Employment Income Income (Loss) From Business Rental Income (Loss) Taxable Capital Gains Allowable Capital Losses Subdivision e Deductions Case A 73,400 $ (14,400) 8,700 42,300 (18,300) (6.300) Case B Case C 41,500 $ 89,200 $ (4,400) (112,400) 6,300 5,200 7,500 23,400 (11,800) (21,400) (2 900) (22 200) Case D 34,200 (48,200) (20,400) 24,600 (26,400) (6500)

Employment Income Income (Loss) From Business Rental Income (Loss) Taxable Capital Gains Allowable Capital Losses Subdivision e Deductions Case A 73,400 $ (14,400) 8,700 42,300 (18,300) (6.300) Case B Case C 41,500 $ 89,200 $ (4,400) (112,400) 6,300 5,200 7,500 23,400 (11,800) (21,400) (2 900) (22 200) Case D 34,200 (48,200) (20,400) 24,600 (26,400) (6500)

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter8: Property Transactions: Capital Gains And Losses, Section 1231 And Recapture Provisions

Section: Chapter Questions

Problem 7BCRQ

Related questions

Question

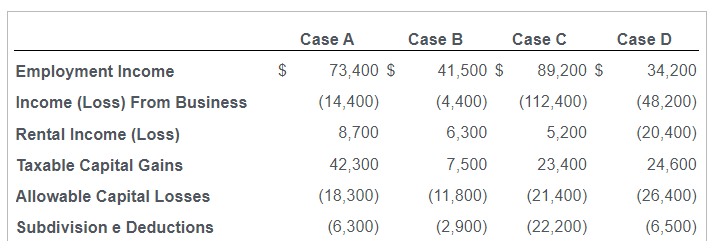

For each case, calculate Mr. McGowan's Net Income (Division B income). Indicate the amount and type of any loss carry overs that would be available at the end of the current year, or state that no carry overs are available.

Transcribed Image Text:Employment Income

Income (Loss) From Business

Rental Income (Loss)

Taxable Capital Gains

Allowable Capital Losses

Subdivision e Deductions

$

Case A

73,400 $

(14,400)

8,700

42,300

(18,300)

(6,300)

Case B

Case C

41,500 $ 89,200 $

(4,400) (112,400)

6,300

5,200

7,500

23,400

(11,800) (21,400)

(2,900)

(22,200)

Case D

34,200

(48,200)

(20,400)

24,600

(26,400)

(6,500)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you