ee the image below. Please provide some solutions so that I can verify that I solved the problem correctly. Question: The accounts receivable from Silang is

ee the image below. Please provide some solutions so that I can verify that I solved the problem correctly. Question: The accounts receivable from Silang is

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 9PB: On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as...

Related questions

Question

100%

See the image below.

Please provide some solutions so that I can verify that I solved the

problem correctly.

Question: The accounts receivable from Silang is

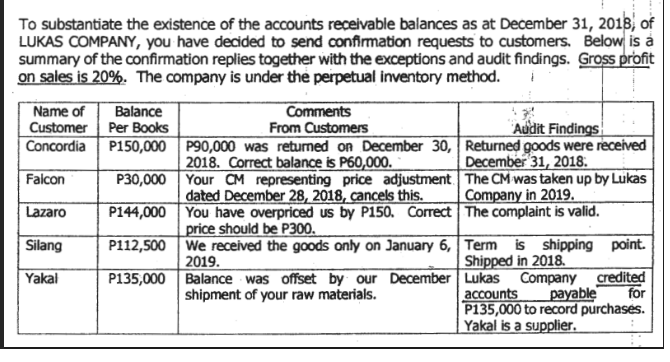

Transcribed Image Text:To substantiate the existence of the accounts receivable balances as at December 31, 2018, of

LUKAS COMPANY, you have decided to send confirmation requests to customers. Below is a

summary of the confirmation replies together with the exceptions and audit findings. Gross profit

on sales is 20%. The company is under the perpetual inventory method.

Balance

Name of

Customer Per Books

Comments

From Customers

Audit Findings

P150,000 P90,000 was returned on December 30, Returned goods were received

Concordia

2018. Correct balance is P60,000.

December 31, 2018.

Falcon

P30,000 Your CM representing price adjustment The CM was taken up by Lukas

dated December 28, 2018, cancels this.

P144,000 You have overpriced us by P150. Correct The complaint is valid.

Company in 2019.

Lazaro

price should be P300.

Silang

P112,500 We received the goods only on January 6, Term is shipping point.

2019.

Shipped in 2018.

P135,000 Balance was offset by our December Lukas

shipment of your raw materials.

Company credited

payable

P135,000 to record purchases.

Yakal

accounts

for

Yakal is a supplier.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning