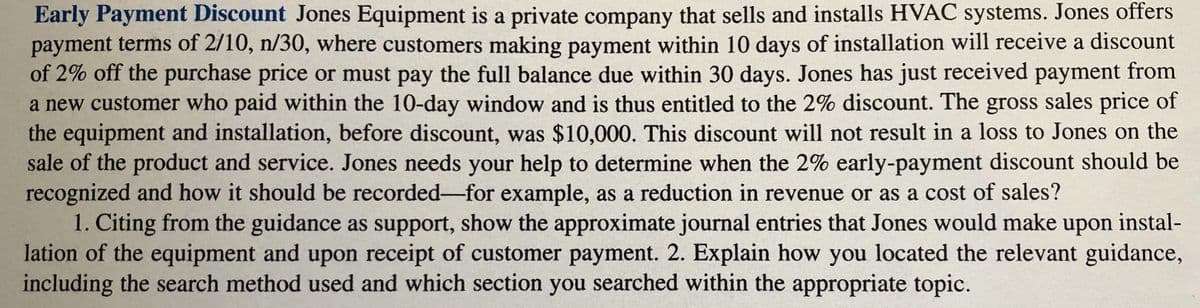

Early Payment Discount Jones Equipment is a private company that sells and installs HVAC systems. Jones offers payment terms of 2/10, n/30, where customers making payment within 10 days of installation will receive a discount of 2% off the purchase price or must pay the full balance due within 30 days. Jones has just received payment from a new customer who paid within the 10-day window and is thus entitled to the 2% discount. The gross sales price of the equipment and installation, before discount, was $10,000. This discount will not result in a loss to Jones on the sale of the product and service. Jones needs your help to determine when the 2% early-payment discount should be recognized and how it should be recorded-for example, as a reduction in revenue or as a cost of sales? 1. Citing from the guidance as support, show the approximate journal entries that Jones would make upon instal- lation of the equipment and upon receipt of customer payment. 2. Explain how you located the relevant guidance, including the search method used and which section you searched within the appropriate topic.

Early Payment Discount Jones Equipment is a private company that sells and installs HVAC systems. Jones offers payment terms of 2/10, n/30, where customers making payment within 10 days of installation will receive a discount of 2% off the purchase price or must pay the full balance due within 30 days. Jones has just received payment from a new customer who paid within the 10-day window and is thus entitled to the 2% discount. The gross sales price of the equipment and installation, before discount, was $10,000. This discount will not result in a loss to Jones on the sale of the product and service. Jones needs your help to determine when the 2% early-payment discount should be recognized and how it should be recorded-for example, as a reduction in revenue or as a cost of sales? 1. Citing from the guidance as support, show the approximate journal entries that Jones would make upon instal- lation of the equipment and upon receipt of customer payment. 2. Explain how you located the relevant guidance, including the search method used and which section you searched within the appropriate topic.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

ChapterA: Appendix - Time Value Of Cash Flows: Compound Interest Concepts And Applications

Section: Chapter Questions

Problem 29E

Related questions

Question

Transcribed Image Text:Early Payment Discount Jones Equipment is a private company that sells and installs HVAC systems. Jones offers

payment terms of 2/10, n/30, where customers making payment within 10 days of installation will receive a discount

of 2% off the purchase price or must pay the full balance due within 30 days. Jones has just received payment from

a new customer who paid within the 10-day window and is thus entitled to the 2% discount. The gross sales price of

the equipment and installation, before discount, was $10,000. This discount will not result in a loss to Jones on the

sale of the product and service. Jones needs your help to determine when the 2% early-payment discount should be

recognized and how it should be recorded-for example, as a reduction in revenue or as a cost of sales?

1. Citing from the guidance as support, show the approximate journal entries that Jones would make upon instal-

lation of the equipment and upon receipt of customer payment. 2. Explain how you located the relevant guidance,

including the search method used and which section you searched within the appropriate topic.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning