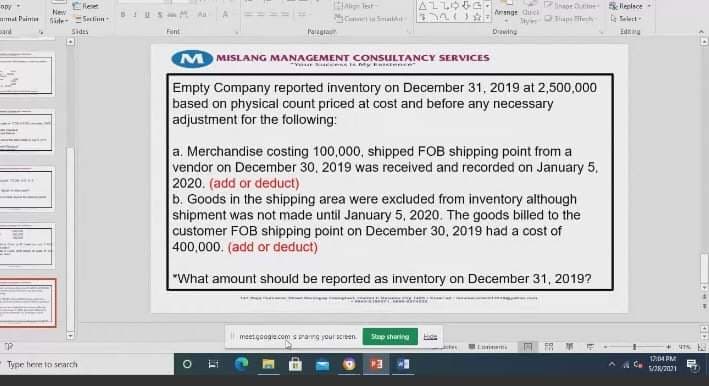

Empty Company reported inventory on December 31, 2019 at 2,500,000 based on physical count priced at cost and before any necessary adjustment for the following: a. Merchandise costing 100,000, shipped FOB shipping point from a vendor on December 30, 2019 was received and recorded on January 5, 2020. (add or deduct) b. Goods in the shipping area were excluded from inventory although shipment was not made until January 5, 2020. The goods billed to the customer FOB shipping point on December 30, 2019 had a cost of 400,000. (add or deduct) "What amount should be reported as inventory on December 31, 2019?

Empty Company reported inventory on December 31, 2019 at 2,500,000 based on physical count priced at cost and before any necessary adjustment for the following: a. Merchandise costing 100,000, shipped FOB shipping point from a vendor on December 30, 2019 was received and recorded on January 5, 2020. (add or deduct) b. Goods in the shipping area were excluded from inventory although shipment was not made until January 5, 2020. The goods billed to the customer FOB shipping point on December 30, 2019 had a cost of 400,000. (add or deduct) "What amount should be reported as inventory on December 31, 2019?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 6E: Goods in Transit Gravais Company made two purchases on December 29, 2019. One purchase for 3,000 was...

Related questions

Topic Video

Question

Transcribed Image Text:Ellee

liepince-

Arange Quel

ay p h

mal Paini

Side Sein

Sides

Font

Paigra

M MISLANG MANAGEMENT CONSULTANCY SERVICES

Empty Company reported inventory on December 31, 2019 at 2,500,000

based on physical count priced at cost and before any necessary

adjustment for the following:

a. Merchandise costing 100,000, shipped FOB shipping point from a

vendor on December 30, 2019 was received and recorded on January 5,

2020. (add or deduct)

b. Goods in the shipping area were excluded from inventory although

shipment was not made until January 5, 2020. The goods billed to the

custor

400,000. (add or deduct)

FOB shipping point on December 30, 2019 had a cost of

"What amount shouid be reported as inventory on December 31, 2019?

meetgooge comsarg your sceen

Sup sharing

17:04 PM

Type here to search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College