Earned and Unearned Income, Transfers from Others (LO. 3) Elwood is retired. During 2020, he receives $11,000 Social Security benefits. In addition, he receives $5,800 in cash dividends on stocks thet he owns and $8,000 in interest on tax-exempt bonds. Assuming that Elwood is single, what is his gross income if a. He recelves no other ingome?s 5,800 b. He also recelves $10,900 in unemployment compensation?S 5,450 X C. He selis some land for $79,600 and he paid $44,300 for the land? s

Earned and Unearned Income, Transfers from Others (LO. 3) Elwood is retired. During 2020, he receives $11,000 Social Security benefits. In addition, he receives $5,800 in cash dividends on stocks thet he owns and $8,000 in interest on tax-exempt bonds. Assuming that Elwood is single, what is his gross income if a. He recelves no other ingome?s 5,800 b. He also recelves $10,900 in unemployment compensation?S 5,450 X C. He selis some land for $79,600 and he paid $44,300 for the land? s

Chapter10: Deductions And Losses: Certain Itemized Deductions

Section: Chapter Questions

Problem 30P

Related questions

Question

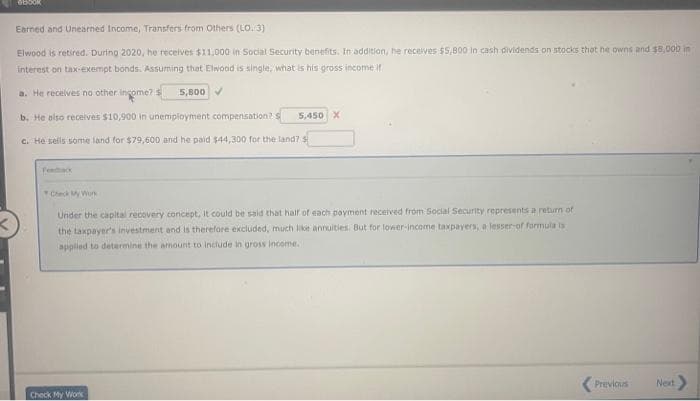

Transcribed Image Text:Earned and Unearned Income, Transfers from Others (LO. 3)

Elwood is retired. During 2020, he receives $11,000 in Social Security benefits. In addition, he receives $5,800 in cash dividends on stocks that he owns and $8,000 in

interest on tax-exempt bonds. Assuming that Elwood is single, what is his gross income if

a. He recelves no other ingome?S

5,800

b. He also recelves $10,900 in unemployment compensation?S

5,450 X

c. He selis some land for $79,600 and he paid $44,300 for the land? s

Fendacx

Check yWun

Under the capital recovery concept, It could be said that half of each payment received from Social Security represents a return of

the taxpayer's investment and is therefore excluded, much like annuities. But for lower-income taxpayers, a lesser of formula is

applied to determine the amount to Include in gross income.

(Previous

Next

Check My Work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT