Required information Exercise 19-7 Income reporting under absorption costing and variable costing LO P2 [The following information applies to the questions displayed below.] Oak Mart, a producer of solid oak tables, reports the following data from its second year of business. Sales price per unit Units produced this year Units sold this year Units in beginning-year inventory Beginning inventory costs Variable (3,500 units x $135) Fixed (3,500 units x $80) Total Manufacturing costs this year Direct materials Direct labor Overhead costs this year Variable overhead Fixed overhead Selling and administrative costs this year Variable Fixed $ 320 per unit 105,000 units 108,500 units 3,500 units $ 472,500 280,000 $ 752,500 $ $ 44 per unit 64 per unit $3,200,000 $7,000,000 $1,300,000 4,200,000

Required information Exercise 19-7 Income reporting under absorption costing and variable costing LO P2 [The following information applies to the questions displayed below.] Oak Mart, a producer of solid oak tables, reports the following data from its second year of business. Sales price per unit Units produced this year Units sold this year Units in beginning-year inventory Beginning inventory costs Variable (3,500 units x $135) Fixed (3,500 units x $80) Total Manufacturing costs this year Direct materials Direct labor Overhead costs this year Variable overhead Fixed overhead Selling and administrative costs this year Variable Fixed $ 320 per unit 105,000 units 108,500 units 3,500 units $ 472,500 280,000 $ 752,500 $ $ 44 per unit 64 per unit $3,200,000 $7,000,000 $1,300,000 4,200,000

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 4CE: Refer to Cornerstone Exercise 18.3. Required: 1. Calculate the cost of each unit using variable...

Related questions

Question

Please do not give solution in image format thanku

![Required information

Exercise 19-7 Income reporting under absorption costing and variable costing LO P2

[The following information applies to the questions displayed below.]

Oak Mart, a producer of solid oak tables, reports the following data from its second year of business.

Sales price per unit

Units produced this year

Units sold this year

Units in beginning-year inventory

Beginning inventory costs

Variable (3,500 units x $135)

Fixed (3,500 units x $80)

Total

Manufacturing costs this year

Direct materials

Direct labor

Overhead costs this year

Variable overhead

Fixed overhead

Selling and administrative costs this year

Variable

Fixed

320 per unit

105,000 units

108,500 units

3,500 units

$ 472,500

280,000

$ 752,500

$

$

44 per unit

64 per unit

$3,200,000

$7,000,000

$1,300,000

4,200,000](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F0ce123d7-ec28-4713-8995-d1c19687ec94%2F992ba770-7ea9-4fe4-9fa2-cd623882b44f%2F8zovp6tw_processed.png&w=3840&q=75)

Transcribed Image Text:Required information

Exercise 19-7 Income reporting under absorption costing and variable costing LO P2

[The following information applies to the questions displayed below.]

Oak Mart, a producer of solid oak tables, reports the following data from its second year of business.

Sales price per unit

Units produced this year

Units sold this year

Units in beginning-year inventory

Beginning inventory costs

Variable (3,500 units x $135)

Fixed (3,500 units x $80)

Total

Manufacturing costs this year

Direct materials

Direct labor

Overhead costs this year

Variable overhead

Fixed overhead

Selling and administrative costs this year

Variable

Fixed

320 per unit

105,000 units

108,500 units

3,500 units

$ 472,500

280,000

$ 752,500

$

$

44 per unit

64 per unit

$3,200,000

$7,000,000

$1,300,000

4,200,000

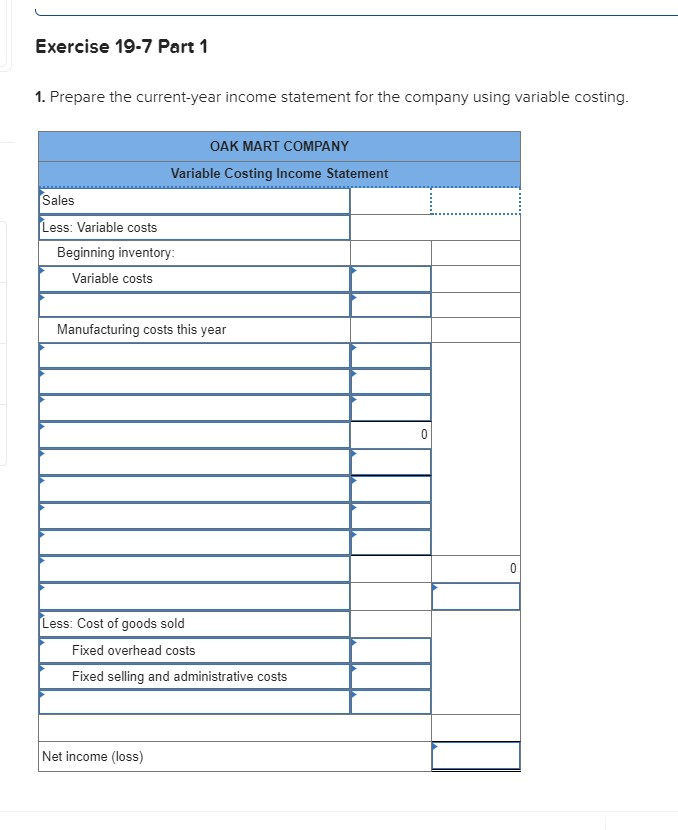

Transcribed Image Text:Exercise 19-7 Part 1

1. Prepare the current-year income statement for the company using variable costing.

Sales

Less: Variable costs

OAK MART COMPANY

Variable Costing Income Statement

Beginning inventory:

Variable costs

Manufacturing costs this year

Less: Cost of goods sold

Fixed overhead costs

Fixed selling and administrative costs

Net income (loss)

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning