Nello Company owed $23,400 overdue rent to its landlord, Bonview Inc. Because Nello is a desirable tenant, Bonview agreed to settle the overdue account for a $15,000 cash payment from Nello. Both Nello and Bonview are accrual basis taxpayers. Required: a. What is the tax consequence to Nello of the settlement of its $23,400 account payable to Bonview? Compute Nello's net cash outflow from the settlement assuming its tax rate is 35 percent. b. What is the tax consequence to Bonview of the settlement of its $23,400 account receivable from Nello? Compute Bonview's net cash inflow from the settlement assuming its tax rate is 21 percent. Complete this question by entering your answers in the tabs below. Required A Required B

Nello Company owed $23,400 overdue rent to its landlord, Bonview Inc. Because Nello is a desirable tenant, Bonview agreed to settle the overdue account for a $15,000 cash payment from Nello. Both Nello and Bonview are accrual basis taxpayers. Required: a. What is the tax consequence to Nello of the settlement of its $23,400 account payable to Bonview? Compute Nello's net cash outflow from the settlement assuming its tax rate is 35 percent. b. What is the tax consequence to Bonview of the settlement of its $23,400 account receivable from Nello? Compute Bonview's net cash inflow from the settlement assuming its tax rate is 21 percent. Complete this question by entering your answers in the tabs below. Required A Required B

Chapter19: Corporations: Distributions Not In Complete Liquidation

Section: Chapter Questions

Problem 34P

Related questions

Question

100%

please attached images

Transcribed Image Text:Nello Company owed $23,400 overdue rent to its landlord, Bonview Inc. Because Nello is a desirable tenant, Bonview agreed to settle

the overdue account for a $15,000 cash payment from Nello. Both Nello and Bonview are accrual basis taxpayers.

Required:

a. What is the tax consequence to Nello of the settlement of its $23,400 account payable to Bonview? Compute Nello's net cash

outflow from the settlement assuming its tax rate is 35 percent.

b. What is the tax consequence to Bonview of the settlement of its $23,400 account receivable from Nello? Compute Bonview's net

cash inflow from the settlement assuming its tax rate is 21 percent.

Complete this question by entering your answers in the tabs below.

Required A

Required B

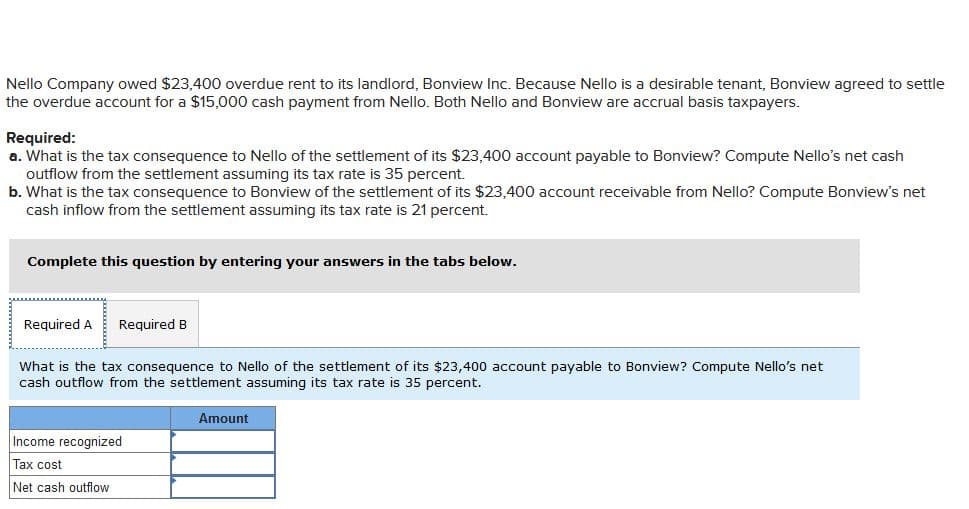

What is the tax consequence to Nello of the settlement of its $23,400 account payable to Bonview? Compute Nello's net

cash outflow from the settlement assuming its tax rate is 35 percent.

Amount

Income recognized

Tax cost

Net cash outflow

Transcribed Image Text:Nello Company owed $23,400 overdue rent to its landlord, Bonview Inc. Because Nello is a desirable tenant, Bonview agreed to settle

the overdue account for a $15,000 cash payment from Nello. Both Nello and Bonview are accrual basis taxpayers.

Required:

a. What is the tax consequence to Nello of the settlement of its $23,400 account payable to Bonview? Compute Nello's net cash

outflow from the settlement assuming its tax rate is 35 percent.

b. What is the tax consequence to Bonview of the settlement of its $23,400 account receivable from Nello? Compute Bonview's net

cash inflow from the settlement assuming its tax rate is 21 percent.

Complete this question by entering your answers in the tabs below.

Required A

Required B

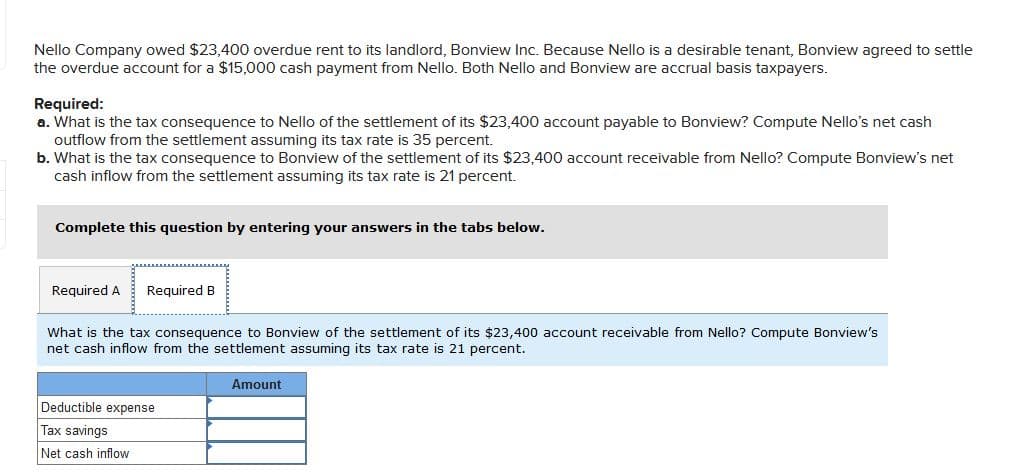

What is the tax consequence to Bonview of the settlement of its $23,400 account receivable from Nello? Compute Bonview's

net cash inflow from the settlement assuming its tax rate is 21 percent.

Amount

Deductible expense

Tax savings

Net cash inflow

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you