A pension fund purchased an office block three months ago. A company has agreed to occupy the office block nine months from now The lease agreement states that the company will rent the office block for 20 years. It is further agreed that rents will be paid half- yearly in advance and will be increased every two years at the rate of 2% per annum compound. The initial rent has been set at $60,000 per annum with the first rental payment due immediately on the date of occupation. As at the date of purchase of the office block, which of the following is the total present value of the rental income to the pension fund using a force of interest of 6% per annum? O $707,962.87 O $717,584.37 $727,918.47 $737,811.17 O $745,953.06

A pension fund purchased an office block three months ago. A company has agreed to occupy the office block nine months from now The lease agreement states that the company will rent the office block for 20 years. It is further agreed that rents will be paid half- yearly in advance and will be increased every two years at the rate of 2% per annum compound. The initial rent has been set at $60,000 per annum with the first rental payment due immediately on the date of occupation. As at the date of purchase of the office block, which of the following is the total present value of the rental income to the pension fund using a force of interest of 6% per annum? O $707,962.87 O $717,584.37 $727,918.47 $737,811.17 O $745,953.06

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 19P

Related questions

Question

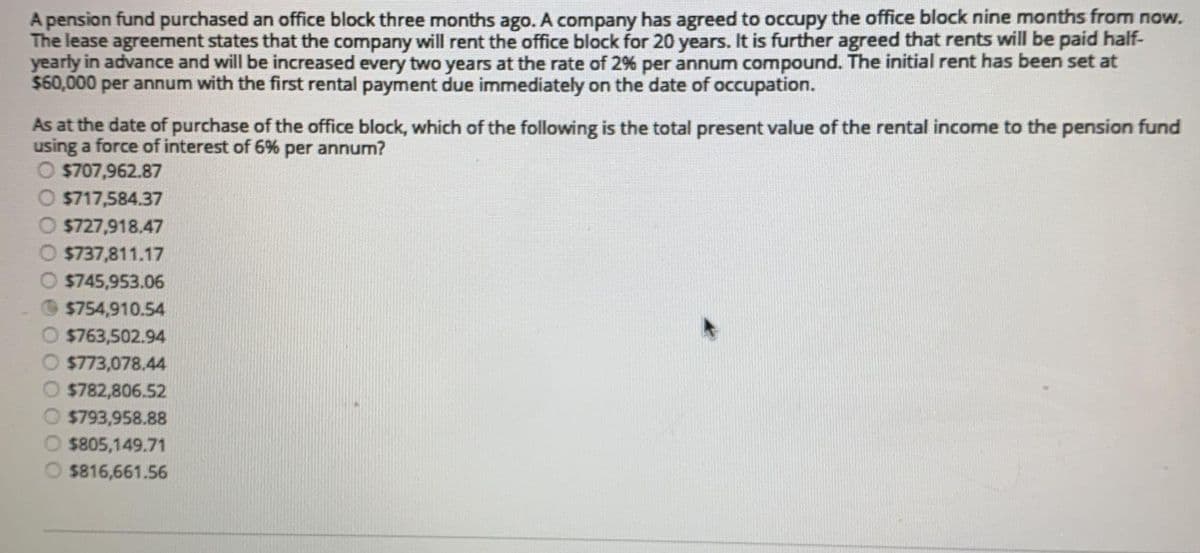

Transcribed Image Text:A pension fund purchased an office block three months ago. A company has agreed to occupy the office block nine months from now.

The lease agreement states that the company will rent the office block for 20 years. It is further agreed that rents will be paid half-

yearly in advance and will be increased every two years at the rate of 2% per annum compound. The initial rent has been set at

$60,000 per annum with the first rental payment due immediately on the date of occupation.

As at the date of purchase of the office block, which of the following is the total present value of the rental income to the pension fund

using a force of interest of 6% per annum?

O $707,962.87

O $717,584.37

$727,918.47

$737,811.17

O $745,953.06

$754,910.54

$763,502.94

$773,078.44

$782,806.52

$793,958.88

$805,149.71

$816,661.56

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning