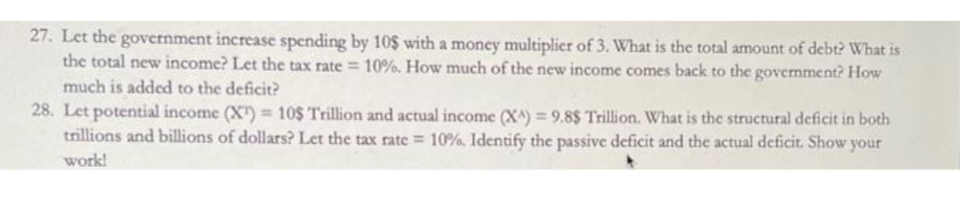

27. Let the government increase spending by 10$ with a money multiplier of 3. What is the total amount of debt? What is the total new income? Let the tax rate = 10%. How much of the new income comes back to the government? How much is added to the deficit? 28. Let potential income (X") 10$ Trillion and actual income (X^) = 9.8$ Trillion. What is the structural deficit in both trillions and billions of dollars? Let the tax rate = 10%. Identify the passive deficit and the actual deficit. Show your work!

27. Let the government increase spending by 10$ with a money multiplier of 3. What is the total amount of debt? What is the total new income? Let the tax rate = 10%. How much of the new income comes back to the government? How much is added to the deficit? 28. Let potential income (X") 10$ Trillion and actual income (X^) = 9.8$ Trillion. What is the structural deficit in both trillions and billions of dollars? Let the tax rate = 10%. Identify the passive deficit and the actual deficit. Show your work!

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter30: Government Budgets And Fiscal Policy

Section: Chapter Questions

Problem 51P: A government starts off with a total debt of $3.5 billion. In year one, the government runs a...

Related questions

Question

10

Transcribed Image Text:27. Let the government increase spending by 10$ with a money multiplier of 3. What is the total amount of debt? What is

the total new income? Let the tax rate = 10%. How much of the new income comes back to the government? How

much is added to the deficit?

28. Let potential income (X") 10$ Trillion and actual income (X^) = 9.8$ Trillion. What is the structural deficit in both

trillions and billions of dollars? Let the tax rate = 10%. Identify the passive deficit and the actual deficit. Show your

work!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning