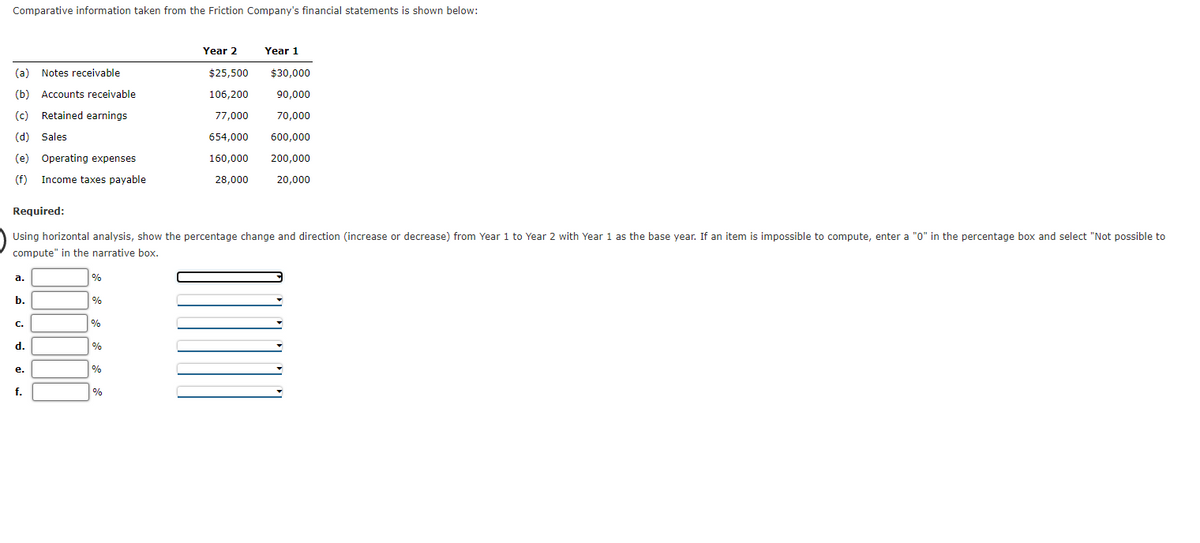

Comparative information taken from the Friction Company's financial statements is shown below: (a) Notes receivable (b) Accounts receivable (c) Retained earnings (d) Sales (e) Operating expenses (f) Income taxes payable a. b. C. Required: Using horizontal analysis, show the percentage change and direction (increase or decrease) from Year 1 to Year 2 with Year 1 as the base year. If an item is impossible to compute, enter a "0" in the percentage box and select "Not possible to compute" in the narrative box. d. e. f. % % % Year 2 % Year 1 $25,500 $30,000 106,200 90,000 77,000 70,000 654,000 600,000 160,000 200,000 28,000 20,000

Comparative information taken from the Friction Company's financial statements is shown below: (a) Notes receivable (b) Accounts receivable (c) Retained earnings (d) Sales (e) Operating expenses (f) Income taxes payable a. b. C. Required: Using horizontal analysis, show the percentage change and direction (increase or decrease) from Year 1 to Year 2 with Year 1 as the base year. If an item is impossible to compute, enter a "0" in the percentage box and select "Not possible to compute" in the narrative box. d. e. f. % % % Year 2 % Year 1 $25,500 $30,000 106,200 90,000 77,000 70,000 654,000 600,000 160,000 200,000 28,000 20,000

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter24: Analysis Of Financial Statements

Section: Chapter Questions

Problem 8SPB

Related questions

Question

Transcribed Image Text:Comparative information taken from the Friction Company's financial statements is shown below:

(a) Notes receivable

(b) Accounts receivable

(c) Retained earnings

(d) Sales

(e) Operating expenses

(f) Income taxes payable

a.

b.

Required:

Using horizontal analysis, show the percentage change and direction (increase or decrease) from Year 1 to Year 2 with Year 1 as the base year. If an item is impossible to compute, enter a "0" in the percentage box and select "Not possible to

compute" in the narrative box.

C.

d.

e.

f.

%

%

%

%

%

Year 2

%

Year 1

$25,500

$30,000

106,200

90,000

77,000

70,000

654,000 600,000

160,000 200,000

28,000 20,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,