings account by depositing a single amount that will increase to $93,000 at the end of seven years.

d. Decided to deposit a single sum in the bank that will provide 10 equal annual year-end payments of $41,500 to a retired

employee (payments starting December 31 of this year).

Required:

a. What is the cost of the truck that should be recorded at the time of purchase? (Round your answer to nearest whole dollar.)

Cost of the truck

b. Which option for the office building results in the lowest present value?

O Pay in single installment

O Pay in three installments

c. What single amount must be deposited in this account on January 1 of this year? (Round your answer to nearest whole dollar.)

Amount to deposit

d. What single sum must be deposited in the bank on January 1 of this year? (Round your answer to nearest whole dollar.)

Amount to deposit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning