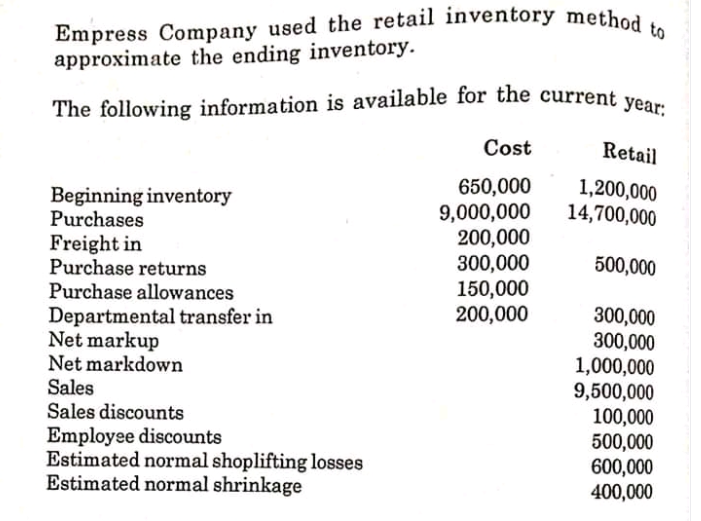

Empress Company used the retail inventory method to approximate the ending inventory. The following information is available for the current year; Cost Retail 650,000 9,000,000 200,000 300,000 150,000 200,000 1,200,000 14,700,000 Beginning inventory Purchases Freight in Purchase returns Purchase allowances Departmental transfer in Net markup Net markdown Sales Sales discounts 500,000 300,000 300,000 1,000,000 9,500,000 100,000 500,000 600,000 400,000 Employee discounts Estimated normal shoplifting losses Estimated normal shrinkage

Empress Company used the retail inventory method to approximate the ending inventory. The following information is available for the current year; Cost Retail 650,000 9,000,000 200,000 300,000 150,000 200,000 1,200,000 14,700,000 Beginning inventory Purchases Freight in Purchase returns Purchase allowances Departmental transfer in Net markup Net markdown Sales Sales discounts 500,000 300,000 300,000 1,000,000 9,500,000 100,000 500,000 600,000 400,000 Employee discounts Estimated normal shoplifting losses Estimated normal shrinkage

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 6P: Retail Inventory Method Turner Corporation uses the retail inventory method. The following...

Related questions

Question

a. What is the estimated cost of the ending inventory if the conservative approach was used?

b. What is the estimated cost of the ending inventory if the average cost approach was used?

c. What is the estimated cost of the ending inventory if the FIFO approach was used?

Please present the solution in good accounting form.

Transcribed Image Text:Empress Company used the retail inventory method to

The following information is available for the current year:

approximate the ending inventory.

The following information is available for the current ve

Cost

Retail

650,000

9,000,000

200,000

300,000

150,000

200,000

Beginning inventory

Purchases

1,200,000

14,700,000

Freight in

Purchase returns

Purchase allowances

Departmental transfer in

Net markup

Net markdown

Sales

Sales discounts

Employee discounts

Estimated normal shoplifting losses

Estimated normal shrinkage

500,000

300,000

300,000

1,000,000

9,500,000

100,000

500,000

600,000

400,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning