Pluto Ltd meets the criteria of a "close company" for corporation tax purposes: Ivor, who is a shareholder and director of the company is considered a "participator" in Pluto Ltd. During the accounting period ended 31 March 2021, Pluto Ltd lent £28,000 to vor. Ivor will repay £8,000 of the loan on 11 December 2021 and he will repay the balance of E20,000 on 29 January 2022. > Calculate the penalty tax liability which will arise in respect to this loan to a participator for the accounting period ended 31 March 2021.

Pluto Ltd meets the criteria of a "close company" for corporation tax purposes: Ivor, who is a shareholder and director of the company is considered a "participator" in Pluto Ltd. During the accounting period ended 31 March 2021, Pluto Ltd lent £28,000 to vor. Ivor will repay £8,000 of the loan on 11 December 2021 and he will repay the balance of E20,000 on 29 January 2022. > Calculate the penalty tax liability which will arise in respect to this loan to a participator for the accounting period ended 31 March 2021.

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 18CE

Related questions

Question

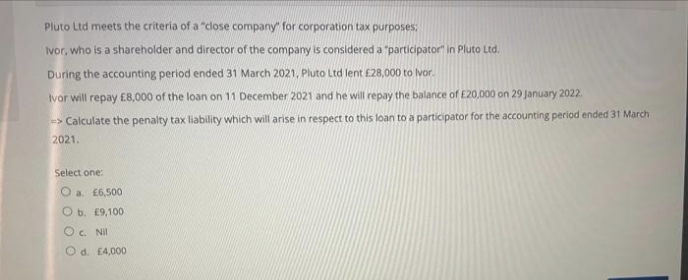

Transcribed Image Text:Pluto Ltd meets the criteria of a "close company" for corporation tax purposes:

Ivor, who is a shareholder and director of the company is considered a "participator" in Pluto Ltd.

During the accounting period ended 31 March 2021, Pluto Ltd lent £28,000 to Ivor.

Ivor will repay £8,000 of the loan on 11 December 2021 and he will repay the balance of E20,000 on 29 January 2022.

=> Calculate the penalty tax liability which will arise in respect to this loan to a participator for the accounting period ended 31 March

2021.

Select one:

O a. £6,500

O b. E9,100

O. Nil

O d. E4,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you