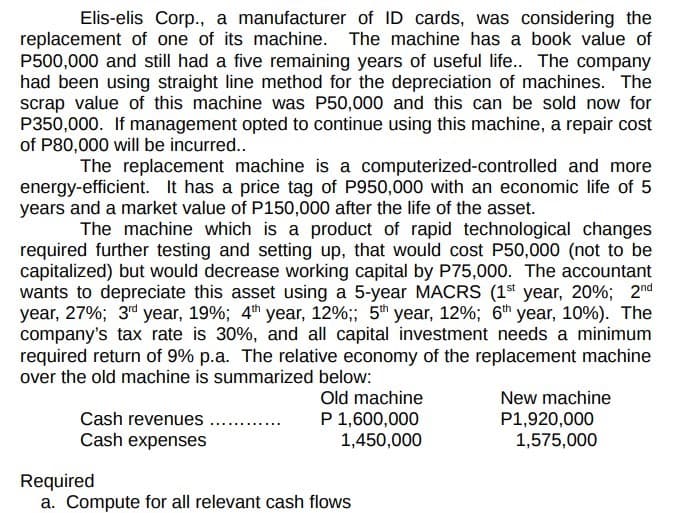

Elis-elis Corp., a manufacturer of ID cards, was considering the replacement of one of its machine. The machine has a book value of P500,000 and still had a five remaining years of useful life.. The company had been using straight line method for the depreciation of machines. The scrap value of this machine was P50,000 and this can be sold now for P350,000. If management opted to continue using this machine, a repair cost of P80,000 will be incurred.. The replacement machine is a computerized-controlled and more energy-efficient. It has a price tag of P950,000 with an economic life of 5 years and a market value of P150,000 after the life of the asset. The machine which is a product of rapid technological changes required further testing and setting up, that would cost P50,000 (not to be capitalized) but would decrease working capital by P75,000. The accountant wants to depreciate this asset using a 5-year MACRS (1st year, 20%; 2nd year, 27%; 3rd year, 19%; 4th year, 12%;; 5th year, 12%; 6th year, 10%). The company's tax rate is 30%, and all capital investment needs a minimum required return of 9% p.a. The relative economy of the replacement machine over the old machine is summarized below: Old machine P 1,600,000 1,450,000 Cash revenues Cash expenses Required a. Compute for all relevant cash flows New machine P1,920,000 1,575,000

Elis-elis Corp., a manufacturer of ID cards, was considering the replacement of one of its machine. The machine has a book value of P500,000 and still had a five remaining years of useful life.. The company had been using straight line method for the depreciation of machines. The scrap value of this machine was P50,000 and this can be sold now for P350,000. If management opted to continue using this machine, a repair cost of P80,000 will be incurred.. The replacement machine is a computerized-controlled and more energy-efficient. It has a price tag of P950,000 with an economic life of 5 years and a market value of P150,000 after the life of the asset. The machine which is a product of rapid technological changes required further testing and setting up, that would cost P50,000 (not to be capitalized) but would decrease working capital by P75,000. The accountant wants to depreciate this asset using a 5-year MACRS (1st year, 20%; 2nd year, 27%; 3rd year, 19%; 4th year, 12%;; 5th year, 12%; 6th year, 10%). The company's tax rate is 30%, and all capital investment needs a minimum required return of 9% p.a. The relative economy of the replacement machine over the old machine is summarized below: Old machine P 1,600,000 1,450,000 Cash revenues Cash expenses Required a. Compute for all relevant cash flows New machine P1,920,000 1,575,000

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 13PB: Montezuma Inc. purchases a delivery truck for $20,000. The truck has a salvage value of $8,000 and...

Related questions

Question

Transcribed Image Text:Elis-elis Corp., a manufacturer of ID cards, was considering the

replacement of one of its machine. The machine has a book value of

P500,000 and still had a five remaining years of useful life.. The company

had been using straight line method for the depreciation of machines. The

scrap value of this machine was P50,000 and this can be sold now for

P350,000. If management opted to continue using this machine, a repair cost

of P80,000 will be incurred..

The replacement machine is a computerized-controlled and more

energy-efficient. It has a price tag of P950,000 with an economic life of 5

years and a market value of P150,000 after the life of the asset.

The machine which is a product of rapid technological changes

required further testing and setting up, that would cost P50,000 (not to be

capitalized) but would decrease working capital by P75,000. The accountant

wants to depreciate this asset using a 5-year MACRS (1st year, 20%; 2nd

year, 27%; 3rd year, 19%; 4th year, 12%;; 5th year, 12%; 6th year, 10%). The

company's tax rate is 30%, and all capital investment needs a minimum

required return of 9% p.a. The relative economy of the replacement machine

over the old machine is summarized below:

Old machine

P 1,600,000

1,450,000

Cash revenues

Cash expenses

Required

a. Compute for all relevant cash flows

New machine

P1,920,000

1,575,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning