End of Year, k Expenses Annual MV at End of Year 1 $3,000 $4,700 2 3,000 3,200 3 3,500 2,200 4 4,000 1,450 5 4,500 950 6. 5,250 600 7 6,250 300 8 7,750

Q: Approximate the after-tax ROR on a project that had a first cost of $500,000, a salvage value of 20%…

A: In finance, the return is a benefit for an investment. It involves any adjustment in the estimation…

Q: A firm must decide between two designs. Their effective income tax rate is 22%, and MACRS…

A: The annual worth is calculated using the following formula:- Annual Worth (AW )=NPVPVAF(r%,n) Step…

Q: A corporation expects to receive $32,000 each year for 15 years from the sale of a product. There…

A: Rate of return is the annual income in percentage earned from an investment.

Q: Telstar Communications is going to purchase an asset for $600,000 that will produce $290.000 per…

A: Modified Accelerated cost recovery system (MACRS) is a method of calculating depreciation on an…

Q: What will be the annual cash outflows for Mimi Inc. if it leased a milling machine for $8,200 per…

A: The cash flows for the lessor are ascertained by adjusting the lease payments with depreciation…

Q: A machine generates $500,000 of gross income during its tax year and incurs operating expenses of…

A: The present worth method is an important method of the time value of money. The present worth is the…

Q: ABC Co. is contemplating an $18,000 investment in a methane gas generator. They estimate gross…

A: After-tax cash flow is the cash flows a project generates after taking taxation into account. It's…

Q: Henredon purchases a high-precision programmable router for shaping furniture components for…

A: Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: company is considering the purchase of an asset which costs $56,000 and has an estimated scrap value…

A:

Q: Macaron Corporation is making a $96,400 investment in equipment with a 5-year life. The company uses…

A: Lets understand the basics. Depreciation is a reduction in value of asset due to wear and tear…

Q: NUBD Co. purchase a machine for P180,000, which will be depreciated on the straight-line basis over…

A: The payback period is calculated as the time taken to recover the initial investment made in a…

Q: Complete the last four columns of the table below using an effective tax rate of 40% for an asset…

A: Under straight line depreciation, the first cost less the salvage value is divided equally…

Q: An after-tax analysis for a new $50,000 machine proposed for a fiber opticsmanufacturing line is in…

A: Depreciation is the amortization of the fixed asset cost over its useful life.

Q: 4. We-Clean-U, Inc., expects to receive $65,000 each year for 5 years from the sale of its newest…

A: Annual Depreciation (straight line) = Cost - SalvageUseful life = 150,000 - 50005 = 29,000 Annual…

Q: A van is bought for $15,000 in Year 0. It generates revenues of $25,000 per year and expenses of…

A: Here, Initial Investment is $15,000 Revenue is $25,000 per year Expenses is $20,000 per year…

Q: Harper Corporation has the following information about the purchase of a new piece of equipment:…

A: Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: A cutting edge metallic 3D printer is purchased by Helix Corp for $160000. It is expected to last 9…

A: The following information has been provided in the question: Cost of metallic printer =$160000 Life…

Q: A special power tool for plastic products costs $400,000 and has a four-year useful life, no salvage…

A: The period in which the cost of asset including working capital investment is fully recovered from…

Q: 0,000 and the firm spent $20,000 for shipping, at the end of its life the machine could be sell for…

A: Depreciation reduce the quantity of tax a corporation or organisation pays by tracking the reduction…

Q: The data required for a new investment are calculated as follows: Cost of the investment: 10.000.000…

A: Depreciation = Cost of investment / Economic life

Q: A firm has recently purchased Class 10 equipment for $100,000 with a CCA rate of 30%. What is the…

A: "Since you have asked multiple questions, we will solve the first question for you". If you want any…

Q: An asset with 5-year MACRS life will be purchased for $12,000. It will produce net annual benefits…

A: Rate of return refers to the income from the investment annually expressed in a form of a…

Q: Sandhill Corporation just purchased computing equipment for $22,000. The equipment will be…

A: The term depreciation refers to the process of systematically allocating the cost of an asset over…

Q: A new piece of equipment costs $500,000, and depreciated according to the 5 year MACRS schedule.…

A: In the given question, we have to calculate the net cash inflow for which we have been given annual…

Q: An asset with a first cost of $250,000 and a 5-year recovery period is subject to MACRS…

A: Given Cost - 250000 life - 5 years MACRS method of depreciation Depreciation: years 1 2 3…

Q: Donata Company purchased equipment for $45,000 in December 20x1. The equipment is expected to…

A: Solution: Additional revenue per year = $12,000 Additional cash expenses = $6,000 Depreciation for…

Q: A special power tool for plastic products costs $400,000 and has a 4year useful life, no salvage…

A: Rate of return A net profit/loss of the investment over the specified period is denoted in terms of…

Q: a. If taxes are 25%, what is the After tax operating cash flow for the first year?

A: Given: Operating income = $200,000 Purchased for = $2,000,000 Land portion = $200,000 Building…

Q: New equipment costs $847,000 and is expected to last for five years with the salvage value of 10% of…

A: The formula for the calculation of PVCCATS is as follows: PVCCATS=CdTd+k×1+0.5k1+k-SdTd+k×11+kn C is…

Q: Harper Corporation has the following information about the purchase of a new piece of equipment:…

A: Gross profit is $50,000 per year Cost of equipment is $130,000 Salvage value at the end of the 8 th…

Q: Complete the last four columns of the table below using an effective tax rate of 40% for an asset…

A: Exercise 4 : Tax is that the obligatory payment that individual and corporation got to pay to the…

Q: A corporation expects to receive $32,000 each year for 15 years from the sale of a product. There…

A: Purpose of every investment is to get return. Return means extra amount received over the invested…

Q: Suppose that the new equipment has a cost basis of $12,000 and a salvage value of $3,0 of 6 years.…

A: The cash flow that is produced by the equipment consider the tax benefits of the depreciation so…

Q: A firm can purchase a centrifugal separator (5-year MACRS property) for $22,000. The estimated…

A: Net Present Value=(Present Value of Cash Inflows-Present Value of Cash Outflows)

Q: A company is considering purchasing a new piece of machinery at a cost $60,000. It is expected to…

A: Economic Value Added = Net Operating Profit After Tax - ( Cost of Capital * Invested Capital)

Q: An asset with a first cost of $250,000 and a 5-year recovery period is subject to MACRS…

A: Answer has been given in the next sheet.

Q: What is the depreciation using straight line deprectiation over 12 years, what is the revenue earned…

A: Note: Present value of Detroit engine warranty given is incorrect. Present value of Detroit engine…

Q: Property, in the form of unimproved land, is purchased at a cost of $8000 and is held for 6 years,…

A: Information Provided: Cost = $8000 Sold = $32,600 Property tax = $220 Interest = 12% Income tax =…

Q: The following data are from an after-tax cash flow analysis in year 1 for anew MACRS 5-year…

A: Depreciation: It refers to a gradual decrease in the fixed asset’s value because of obsolescence,…

Q: What is the payback period in years approximated to two decimal points? Group of answer choices 2.63…

A: Equipment Cost = $60000 Annual Depreciation (Straight Line Method) = (Cost - Salvage Value) / Useful…

Q: as invested $50,000 in equipment with a 5-year useful life. The machinery will have a salvage value…

A: IRR stands for Internal rate of return refers to the concept that evaluates the profitability factor…

Q: A piece of construction equipment costs $325,000. It will be depreciated as Modified Accelerated…

A: After tax cash flow = Profit after tax + depreciation for the year Depreciation is calculated by…

Q: The $500,000 investment in the surface-mount placement (SMP) machine in an electronics manufacturing…

A: If the salvage value of an asset is adjusted for the tax rate then it is known as after- tax salvage…

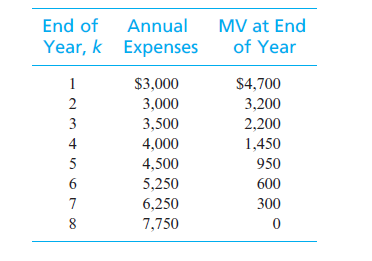

Consider a piece of equipment that initially cost $8,000 and has these estimated annual expenses and MV: If the after-tax MARR is 7% per year, determine the after-tax economic life of this equipment. MACRS (GDS)

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- PROVIDE COMPUTATION! 5. Cumulative compensation expense at the end of year 1a. P407,000 c. P430,000b. P645,000 d. P82,500 6. Cumulative compensation expense at the end of year 2a. P1,290,000 c. P810,000b. P330,000 d. P822,000 7. Cumulative compensation expense at the end of year 3a. P1,221,000 c. P1,215,000b. P1,290,000 d. P1,500,000Income 31955 , assets 213000, assets at end year, 259000. What return on assetsQuestion 1The following information was extracted from the financial statement of Barryfor the year ended 31 December 2020. RMSales 437,500Opening inventories 17,500Closing inventories 26,250Cost of sales 262,500Other income 3,750Expenses 61,250Current liabilities 47,250Trade receivables 39,375Bank 8,750Cash 31,500Required:(a) Show the formulae and compute the value of the following for Barry:(i) Purchases(ii) Gross profit(iii)Net Profit

- For item 5. An SME has the following informationRetained Earnings P 2,400Transactions during the yearRevenues 5,000Dividend Income 800Dividend income and other expenses 3,200Dividend Declared P 350Additional information:• During the year, the SME changed the cost flow for its inventories from the FIFO method to theweighted average.FIFO AverageJan. 1 P 3,200 P 2,600December 31 5,300 6,4005. If the SME opts present a statements of income and retained earnings, the bottom line in thestatement shows an amount equal toa. P2,600 b. P2,850 c. P4,550 d. P4,050Year ended December 31, 2023 2022 2021 Revenues $4,578,041 $3,864,324 $3,003,610 Costs and expenses: Cost of goods sold $2,227,189 $2,089,089 $2,005,691 Selling and administrative 922,261 836,212 664,061 Interest 29,744 32,966 30,472 Other expenses (income) 1,475 2,141 (43) Total costs and expenses $3,180,669 $2,960,408 $2,700,181 Income before income taxes $1,397,372 $903,916 $303,429 Income taxes 229,500 192,600 174,700 Net income $1,167,872 $711,316 $128,729 Venus IndustriesConsolidated Balance Sheets (in thousands) December 31, ASSETS 2023 2022 Current assets: Cash and equivalents $291,284 $260,050 Accounts receivable, less allowance for doubtful accounts of $19,447 and $20,046 826,977 616,064 Inventories 592,986 512,917 Deferred income taxes 26,378 28,355 Prepaid expenses 40,663 32,977 Total current assets $1,778,288 $1,450,363 Property, plant, and equipment $571,032 $497,795 Less accumulated depreciation (193,037)…39- YEAR 2018 YEAR 2019 Current Assets 800.000 TL 1,000,000 TL Calculate the amount of change in TL using the comparative table analysis method according to the information above. a) 100,000 TL B) 200.000 TL NS) 300.000 TL D) 500.000 TL TO) 400.000 TL

- Life-Positive’s Account Balances 2021 ($) 2022 ($) Accounts Payable 24,600.00 21,250.00 Accounts receivable 15,700.00 12,340.00 Cash 23,450.00 28,600.00 Cost of goods sold 19,700.00 23,000.00 Depreciation 3,090.00 4,590.00 Dividends 5,800.00 10,800.00 Interest 2,340.00 2,890.00 Inventory 7,050.00 8,640.00 Long-term debt 28,000.00 30,000.00 Net fixed assets 41,500.00 48,000.00 Other expenses 2,400.00 2,800.00 Sales 58,000.00 62,500.00 Short-term Notes Payable 2,890.00 2,340.00 Shares outstanding 85,000.00 90,000.00 The tax rate is 32% 1.Prepare a balance sheet for 2021 and 2022 for the company, clearly showing information about each line item. 2.Prepare an income statement for 2021 and 2022 for the company. 3.For the year ending 2022, determine the Net New Equity, Change in Net Working Capital, Net Capital Spending and Operating Cash flow. 4.Calculate the cash flow from assets, cash flow to creditors,…Life-Positive’s Account Balances 2021 ($) 2022 ($) Accounts Payable 24,600.00 21,250.00 Accounts receivable 15,700.00 12,340.00 Cash 23,450.00 28,600.00 Cost of goods sold 19,700.00 23,000.00 Depreciation 3,090.00 4,590.00 Dividends 5,800.00 10,800.00 Interest 2,340.00 2,890.00 Inventory 7,050.00 8,640.00 Long-term debt 28,000.00 30,000.00 Net fixed assets 41,500.00 48,000.00 Other expenses 2,400.00 2,800.00 Sales 58,000.00 62,500.00 Short-term Notes Payable 2,890.00 2,340.00 Shares outstanding 85,000.00 90,000.00 The tax rate is 32% 1.Calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders for 2022. 2.what is the Dividends per Share and Earnings per Share for each year for Brown Company. 3.Briefly comment on the company’s cash flows for 2022 in light of an expansion plan which will be financed by both debt and…Life-Positive’s Account Balances 2021 ($) 2022 ($) Accounts Payable 24,600.00 21,250.00 Accounts receivable 15,700.00 12,340.00 Cash 23,450.00 28,600.00 Cost of goods sold 19,700.00 23,000.00 Depreciation 3,090.00 4,590.00 Dividends 5,800.00 10,800.00 Interest 2,340.00 2,890.00 Inventory 7,050.00 8,640.00 Long-term debt 28,000.00…

- May Mahal Nang Iba Company Question: The net income for the year is a. P220,0000 b. P260,000 c. P130,000 d. P180,000Cash$ 9,000Depreciation expense$ 4,000Building98,000Wages expense45,000Accounts payable8,000Insurance expense3,000Services revenue60,000Supplies expense2,000Interest revenue5,000Utilities expense1,000 Use the following selected accounts and amounts with normal balances from Buildex Company’s adjusted trial balance to prepare its income statement for the year ended December 31. Hint: Not all accounts need to be used.Net income for 2020 was P1.825.600.in 2021. it decreased by 53%. Still using the 2020 net income as the base year, by 2022, net income increased by 130%. Determine the net income for 2021 and 2022. respectively separate the valves by a commafollowed by a space :