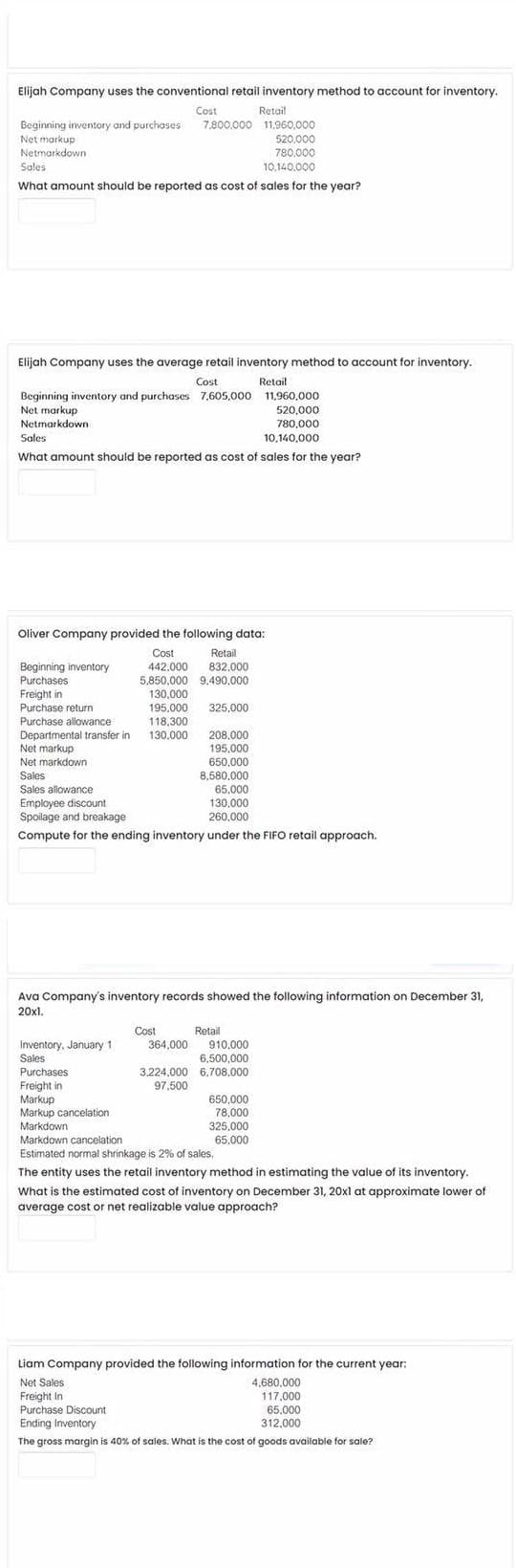

Elijah Company uses the conventional retail inventory method to account for inventory. Cost Retail Beginning inventory and purchases 7.800.000 11.960.000 Net markup Netmarkdown 520.000 780.000 Sales 10.140.000 What amount should be reported as cost of sales for the year?

Elijah Company uses the conventional retail inventory method to account for inventory. Cost Retail Beginning inventory and purchases 7.800.000 11.960.000 Net markup Netmarkdown 520.000 780.000 Sales 10.140.000 What amount should be reported as cost of sales for the year?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 13E: Retail Inventory Method The following information relates to the retail inventory method used by...

Related questions

Question

I need answers for checking and review purposes. Thanks

Transcribed Image Text:Elijah Company uses the conventional retail inventory method to account for inventory.

Retail

Beginning inventory and purchoses 7.800.000 11.960,000

520.000

780.000

10.140.000

Cost

Net markup

Netmarkdown

Sales

What amount should be reported as cost of sales for the year?

Elijah Company uses the average retail inventory method to account for inventory.

Cost

Retail

Beginning inventory and purchases 7,605,000 11,960,000

Net markup

520.000

Netmarkdown

780,000

Sales

10,140,000

What amount should be reported as cost of sales for the year?

Oliver Company provided the following data:

Retail

832,000

Beginning inventory

Purchases

Freight in

Purchase return

Cost

442.000

5,850,000 9,490,000

130,000

195.000

325,000

118,300

130.000

Purchase allowance

208,000

195,000

650,000

8,580.000

65,000

130,000

260,000

Departmental transfer in

Net markup

Net markdown

Sales

Sales allowance

Employee discount

Spoilage and breakage

Compute for the ending inventory under the FIFO retail approach.

Ava Company's inventory records showed the following information on December 31,

20x1.

Cost

Retail

Inventory, January 1

Sales

364,000 910,000

6.500,000

3,224,000 6,708,000

97,500

Purchases

Freight in

Markup

Markup cancelation

Markdown

Markdown cancelation

Estimated normal shrinkage is 2% of sales.

650,000

78,000

325.000

65.000

The entity uses the retail inventory method in estimating the value of its inventory.

What is the estimated cost of inventory on December 31, 20xl at approximate lower of

average cost or net realizable value approach?

Liam Company provided the following information for the current year:

Net Sales

Freight In

Purchase Discount

4,680,000

117,000

65.000

Ending Inventory

312.000

The gross margin is 40% of sales. What is the cost of goods available for sale?

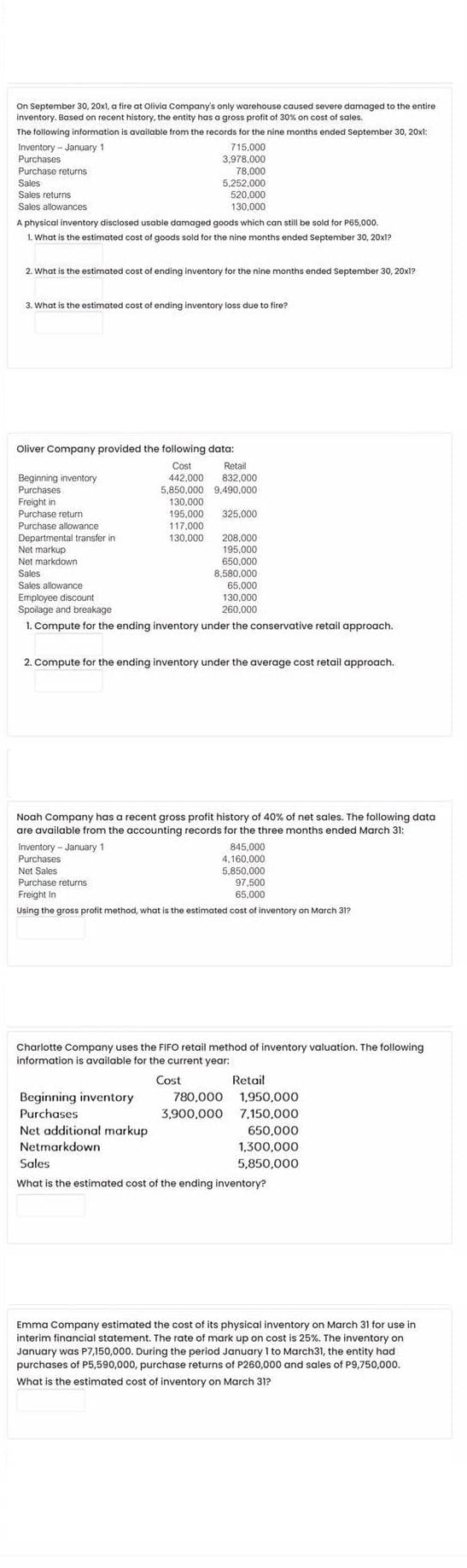

Transcribed Image Text:On September 30, 20x1, a fire at Olivia Company's only warehouse caused severe damaged to the entire

inventory. Based on recent history, the entity has a gross profit of 30% on cost of sales.

The following information is available from the records for the nine months ended September 30, 20xl:

715,000

3,978.000

78,000

5,252,000

520,000

Inventory - January 1

Purchases

Purchase returns

Sales

Sales returns

Sales allowances

130,000

A physical inventory disclosed usable damaged goods which can still be sold for P65,000.

1. What is the estimated cost of goods sold for the nine months ended September 30, 20x1?

2. What is the estimated cost of ending inventory for the nine months ended September 30, 20x1?

3. What is the estimated cost of ending inventory loss due to fire?

Oliver Company provided the following data:

Cost

442,000

5,850,000 9,490,000

130,000

195,000

117,000

130,000

Retail

832,000

Beginning inventory

Purchases

Freight in

Purchase return

325,000

Purchase allowance

Departmental transfer in

Net markup

208,000

195,000

650,000

8,580,000

65,000

130,000

260.000

Net markdown

Sales

Sales allowance

Employee discount

Spoilage and breakage

1. Compute for the ending inventory under the conservative retail approach.

2. Compute for the ending inventory under the average cost retail approach.

Noah Company has a recent gross profit history of 40% of net sales. The following data

are available from the accounting records for the three months ended March 31:

845,000

4,160,000

5.850.000

97,500

65,000

Inventory - January 1

Purchases

Net Sales

Purchase returns

Freight In

Using the gross profit method, what is the estimated cost of inventory on March 31?

Charlotte Company uses the FIFO retail method of inventory valuation. The following

information is available for the current year:

Cost

Retail

Beginning inventory

780,000 1,950,000

Purchases

3,900,000 7.150.000

Net additional markup

650,000

Netmarkdown

1,300,000

Sales

5,850,000

What is the estimated cost of the ending inventory?

Emma Company estimated the cost of its physical inventory on March 31 for use in

interim financial statement. The rate of mark up on cost is 25%. The inventory on

January was P7,150,000. During the period January I to March31, the entity had

purchases of P5,590,000, purchase returns of P260,000 and sales of P9,750,000.

What is the estimated cost of inventory on March 31?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College