ect labor hours or ate is $21510 per DH The drect materias cont per unt for each product g Direct Materials Cest per it $229.0 eeces has an actiy baed costng system wim 1acivty cat poo actve Estimeted Overteat tpectedtiity Activity Cest

ect labor hours or ate is $21510 per DH The drect materias cont per unt for each product g Direct Materials Cest per it $229.0 eeces has an actiy baed costng system wim 1acivty cat poo actve Estimeted Overteat tpectedtiity Activity Cest

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 12.16E: Product cost concept of product pricing Based on the data presented in Exercise 12-15, assume that...

Related questions

Question

100%

10

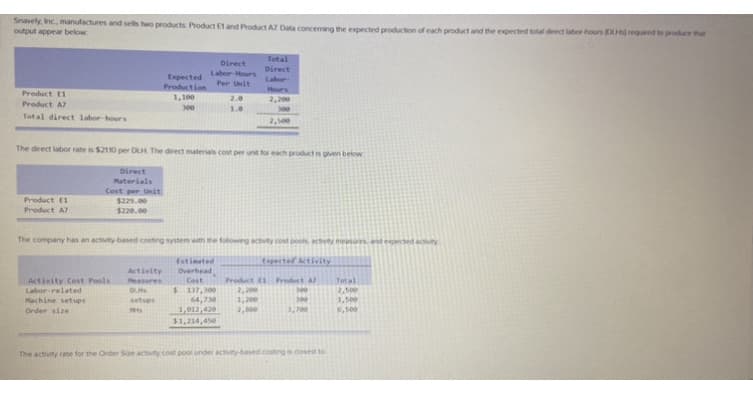

Transcribed Image Text:Snavely, Inc, manufactures and sels two products Product El and Product AZ Data conceming the expected productton of each product and the expected total direct labor hours (DH) requred to produce that

output appear below

Total

Direct

Direct

Labor-Hours

Expected

Production Per Unit

1,100

Labor

Hours

Product E1

2.0

2,200

Product A7

300

1.0

300

Total direct labor-hours

2,500

The direct labor rate is $2110 per DLH The direct materials cost per unt for each product is given below

Direct

Materials

Cost per Unit

Product E1

$229.00

Product A7

$220.00

The company has an activity based costing system wth the folowng actvey cost pooh, actvty measres and expected activity

Estimated

topected tivity

Activity

Overhead

Activity Cost Pools

Labor-related

Product E1 Product A

2,200

1,200

Measures

Cost

$ 137,300

64,730

Total

2,500

1,500

300

Machine setups

setups

300

6,500

1,012,420

$1,214,450

Order size

2,800

3,700

The activity rate for the Order Sze activity cost pool under activity-based costing is closest to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning