Elite Hame Decor manufactures customized household furnishi labour intensive production process, so it assigns manufacturing manufacturing overhead costs and estimated direct labour cost At the end of December 2019, Elite reported work in process during January -March 2020. i) Purchased materials on account, $392,000 ECA00 000

Elite Hame Decor manufactures customized household furnishi labour intensive production process, so it assigns manufacturing manufacturing overhead costs and estimated direct labour cost At the end of December 2019, Elite reported work in process during January -March 2020. i) Purchased materials on account, $392,000 ECA00 000

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter2: Accounting For Materials

Section: Chapter Questions

Problem 13P: Webster Company uses backflush costing to account for its manufacturing costs. The trigger points...

Related questions

Question

Please answer questions

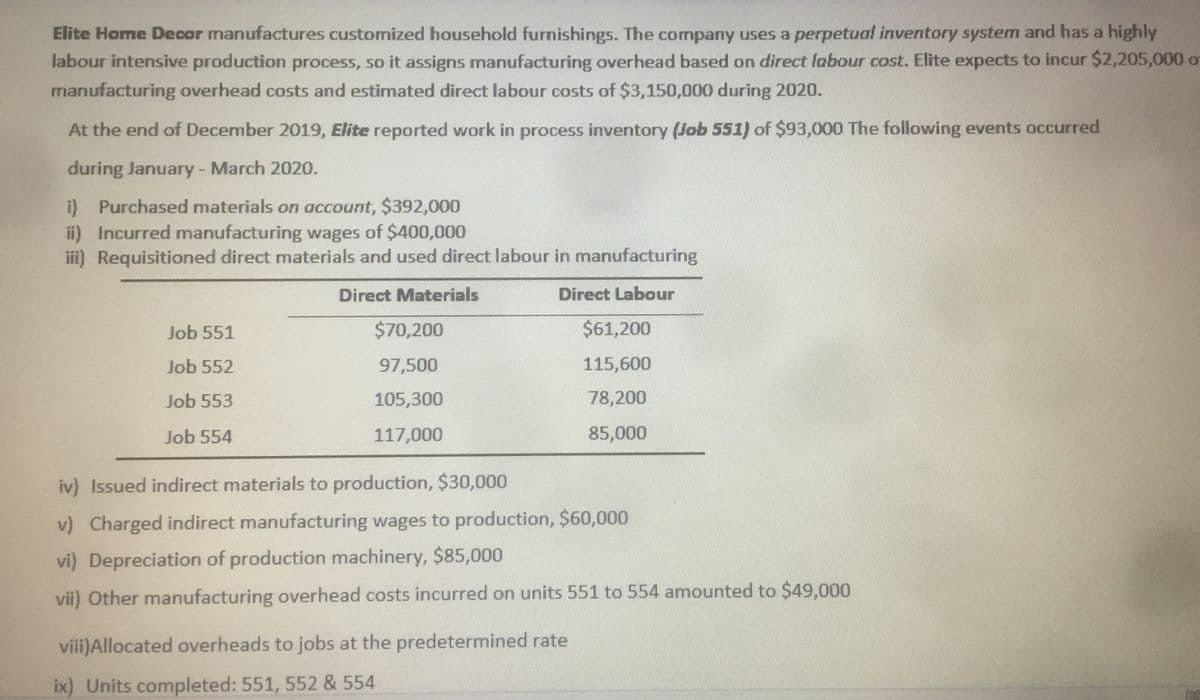

Transcribed Image Text:Elite Home Decor manufactures customized household furnishings. The company uses a perpetual inventory system and has a highly

labour intensive production process, so it assigns manufacturing overhead based on direct labour cost. Elite expects to incur $2,205,000 or

manufacturing overhead costs and estimated direct labour costs of $3,150,000 during 2020.

At the end of December 2019, Elite reported work in process inventory (Job 551) of $93,000 The following events occurred

during January - March 2020.

i) Purchased materials on account, $392,000

ii) Incurred manufacturing wages of $400,000

iii) Requisitioned direct materials and used direct labour in manufacturing

Direct Materials

Direct Labour

Job 551

$70,200

$61,200

Job 552

97,500

115,600

Job 553

105,300

78,200

Job 554

117,000

85,000

iv) Issued indirect materials to production, $30,000

v) Charged indirect manufacturing wages to production, $60,000

vi) Depreciation of production machinery, $85,000

vii) Other manufacturing overhead costs incurred on units 551 to 554 amounted to $49,000

viii)Allocated overheads to jobs at the predetermined rate

ix) Units completed: 551, 552 & 554

Transcribed Image Text:Paragraph

Arrange

2.

5 1

6 1

7.

10

12 1 13 14 1

15 1

16

20 1 21 1 22 1 23 1 24

17 1

18 1

19

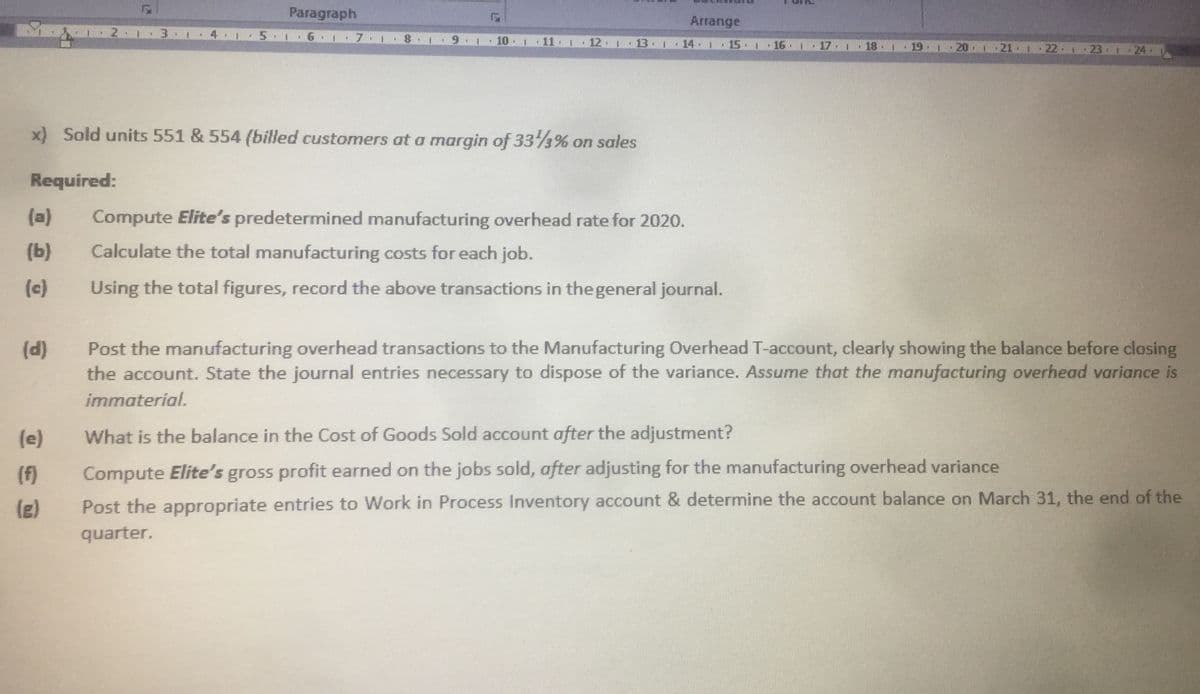

x) Sold units 551 & 554 (billed customers at a margin of 333% on sales

Required:

(a)

Compute Elite's predetermined manufacturing overhead rate for 2020.

(b)

Calculate the total manufacturing costs for each job.

(c)

Using the total figures, record the above transactions in the general journal.

Post the manufacturing overhead transactions to the Manufacturing Overhead T-account, clearly showing the balance before closing

the account. State the journal entries necessary to dispose of the variance. Assume that the manufacturing overhead variance is

(d)

immaterial.

(e)

What is the balance in the Cost of Goods Sold account after the adjustment?

(f)

Compute Elite's gross profit earned on the jobs sold, after adjusting for the manufacturing overhead variance

(g)

Post the appropriate entries to Work in Process Inventory account & determine the account balance on March 31, the end of the

quarter.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning