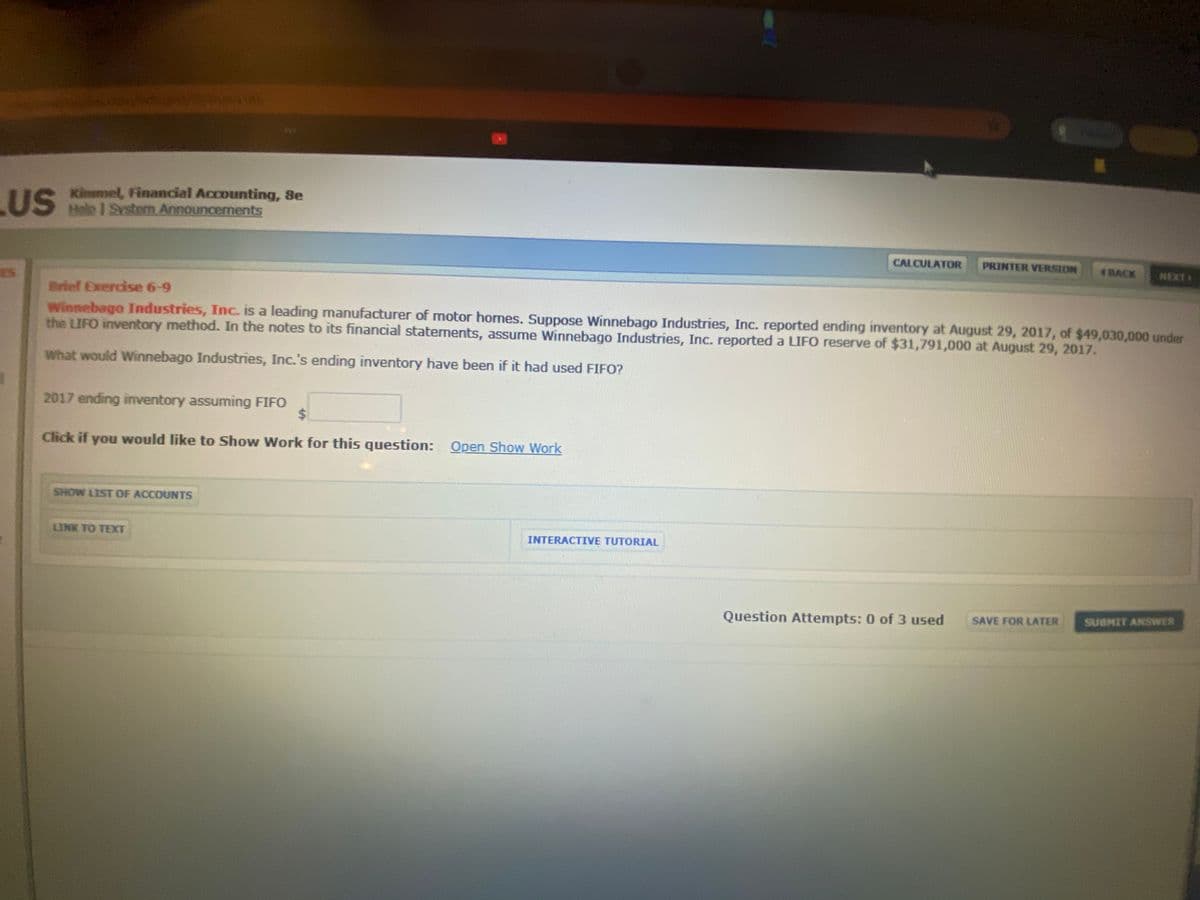

Ending inventory calculation. Please see photo for question. Winnebago reported ending inventory August 29 2017 of 49,030,000 under LIFO method. In financial stmts assume Winnebago reported a LIFO reserve of 39,791,000 at August 29. What would ending inventory have been if FIFO?

Q: Presented below is information related to Nash Company. Date Ending Inventory (End-of-Year…

A: Under dollar value LIFO method, the goods are taken collectively into the form of pools and then…

Q: The dollar-value LIFO method was adopted by Windsor Corp. on January 1, 2017. Its inventory on that…

A: Calculation of amount of the inventory at December 31, 2017, under the dollar-value LIFO method:…

Q: Mercury Company has only one inventory pool. On December 31, 2021, Mercury adopted the dollar-value…

A: Using LIFO method, the inventory at last would be sold first and old inventory would be in ending…

Q: Sandhill, Inc. uses the dollar-value LIFO method of computing its inventory. Data for the past 3…

A: Last-in-First-Out: In Last-in-first-out method, the costs of last purchase items are considered as…

Q: At the beginning of 2016, a company adopts the dollar-value LIFO inventory method for its one…

A: Dollar-Value-LIFO: This method shows all the inventory figures at dollar price rather than units.…

Q: Based on our understanding of inventcory cost fowis,and given the information listed below for the…

A: Cost of goods sold is calculated by subtracting gross profit from net sales. Note :- Net Sales is…

Q: In 2016, Adonis Industries changed its method of valuing inventory from the average cost method to…

A: Calculate the changes in inventory value.

Q: In 2017, Blue company adopted the Dollar-Value LIFO method for externally reporting inventory. The…

A: Dollar value LIFO method: This method is different model for the last-in first layering model. Under…

Q: Esquire Inc. uses the LIFO method to report its inventory. Inventory at January 1, 2021, was…

A: Under Last-in-First out method, inventory that is brought at later dates is sold first ( Newest…

Q: The Cecil-Booker Vending Company changed its method of valuing inventory from the average cost…

A:

Q: On January 1, 2021, the National Furniture Company adopted the dollar-value LIFO method of computing…

A: Inventory is the current assets of the company that is used in the production process.

Q: Mercury Company has only one inventory pool. On December 31, 2021, Mercury adopted the dollar-value…

A: Solution: computation of inventory at December 31, 2022, 2023, and 2024, using the dollar-value LIFO…

Q: Alster Corporation adopted the dollar-value LIFO method of inventory valuation on December 31, 2015.…

A: Solution : Computation of inventory at base year prices and change from prior year - Alster…

Q: Midori Company had ending inventory at end-of-year prices of $100,000 at December 31, 2016; $119,900…

A: "Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Covid Company used a perpetual inventory system. At the end of 2020, the inventory account was…

A: Cost of goods sold: It refers to the cost incurred by a company that is directly related to…

Q: Marigold Company has used the dollar-value LIFO method for inventory cost determination for many…

A: Determine the amount of change in base price.

Q: Dollar-Value LIFO Kwestel Company adopted the dollar-value LIFO method for inventory valuation at…

A: Here in this question we are required to calculate dollar value LIFO inventory. In this method,…

Q: Sultan Co. uses the retail inventory method to estimate its inventory for interim statement…

A: Inventory is the current asset of the company that includes the raw materials which are required to…

Q: In 2018, Adonis Industries changed its method of valuing inventory from the average cost method to…

A: FIFO: In First-in-First-Out method, items purchased initially are sold first. So, the value of the…

Q: At the beginning of 2016, the Joan Company had an inventory valued at $34,375 at cost ($50,000 at…

A: Retail inventory method is used by retailers to value their closing stock without need of taking…

Q: The Tam Company uses the retail inventory method and the average cost flow assumption for…

A: Formula: Selling price of good available = Beginning inventory + purchases + markup Sum of beginning…

Q: On January 1, 2016, the Wind Company’s beginning inventory P400,000. During 2016, Wind purchased…

A: Given information, beginning inventory=P400,000 purchases =P1,900,000 ending inventory=P500,000

Q: following data concerning inventory. At December 31, 2015, the balance in Zebra's Inventory account…

A: The allowance for inventory loss is created to overcome any reduction in value of inventory.

Q: Mercury Company has only one Inventory pool. On December 31, 2021, Mercury adopted the dollar-value…

A: The dollar value method to valuate the LIFO inventories , is a method which determines the cost by…

Q: On January 1, 2016, the Haskins Company adopted the dollar-value LIFO method for its one inventory…

A: Dollar-Value-LIFO: This method shows all the inventory figures at dollar price rather than units.…

Q: Midori Company had ending inventory at end-of-year prices of $100,000 at December 31, 2019; $119,900…

A: Base year prices = Ending inventory / year-end price indexe 2019 = $100,000 / 1.0 = $100,000 2020 =…

Q: Presented below is information related to Dino Radja Company. Date Ending…

A: Last in First Out (LIFO): Under this inventory method, the units that are purchased last, are sold…

Q: On January 1, 2011, the National Furniture Company adopted the dollar-value LIFO method of computing…

A: Inventory on Jan-1 is $ 200,000. If we assume prices at the beginning of the year to be 100%, we can…

Q: Winnebago Industries, Inc. is a leading manufacturer of motor homes. Suppose Winnebago reported…

A: Inventory refers to the raw materials, work in progress, and the finished goods products that are…

Q: On January 1, 2018, the Taylor Company adopted the dollar-value LIFO method. The inventory value for…

A: 1. Find the value of inventory at the current cost 2. Convert it to base year cost 3. Then apply…

Q: The following information relates to the Jimmy Johnson Company. Date Ending…

A: The dollar-value LIFO method is used by the companies which accounts the inventory by using LIFO…

Q: On January 1, 2016, the Taylor Company adopted the dollar-value LIFO method. The inventory value for…

A: Dollar-Value-LIFO: This method shows all the inventory figures at dollar price rather than units.…

Q: Mercury Company has only one inventory pool. On December 31, 2016, Mercury adopted the dollar-value…

A: Dollar-Value-LIFO: This method shows all the inventory figures at dollar price rather than units.…

Q: Carswell Electronics adopted the dollar-value LIFO method on January 1, 2016, when the inventory…

A: Dollar value LIFO method: In this method, the aggregate cost of inventory is compiled to layers for…

Q: At the beginning of 2018, a company adopts the dollar-value LIFO inventory method for its one…

A:

Q: On January 1, 2020, Temple Company adopted the dollar-value LIFO method for its one inventory pool.…

A: The question is based on the concept of Financial Accounting.

Q: Sunland Company had ending inventory at end-of-year prices of $108,000 at December 31, 2019;…

A: Dollar Value LIFO Method Date Inventory at the end of the year Price Index Inventory at base year…

Q: Based on our understanding of inventory cost flows, and given the information listed below for the…

A: The correct answer is option (e).

Q: dollar-value LIFO method

A: Year Inventory (end Year) (Actual Cost) Price Index nventory (end Year) (base year Cost)…

Q: A company has the following information available that was used to report inventory using the…

A: The cost index represents the cost fluctuations incurred by businesses as a result of the…

Q: On January 1, 2018, Devoe Company changed from the FIFO method to the average cost method to account…

A: Net Income: Net income (also consolidated income, net earnings, net profit, bottom line, sales…

Q: Tamarisk Company had ending inventory at end-of-year cost of $116,900 at December 31, 2016; $143,640…

A: The dollar value of LIFO strategy collects total cost data for a lot of stock, with the goal that…

Q: The January 28, 2020 (fiscal year 2019) financial statements of Firm C reported the following…

A: Under the FIFO method, the inventory that is purchased first is sold first, hence the ending…

Q: Esquire Inc. uses the LIFO method to value its inventory. Inventory at January 1, 2018, was $500,000…

A: Definition: Last-in-First-Out (LIFO): In this method, items purchased recently are sold first. So,…

Q: Lol Company’s inventory account balance on December 31, 2019 was 360,000 and 30,000 of those goods…

A: Ending inventory for 2019 = inventory account balance + goods purchased on FOB shipping point =…

Q: utler Company reported ending inventory at December 31, 2010 of $1,200,000 under LIFO. It also…

A: Cost of goods sold for 2010 as per FIFO = Cost of goods sold for 2010 as per LIFO - (LIFO reserve at…

Q: In its 2019 annual report, Kingbird, Inc. reported inventory of $ 626 million on January 31, 2020,…

A: Inventory turnover is an accounting turnover ratio that determines the number of times inventory is…

Q: On January 1, 2021, Badger Inc. adopted the dollar-value LIFO method. The inventory cost on this…

A: Dollar-value LIFO method: In this method, the valuation of inventory is calculated on the monetary…

Q: Brooke Company used a perpetual inventory system. At the end of 2012, the inventory account was…

A: Introduction: The total amount your organisation paid as a cost directly tied to the selling of…

Ending inventory calculation. Please see photo for question. Winnebago reported ending inventory August 29 2017 of 49,030,000 under LIFO method. In financial stmts assume Winnebago reported a LIFO reserve of 39,791,000 at August 29. What would ending inventory have been if FIFO?

Inventory: It refers to the items held by an organization which were in various forms like raw material, work-in process, and finished goods. The inventory is generally held for resale or to use in the production process.

First-in first out method (FIFO): The FIFO method under the perpetual inventory system values the cost of units sold at the rate of units which were first purchased in the inventory. Thus, the cost of goods sold is valued at cost of earlier purchased goods and the ending inventory is valued at the cost of recently purchased goods.

Last in first out method (LIFO): The LIFO method under the perpetual inventory system values the cost of units sold at the rate of units which were recently purchased. Thus, the ending inventory is valued at the cost of earlier purchased goods.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Appendix Periodic inventory accounts, multiple-step income statement, closing entries On December 31, 2018, the balances of the accounts appearing in the ledger of Wyman Company are as follows: Cash 13,500 Dividends 25,000 Accounts Receivable 72,000 Sales 3,280,000 Inventory, January 1, 2018 257,000 Purchases 2,650,000 Estimated Returns Inventory, January 1,2018 35,000 Purchases Returns and Allowances 93,000 Purchases Discounts 37,000 Office Supplies 3,000 Freight In 48,000 Prepaid Insurance 4,500 Sales Salaries Expense 300,000 Land 150,000 Advertising Expense 45,000 Store Equipment 270,000 Delivery Expense 9,000 Accumulated Depreciation Store Equipment 55,900 Depreciation Expense Store Equipment 6,000 Office Equipment 78,500 Miscellaneous Selling Expense 12,000 Accumulated Depreciation Office Equipment 16,000 Office Salaries Expense 175,000 Rent Expense 28,000 Accounts Payable 77,800 Insurance Expense 3,000 Salaries Payable 3,000 Office Supplies Expense 2,000 Customer Refunds Payable 50,000 Depreciation Expense Office Equipment 1,500 Unearned Rent 8,300 Notes Payable 50,000 Miscellaneous Administrative Expense 3,500 Common Stock 150,000 Rent Revenue 7,000 Retained Earnings 365,600 Interest Expense 2,000 Instructions 1. Does Wyman Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Wyman Company for the year ended December 31, 2018. The inventory as of December 31, 2018, was 305,000. The estimated cost of customer returns inventory for December 31, 2018, is estimated to increase to 40,000. 3. Prepare the closing entries for Wyman Company as of December 31, 2018. 4. What would be the net income if the perpetual inventory system had been used?Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek Co. as of May 1, 2016 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: May 1. Paid rent for May, 5,000. 3. Purchased merchandise on account from Martin Co., terms 2/10, n/30, FOB shipping point, 36,000. 4. Paid freight on purchase of May 3, 600. 6. Sold merchandise on account to Korman Co., terms 2/10, n/30, FOB shipping point, 68,500. The cost of the merchandise sold was 41,000. 7. Received 22,300 cash from Halstad Co. on account. 10. Sold merchandise for cash, 54,000. The cost of the merchandise sold was 32,000. 13. Paid for merchandise purchased on May 3. 15. Paid advertising expense for last half of May, 11,000. 16. Received cash from sale of May 6. 19. Purchased merchandise for cash, 18,700. 19. Paid 33,450 to Buttons Co. on account. 20. Paid Korman Co. a cash refund of 13,230 for returned merchandise from sale of May 6. The invoice amount of the returned merchandise was 13,500 and the cost of the returned merchandise was 8,000. Record the following transactions on Page 21 of the journal: 20. Sold merchandise on account to Crescent Co., terms 1/10, n/30, FOB shipping point, 110,000. The cost of the merchandise sold was 70,000. 21. For the convenience of Crescent Co., paid freight on sale of May 20, 2,300. 21. Received 42,900 cash from Gee Co. on account. May 21. Purchased merchandise on account from Osterman Co., terms 1/10, n/30, FOB destination, 88,000. 24. Returned of damaged merchandise purchased on May 21, receiving a credit memo from the seller for 5,000. 26. Refunded cash on sales made for cash, 7,500. The cost of the merchandise returned was 4,800. 28. Paid sales salaries of 56,000 and office salaries of 29, 000. 29. Purchased store supplies for cash, 2,400. 30. Sold merchandise on account to Turner Co., terms 2/10, n/30, FOB shipping point, 78,750. The cost of the merchandise sold was 47,000. 30. Received cash from sale of May 20 plus freight paid on May 21. 31. Paid for purchase of May 21, less return of May 24. Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for July, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). f. The adjustment for customer returns and allowances is 60,000 for sales and 35,000 for cost of merchandise sold. 5. (Optional) Enter the unadjusted trial balance on a IO-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the owners capital account. 10. Prepare a post-closing trial balance.Continuing problem Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account Balances for Palisade Creek Co. as of May 1, 2016 (unless otherwise indicated), are as follows: 110 Cash 83,600 112 Accounts Receivable 233,900 115 Merchandise Inventory 624,400 116 Estimated Returns Inventory 28,000 117 Prepaid Insurance 16,800 118 Store Supplies 11,400 123 Store Equipment 569,500 124 Accumulated DepreciationStore Equipment 56,700 210 Accounts Payable 96,600 211 Salaries Payable 212 Customers Refunds Payable 50,000 310 Common Stock 100,000 311 Retained Earnings 585,300 312 Dividends 135,000 313 Income Summary 410 Sales 5,069,000 510 Cost of Merchandise Sold 2,823,000 520 Sales Salaries Expense 664,800 521 Advertising Expense 281,000 522 Depreciation Expense 523 Store Supplies Expense 529 Miscellaneous Selling Expense 12,600 530 Office Salaries Expense 382,100 531 Rent Expense 83,700 532 Insurance Expense 539 Miscellaneous Administrative Expense 7,800 During May, the last month of the fiscal year, the following transactions were completed: May 1. Paid rent for May, 5,000. 3. Purchased merchandise on account from Martin Co. terms 2/10t n/30, FOB shipping point, 36,000. 4. Paid freight on purchase of May 3, 600. 6. Sold merchandise on account to Korman Co., terms 2/10, n/30, FOB shipping point, 68,500. The cost of the merchandise sold was 41,000. 7. Received 22,300 cash from Halstad Co. on account. 10. Sold merchandise for cash, 54,000. The cost of the merchandise sold was 32,000. 13. Paid for merchandise purchased on May 3- 15. Paid advertising expense for last half of May, 11,000. 16. Received cash from sale of May 6. 19. Purchased merchandise for cash, 18,700. 19. Paid 33,450 to Buttons Co. on account 20. Paid Korman Co. a cash refund of 13,230 for returned merchandise from sale of May 6. The invoice amount of the returned merchandise was 13,500 and the cost of the returned merchandise was 8,000. Record the following transactions on Page 21 of the journal: 20. Sold merchandise on account to Crescent Co., terms 1/10, n/30, FOB shipping point, 110,000. The cost of the merchandise sold was 70,000. 21. For the convenience of Crescent Co., paid freight on sale of May 20. 2,300. 21. Received 42,900 cash from Gee Co. on account. May 21. Purchased merchandise on account from Osterman Co., terms 1/10, n/30, FOB destination. 88,000. 24. Returned of damaged merchandise purchased on May 21, receiving a credit memo from the seller for 5,000. 26. Refunded cash on sales made for cash. 7,500. The cost of the merchandise returned was 4,800. 28. Paid sales salaries of 56,000 and office salaries of 29,000. 29. Purchased store supplies for cash, 2,400. 30. Sold merchandise on account to Turner Co., terms 2/10, n/30, FOB shipping point, 78,750. The cost of the merchandise sold was 47,000. 30. Received cash from sale of May 20 plus freight paid on May 21. 31. Paid for purchase of May 21. less return of May 24. Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for July, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). a. Merchandise inventory on May 31 570,000 b. Insurance expired during the year 12,000 c. Store supplies on hand on May 31 4,000 d. Depreciation for the current year 14,000 e. Accrued salaries on May 31: Sales salaries 7,000 Office salaries 6,600 13,600 f. The adjustment for customer returns and allowances is 60,000 for sales and 35,000 for cost of merchandise sold. 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a retained earnings statement, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the retained earnings account. 10. Prepare a post-closing trial balance.

- Periodic inventory accounts, multiple-step income statement, closing entries On December 31, 2019, the balances of the accounts appearing in the ledger of Wyman Company are as follows: Cash 13,500 Accounts Receivable 72,000 Merchandise Inventory, January 1,2019 257,000 Estimated Returns Inventory 35,000 Office Supplies 3,000 Prepaid Insurance 4,500 Land 150,000 Store Equipment 270,000 Accumulated DepreciationStore Equipment 55000 Office Equipment 78,500 Accumulated DepreciationOffice Equipment 16000 Accounts Payable 27,800 Customer Refunds Payable 50,000 Salaries Payable 3,000 Unearned Rent 8,300 Notes Payable 50,000 Shirley Wyman, Capital 515,600 Shirley Wyman, Drawing 25,000 Sales 3280000 Purchases 2650000 Purchases Returns and Allowances 93,000 Purchases Discounts 37,000 Freight In 48,000 Sales Salaries Expense 300,000 Advertising Expense 45,000 Delivery Expense 9,000 Depreciation ExpenseStore Equipment 6,000 Miscellaneous Selling Expense 12,000 Office Salaries Expense 175,000 Rent Expense 28,000 Insurance Expense 3,000 Office Supplies Expense 2,000 Depreciation Expense-Office Equipment 1,500 Miscellaneous Administrative Expense 3,500 Rent Revenue 7,000 Interest Expense 2,000 Instructions 1. Does Wyman Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Wyman Company for the year ended December 31, 2019. The merchandise inventory as of December 31, 2019, was 305,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was 30,000. 3. Prepare the closing entries for Wyman Company as of December 31, 2019. 4. What would the net income have been if the perpetual inventory system had been used?Appendix Periodic inventory accounts, multiple-step income statement, closing entries On June 30, 2018, the balances of the accounts appearing in the ledger of Simkins Company are as follows: Cash 125,000 Dividends 275,000 Accounts Receivable 72,000 Sales 6,590,000 Inventory, July 1, 2017 415,000 Purchases 4,100,000 Estimated Returns Inventory, July 1,2017 25,000 Purchases Returns and Allowances 32,000 Purchases Discounts 13,000 Office Supplies 9,000 Freight In 45,000 Prepaid Insurance 18,000 Sales Salaries Expense 580,000 Land 300,000 Advertising Expense 315,000 Store Equipment 550,000 Delivery Expense 18,000 Accumulated Depreciation Store Equipment 190,000 Depreciation Expense Store Equipment 12,000 Office Equipment 250,000 Miscellaneous Selling Expense 28,000 Accumulated Depreciation Office Equipment 110,000 Office Salaries Expense 375,000 Rent Expense 43,000 Accounts Payable 85,000 Insurance Expense 17,000 Salaries Payable 30,000 Office Supplies Expense 5,000 Customer Refunds Payable 9,000 Depreciation Expense Office Equipment 4,000 Unearned Rent 6,000 Notes Payable 50,000 Miscellaneous Administrative Expense 16,000 Common Stock 300,000 Rent Revenue 32,500 Retained Earnings 520,000 Interest Expense 2,500 Instructions 1. Does Simkins Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Simkins Company for the year ended June 30, 2018. The inventory as of June 30, 2018, was 508,000. The estimated cost of customer returns inventory for June 30, 2018, is estimated to increase to 33,000. 3. Prepare the closing entries for Simkins Company as of June 30, 2018. 4. What would be the net income if the perpetual inventory system had been used?The following data pertain to 2012 activities of Twisp Industries: Use your completed worksheet to determine the firms cost of goods sold for 2012. Remember to change the year in row 24 and to enter new beginning inventory balances. Save the 2012 file as MFG3. Print the worksheet when done. If sales and other expenses were identical in 2011 and 2012, during which year did Twisp earn more income? Why?

- ( Appendix 6B) Refer to the information for Morgan Inc. above. If Morgan uses a periodic inventory system, what is the cost of ending inventory under LIFO at April 30? a. $32,800 b. $38,400 c. $63,600 d. $69,200Costco, Walmart, Nordstrom: Inventory turnover and number of days sales in inventory The general merchandise retail industry has a number of segments represented by the following companies: Company Name Merchandise Concept Costco Wholesale Corporation Membership warehouse Walmart Stores, Inc. Discount general merchandise Nordstrom, Inc. Fashion department store For a recent year, the following cost of goods sold and beginning and ending inventories are provided from corporate annual reports (in millions) for these three companies: Costco Walmart Nordstrom Cost of goods sold 98,458 365,086 8,406 Inventories: Beginning of year 7,894 44,858 1,531 End of year 8,456 45,141 1,733 A. Determine the inventory turnover ratio for all three companies. (Round all calculations to one decimal place.) B. Determine the number of days sales in inventory for all three companies. (Use 365 days and round all calculations to one decimal place.) C. Interpret these results based on each companys merchandising concept.Analyzing Inventory The recent financial statements of McLelland Clothing Inc. include the following data: Required: 1. Calculate McLellands gross profit ratio (rounded to two decimal places), inventory turnover ratio (rounded to three decimal places), and the average days to sell inventory (assume a 365-day year and round to two decimal places) using the FIFO inventory costing method. Be sure to explain what each ratio means. 2. Calculate McLellands gross profit ratio (rounded to two decimal places), inventory turnover ratio (rounded to three decimal places), and the average days to sell inventory (assume a 365-day year and round to two decimal places) using the LIFO inventory costing method. Be sure to explain what each ratio means. 3. CONCEPTUAL CONNECTION Which ratios-the ones computed using FIFO or LIFO inventory values-provide the better indicator of how successful McLelland was at managing and controlling its inventory?

- Periodic inventory accounts, multiple-step income statement, closing entries On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as follows: Cash 125,000 Accounts Receivable 340,000 Merchandise Inventory. July 1,2018 415,000 Estimated Returns Inventory 25,000 Office Supplies 9,000 Prepaid Insurance 18,000 Land 300,000 Store Equipment 550,000 Accumulated DepreciationStore Equipment 190,000 Office Equipment 250,000 Accumulated DepreciationOffice Equipment 110,000 Accounts Payable 85,000 Customer Refunds Payable 20,000 Salaries Payable 9,000 Unearned Rent 6,000 Notes Payable 50,000 Amy Gant, Capital 820,000 Amy Gant, Drawing 275,000 Sales 6,590,000 Purchases 4,100,000 Purchases Returns and Allowances 32,000 Purchases Discounts 13,000 Freight In 45,000 Sales Salaries Expense 580,000 Advertising Expense 315,000 Delivery Expense 18,000 Depreciation ExpenseStore Equipment 12,000 Miscellaneous Selling Expense 28,000 Office Salaries Expense 375,000 Rent Expense 43,000 Insurance Expense 17,000 Office Supplies Expense 5,000 Depreciation Expense-Office Equipment 4,000 Miscellaneous Administrative Expense 16,000 Rent Revenue 32,500 Interest Expense 2,500 Instructions 1.Does Simkins Company use a periodic or perpetual inventory system? Explain. 2.Prepare a multiple-step income statement for Simkins Company for the year ended June 30, 2019. The merchandise inventory as of June 30, 2019, was 508,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was 33,000. 3.Prepare the closing entries for Simkins Company as of June 30, 2019. 4.What would the net income have been if the perpetual inventory system had been used?Effects of an Inventory Error The income statements for Graul Corporation for the 3 years ending in 2019 appear below. During 2019, Graul discovered that the 2017 ending inventory had been misstated due to the following two transactions being recorded incorrectly. a. A purchase return of inventory costing $42,000 was recorded twice. b. A credit purchase of inventory' made on December 20 for $28,500 was not recorded. The goods were shipped F.O.B. shipping point and were shipped on December 22, 2017. Required: 1. Was ending inventory for 2017 overstated or understated? By how much? 2. Prepare correct income statements for all 3 years. 3. CONCEPTUAL CONNECTION Did the error in 2017 affect cumulative net income for the 3-year period? Explain your response. 4. CONCEPTUAL CONNECTION Why was the 2019 net income unaffected?LIFO perpetual inventory The beginning inventory for Dunne Co. and data on purchases and sales for a three-month period are shown in Problem 6-1B. Instructions 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 4, using the last-in, first-out method. 2. Determine the total sales, the total cost of goods sold, and the gross profit from sales for the period. 3. Determine the ending inventory cost on June 30.