ente the liability sec

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 12P: Balance Sheet from Adjusted Trial Balance The following is the alphabetical adjusted trial balance...

Related questions

Question

Do the following, if not possible with time allotment to you - atleast the first one.

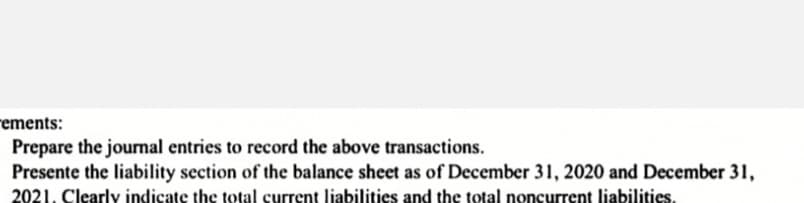

Transcribed Image Text:rements:

Prepare the jourmal entries to record the above transactions.

Presente the liability section of the balance sheet as of December 31, 2020 and December 31,

2021. Clearly indicate the total current liabilities and the total noncurrent liabilities.

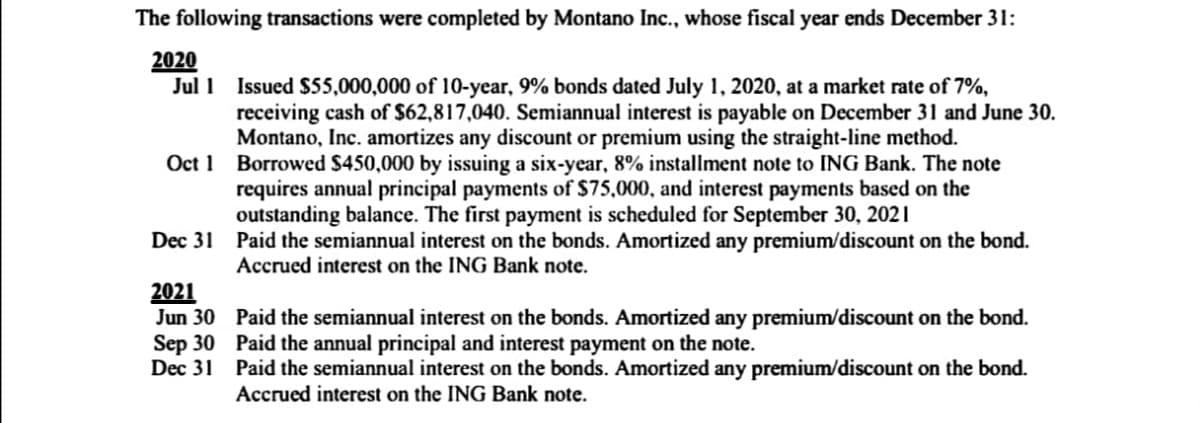

Transcribed Image Text:The following transactions were completed by Montano Inc., whose fiscal year ends December 31:

2020

Jul 1 Issued S55,000,000 of 10-year, 9% bonds dated July 1, 2020, at a market rate of 7%,

receiving cash of $62,817,040. Semiannual interest is payable on December 31 and June 30.

Montano, Inc. amortizes any discount or premium using the straight-line method.

Oct 1 Borrowed $450,000 by issuing a six-year, 8% installment note to ING Bank. The note

requires annual principal payments of $75,000, and interest payments based on the

outstanding balance. The first payment is scheduled for September 30, 2021

Dec 31 Paid the semiannual interest on the bonds. Amortized any premium/discount on the bond.

Accrued interest on the ING Bank note.

2021

Jun 30 Paid the semiannual interest on the bonds. Amortized any premium/discount on the bond.

Sep 30 Paid the annual principal and interest payment on the note.

Dec 31 Paid the semiannual interest on the bonds. Amortized any premium/discount on the bond.

Accrued interest on the ING Bank note.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning