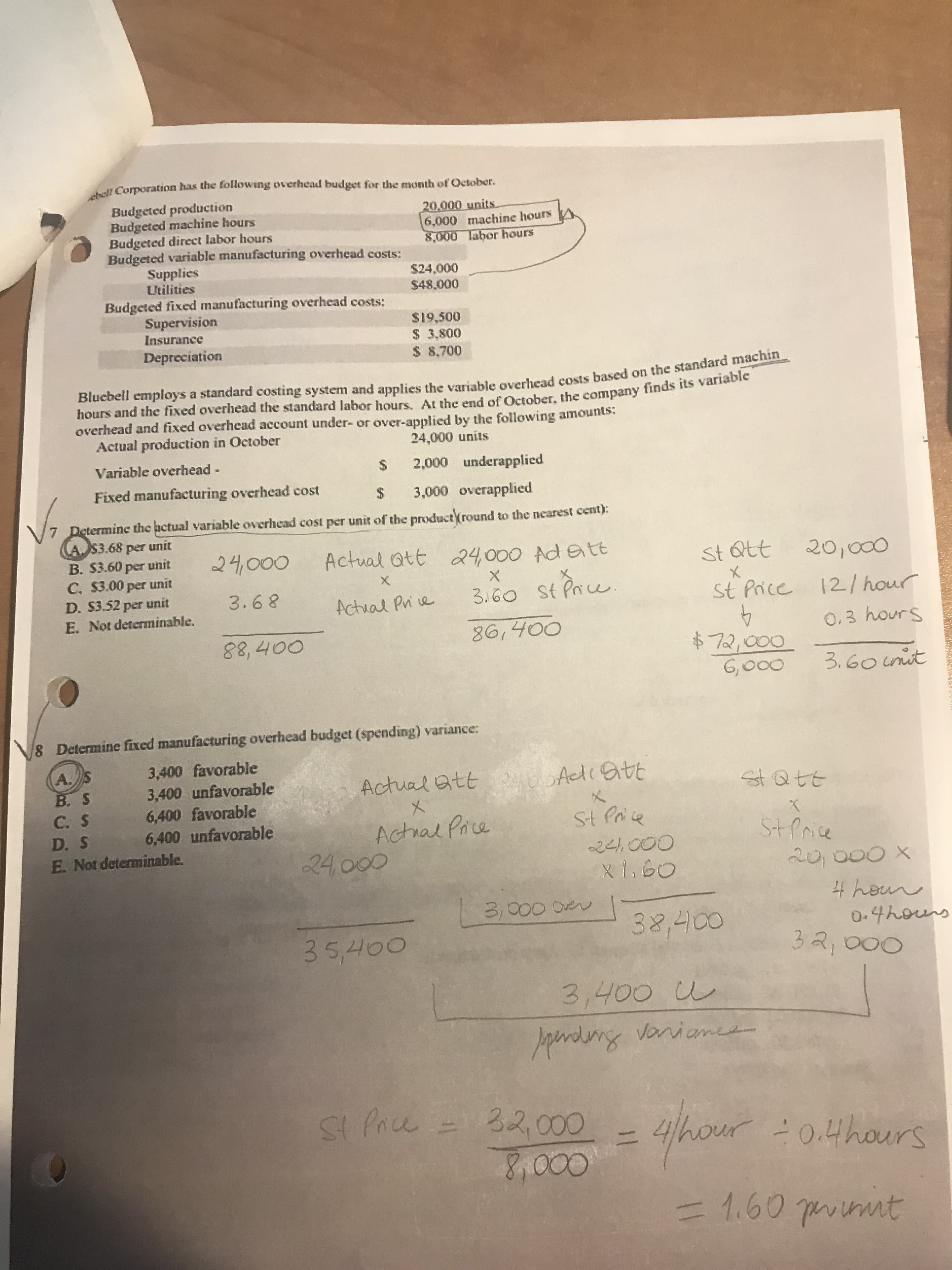

ebell Corporation has the following overhead budget for the month of October. Budgeted production Budgeted machine hours Budgeted direct labor hours Budgeted variable manufacturing overhead costs: Supplies Utilities 20.000 units. 6,000 machine hours 8,000 labor hours $24,000 $48,000 Budgeted fixed manufacturing overhead costs: Supervision Insurance $19.500 3,800 Depreciation $ 8,700 Blucbell employs a standard costing system and applies the variable overhead costs based on the standard machin hours and the fixed overhead the standard labor hours. At the end of October, the company finds its variable overhead and fixed overhead account under- or over-applied by the following amounts Actual production in October 24,000 units Variable overhead - 2,000 underapplied Fixed manufacturing overhead cost $ 3,000 overapplied 7 Determine the actual variable overhead cost per unit of the product(round to the nearest cent): A S3.68 per unit B. $3.60 per unit C. $3.00 per unit D. S3.52 per unit 24000 Actual att 4000 Ad ett 20,000 St Qtt 3.68 3 G0 St Pa 12/ hour St Pice Achual Pri a E. Not determinable. 86,400 O.3 hours 88,400 72,000 G,000 3.60 unut Determine fixed manufacturing overhead budget (spending) variance: 8 3,400 favorable 3,400 unfavorable 6,400 favorable 6,400 unfavorable Actual att40 Aed tt B. S stQtt C. S Actral Pae 24000 D. S Stpre E. Not determinable. 24,000 4 heur 0.4hours 3a, 000 3/000 0e 32,400 35,Ho0 3,400 u =4hour 20.4hours = 1.60 pmint

ebell Corporation has the following overhead budget for the month of October. Budgeted production Budgeted machine hours Budgeted direct labor hours Budgeted variable manufacturing overhead costs: Supplies Utilities 20.000 units. 6,000 machine hours 8,000 labor hours $24,000 $48,000 Budgeted fixed manufacturing overhead costs: Supervision Insurance $19.500 3,800 Depreciation $ 8,700 Blucbell employs a standard costing system and applies the variable overhead costs based on the standard machin hours and the fixed overhead the standard labor hours. At the end of October, the company finds its variable overhead and fixed overhead account under- or over-applied by the following amounts Actual production in October 24,000 units Variable overhead - 2,000 underapplied Fixed manufacturing overhead cost $ 3,000 overapplied 7 Determine the actual variable overhead cost per unit of the product(round to the nearest cent): A S3.68 per unit B. $3.60 per unit C. $3.00 per unit D. S3.52 per unit 24000 Actual att 4000 Ad ett 20,000 St Qtt 3.68 3 G0 St Pa 12/ hour St Pice Achual Pri a E. Not determinable. 86,400 O.3 hours 88,400 72,000 G,000 3.60 unut Determine fixed manufacturing overhead budget (spending) variance: 8 3,400 favorable 3,400 unfavorable 6,400 favorable 6,400 unfavorable Actual att40 Aed tt B. S stQtt C. S Actral Pae 24000 D. S Stpre E. Not determinable. 24,000 4 heur 0.4hours 3a, 000 3/000 0e 32,400 35,Ho0 3,400 u =4hour 20.4hours = 1.60 pmint

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter8: Standard Cost Accounting—materials, Labor, And Factory Overhead

Section: Chapter Questions

Problem 17P: Shinto Corp. uses a standard cost system and manufactures one product. The variable costs per...

Related questions

Question

Are the answers correct?

Transcribed Image Text:ebell Corporation has the following overhead budget for the month of October.

Budgeted production

Budgeted machine hours

Budgeted direct labor hours

Budgeted variable manufacturing overhead costs:

Supplies

Utilities

20.000 units.

6,000 machine hours

8,000 labor hours

$24,000

$48,000

Budgeted fixed manufacturing overhead costs:

Supervision

Insurance

$19.500

3,800

Depreciation

$ 8,700

Blucbell employs a standard costing system and applies the variable overhead costs based on the standard machin

hours and the fixed overhead the standard labor hours. At the end of October, the company finds its variable

overhead and fixed overhead account under- or over-applied by the following amounts

Actual production in October

24,000 units

Variable overhead -

2,000 underapplied

Fixed manufacturing overhead cost

$

3,000 overapplied

7 Determine the actual variable overhead cost per unit of the product(round to the nearest cent):

A S3.68 per unit

B. $3.60 per unit

C. $3.00 per unit

D. S3.52 per unit

24000

Actual att 4000 Ad ett

20,000

St Qtt

3.68

3 G0 St Pa

12/ hour

St Pice

Achual Pri a

E. Not determinable.

86,400

O.3 hours

88,400

72,000

G,000

3.60 unut

Determine fixed manufacturing overhead budget (spending) variance:

8

3,400 favorable

3,400 unfavorable

6,400 favorable

6,400 unfavorable

Actual att40 Aed tt

B. S

stQtt

C. S

Actral Pae

24000

D. S

Stpre

E. Not determinable.

24,000

4 heur

0.4hours

3a, 000

3/000 0e

32,400

35,Ho0

3,400 u

=4hour 20.4hours

= 1.60 pmint

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning