eighted average cost flow method under perpetual inventory system e following units of a particular item were available for sale during the calendar year: n. 1 Inventory 9,000 units at $50.00 ar. 18. 7,000 units ay 2 8,000 units at $56.50 8,000 units 4,000 units at $60.00 g. 9 t. 20 Date n. 1 r. 18 e firm uses the weighted average cost method with a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale. Present the data in the form illustrated in mibit 5. Round your "Unit Cost" answers to two decimal places. y 2 9.9 t. 20 Sale ec. 31 Purchase Sale Purchase Purchases Quantity Balances 8,000 4,000 Purchases Unit Cost 56.50 60 Furchases Total Cost 452,000 240,000 Weighted Average Cost Flow Method Cost of Goods Sold Unit Cost Cost of Goods Sold Quantity 7,000 8,000 50 Cost of Goods Sold Total Cost 350,000 Inventory Quantity 9,000 2,000 10,000 Inventory Unit Cost 50 50 Inventor Total Cos 450, 100, 552,

eighted average cost flow method under perpetual inventory system e following units of a particular item were available for sale during the calendar year: n. 1 Inventory 9,000 units at $50.00 ar. 18. 7,000 units ay 2 8,000 units at $56.50 8,000 units 4,000 units at $60.00 g. 9 t. 20 Date n. 1 r. 18 e firm uses the weighted average cost method with a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale. Present the data in the form illustrated in mibit 5. Round your "Unit Cost" answers to two decimal places. y 2 9.9 t. 20 Sale ec. 31 Purchase Sale Purchase Purchases Quantity Balances 8,000 4,000 Purchases Unit Cost 56.50 60 Furchases Total Cost 452,000 240,000 Weighted Average Cost Flow Method Cost of Goods Sold Unit Cost Cost of Goods Sold Quantity 7,000 8,000 50 Cost of Goods Sold Total Cost 350,000 Inventory Quantity 9,000 2,000 10,000 Inventory Unit Cost 50 50 Inventor Total Cos 450, 100, 552,

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 12E: Alternative Inventory Methods Park Companys perpetual inventory records indicate the following...

Related questions

Topic Video

Question

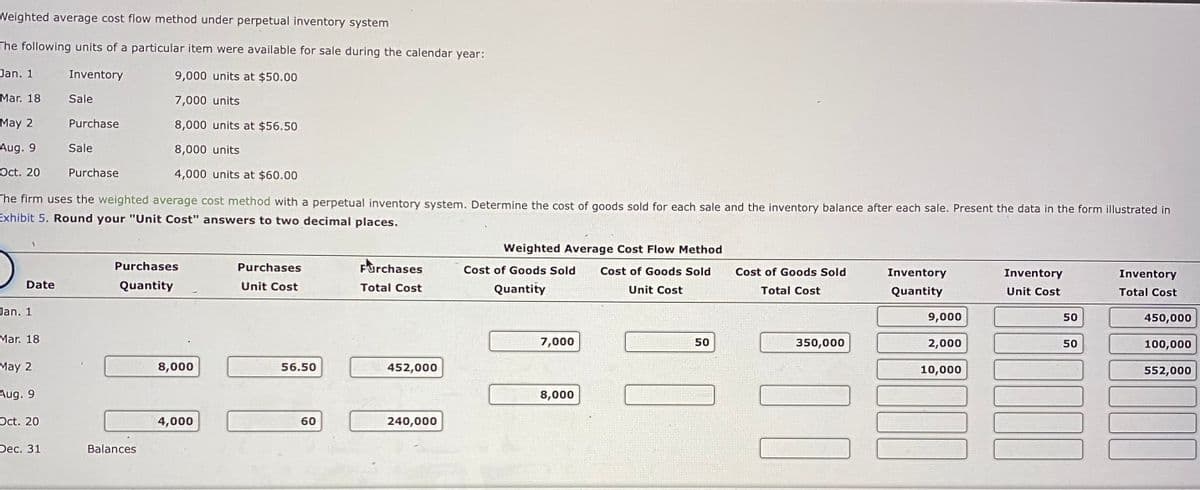

Transcribed Image Text:Weighted average cost flow method under perpetual inventory system

The following units of a particular item were available for sale during the calendar year:

Jan. 1

Inventory

9,000 units at $50.00

Mar. 18

7,000 units

May 2

8,000 units at $56.50

Aug. 9

8,000 units

Oct. 20

4,000 units at $60.00

Date

Jan. 1

Mar. 18

Sale

The firm uses the weighted average cost method with a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale. Present the data in the form illustrated in

Exhibit 5. Round your "Unit Cost" answers to two decimal places.

May 2

Aug. 9

Oct. 20

Dec. 31

Purchase

Sale

Purchase

Purchases

Quantity

Balances

8,000

4,000

Purchases

Unit Cost

56.50

60

Purchases

Total Cost

452,000

240,000

Weighted Average Cost Flow Method

Cost of Goods Sold

Unit Cost

Cost of Goods Sold

Quantity

7,000

8,000

50

Cost of Goods Sold

Total Cost

350,000

10

Inventory

Quantity

9,000

2,000

10,000

Inventory

Unit Cost

50

50

Inventory

Total Cost

450,000

100,000

552,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,