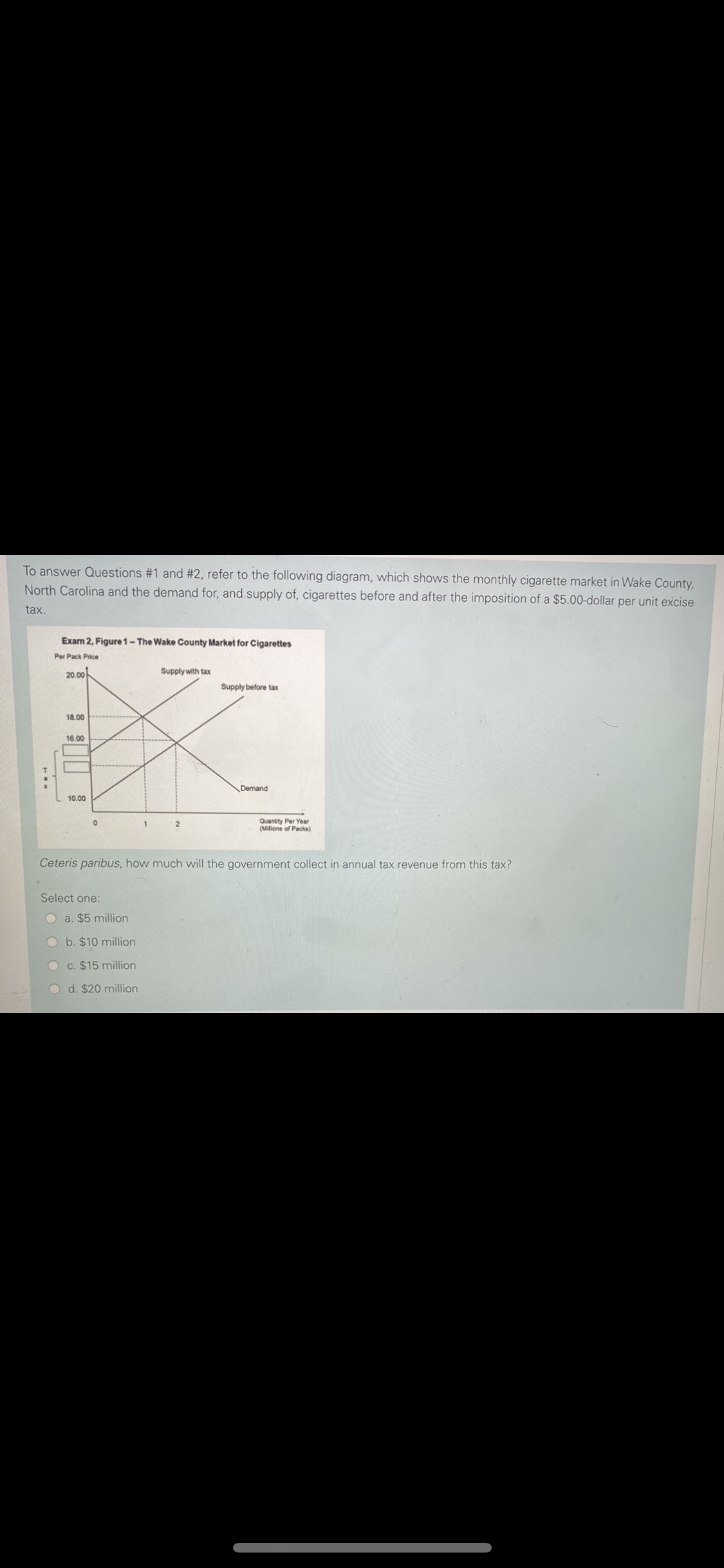

To answer Questions #1 and #2, refer to the following diagram, which shows the monthly cigarette market in Wake County, North Carolina and the demand for, and supply of, cigarettes before and after the imposition of a $5.00-dollar per unit excise tax. Exam 2, Figure 1- The Wake County Market for Cigarettes Per Pack Price Supply with tax 20.00 Supply before tax 18.00 16.00 Demand 10.00 Quantity Per Year (Milions of Packs) 2 Ceteris paribus, how much will the government collect in annual tax revenue from this tax? Select one: O a. $5 million Ob. $10 million O c. $15 million O d. $20 million What is the deadweight loss from this tax? Select one: Oa. $1.0 million Ob. $2.0 million c. $2.5 million d. $5.0 million

To answer Questions #1 and #2, refer to the following diagram, which shows the monthly cigarette market in Wake County, North Carolina and the demand for, and supply of, cigarettes before and after the imposition of a $5.00-dollar per unit excise tax. Exam 2, Figure 1- The Wake County Market for Cigarettes Per Pack Price Supply with tax 20.00 Supply before tax 18.00 16.00 Demand 10.00 Quantity Per Year (Milions of Packs) 2 Ceteris paribus, how much will the government collect in annual tax revenue from this tax? Select one: O a. $5 million Ob. $10 million O c. $15 million O d. $20 million What is the deadweight loss from this tax? Select one: Oa. $1.0 million Ob. $2.0 million c. $2.5 million d. $5.0 million

Principles of Microeconomics (MindTap Course List)

8th Edition

ISBN:9781305971493

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter8: Application: The Cost Of Taxation

Section: Chapter Questions

Problem 10PA

Related questions

Question

Transcribed Image Text:To answer Questions #1 and #2, refer to the following diagram, which shows the monthly cigarette market in Wake County,

North Carolina and the demand for, and supply of, cigarettes before and after the imposition of a $5.00-dollar per unit excise

tax.

Exam 2, Figure 1- The Wake County Market for Cigarettes

Per Pack Price

Supply with tax

20.00

Supply before tax

18.00

16.00

Demand

10.00

Quantity Per Year

(Milions of Packs)

2

Ceteris paribus, how much will the government collect in annual tax revenue from this tax?

Select one:

O a. $5 million

Ob. $10 million

O c. $15 million

O d. $20 million

Transcribed Image Text:What is the deadweight loss from this tax?

Select one:

Oa. $1.0 million

Ob. $2.0 million

c. $2.5 million

d. $5.0 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning