ent values

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter7: Corporate Valuation And Stock Valuation

Section: Chapter Questions

Problem 26SP

Related questions

Question

100%

2. Find All four present values

Transcribed Image Text:CIAL MGMT 7120

Question 2 - HW5- Connect

Channel content - Your

A ezto.mheducation.com/ext/map/index.html?_con%3con&external_browser3D08&laur

Saved

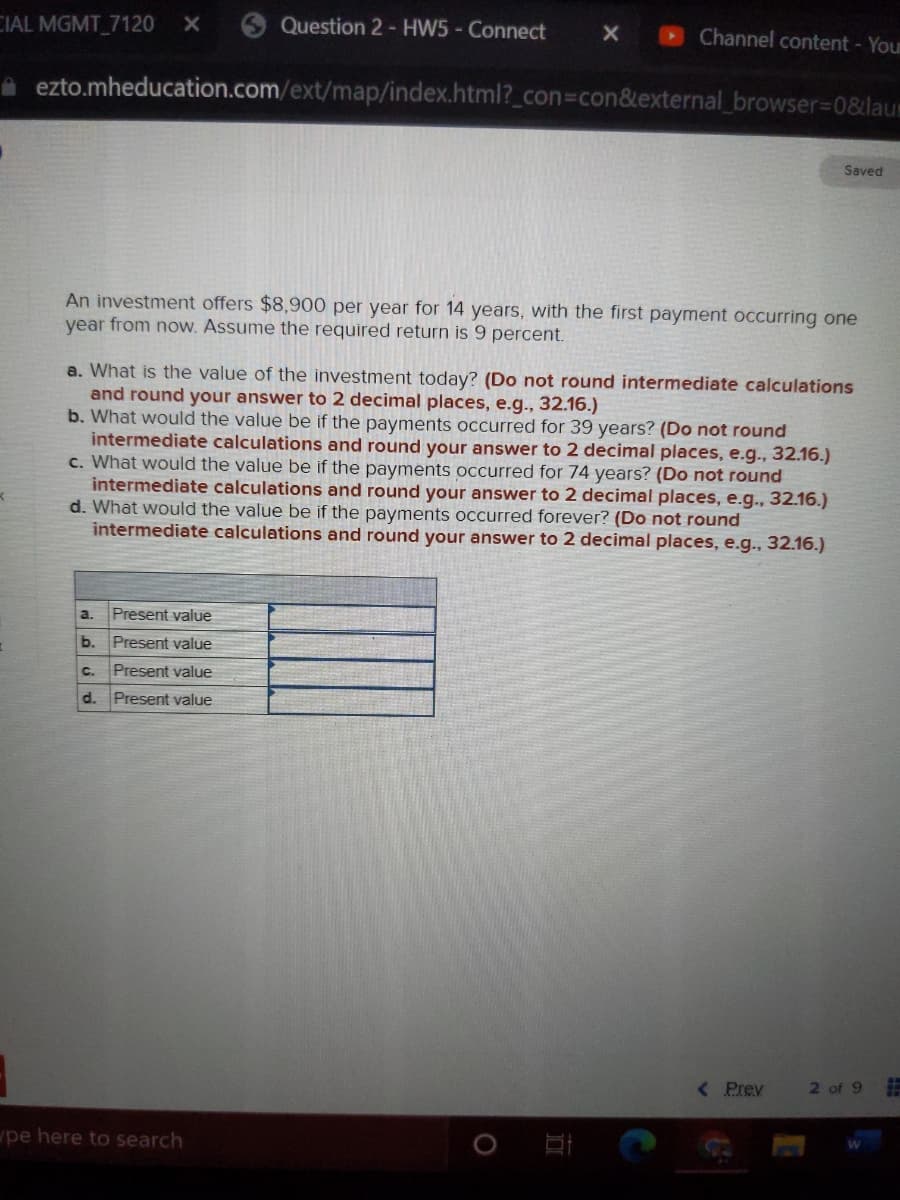

An investment offers $8,900 per year for 14 years, with the first payment occurring one

year from now. Assume the required return is 9 percent.

a. What is the value of the investment today? (Do not round intermediate calculations

and round your answer to 2 decimal places, e.g., 32.16.)

b. What would the value be if the payments occurred for 39 years? (Do not round

intermediate calculations and round your answer to 2 decimal places, e.g.., 32.16.)

c. Wha

would the value be if the payments occurred for 74 years? (Do not round

intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

d. What would the value be if the payments occurred forever? (Do not round

intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

a.

Present value

b.

Present value

C.

Present value

d.

Present value

< Prev

2 of 9

pe here to search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you