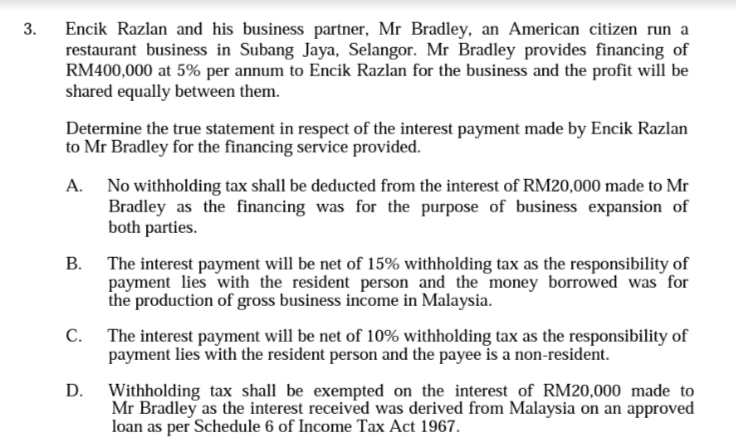

Encik Razlan and his business partner, Mr Bradley, an American citizen run a restaurant business in Subang Jaya, Selangor. Mr Bradley provides financing of RM400,000 at 5% per annum to Encik Razlan for the business and the profit will be shared equally between them. Determine the true statement in respect of the interest payment made by Encik Razlan to Mr Bradley for the financing service provided. A. No withholding tax shall be deducted from the interest of RM20,000 made to Mr Bradley as the financing was for the purpose of business expansion of both parties. B. The interest payment will be net of 15% withholding tax as the responsibility of payment lies with the resident person and the money borrowed was for the production of gross business income in Malaysia. C. The interest payment will be net of 10% withholding tax as the responsibility of payment lies with the resident person and the payee is a non-resident. D. Withholding tax shall be exempted on the interest of RM20,000 made to Mr Bradley as the interest received was derived from Malaysia on an approved loan as per Schedule 6 of Income Tax Act 1967.

Encik Razlan and his business partner, Mr Bradley, an American citizen run a restaurant business in Subang Jaya, Selangor. Mr Bradley provides financing of RM400,000 at 5% per annum to Encik Razlan for the business and the profit will be shared equally between them. Determine the true statement in respect of the interest payment made by Encik Razlan to Mr Bradley for the financing service provided. A. No withholding tax shall be deducted from the interest of RM20,000 made to Mr Bradley as the financing was for the purpose of business expansion of both parties. B. The interest payment will be net of 15% withholding tax as the responsibility of payment lies with the resident person and the money borrowed was for the production of gross business income in Malaysia. C. The interest payment will be net of 10% withholding tax as the responsibility of payment lies with the resident person and the payee is a non-resident. D. Withholding tax shall be exempted on the interest of RM20,000 made to Mr Bradley as the interest received was derived from Malaysia on an approved loan as per Schedule 6 of Income Tax Act 1967.

Chapter13: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 41P

Related questions

Question

Please answer the question.

Transcribed Image Text:Encik Razlan and his business partner, Mr Bradley, an American citizen run a

restaurant business in Subang Jaya, Selangor. Mr Bradley provides financing of

RM400,000 at 5% per annum to Encik Razlan for the business and the profit will be

shared equally between them.

3.

Determine the true statement in respect of the interest payment made by Encik Razlan

to Mr Bradley for the financing service provided.

A. No withholding tax shall be deducted from the interest of RM20,000 made to Mr

Bradley as the financing was for the purpose of business expansion of

both parties.

B. The interest payment will be net of 15% withholding tax as the responsibility of

payment lies with the resident person and the money borrowed was for

the production of gross business income in Malaysia.

C. The interest payment will be net of 10% withholding tax as the responsibility of

payment lies with the resident person and the payee is a non-resident.

D.

Withholding tax shall be exempted on the interest of RM20,000 made to

Mr Bradley as the interest received was derived from Malaysia on an approved

loan as per Schedule 6 of Income Tax Act 1967.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you