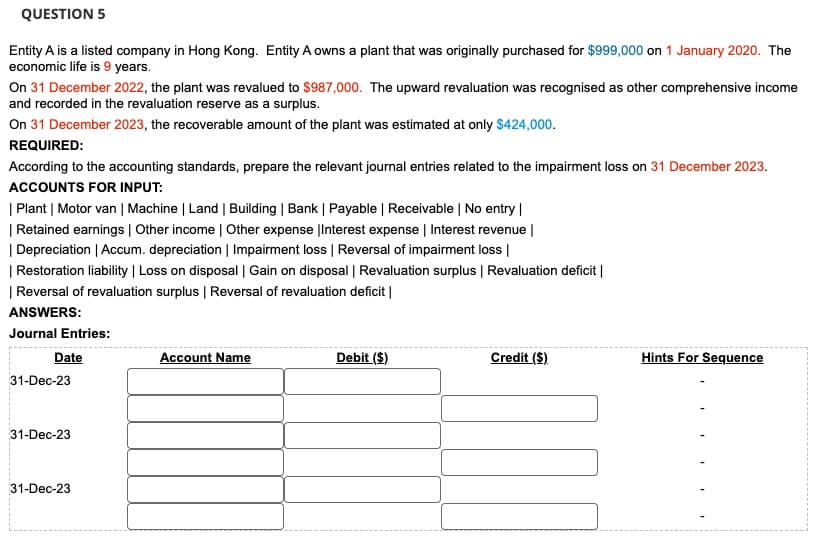

Entity A is a listed company in Hong Kong. Entity A owns a plant that was originally purchased for $999,000 on 1 January 2020. The economic life is 9 years. On 31 December 2022, the plant was revalued to $987,000. The upward revaluation was recognised as other comprehensive incom and recorded in the revaluation reserve as a surplus. On 31 December 2023, the recoverable amount of the plant was estimated at only $424,000. REQUIRED: According to the accounting standards, prepare the relevant journal entries related to the impairment loss on 31 December 2023.

Entity A is a listed company in Hong Kong. Entity A owns a plant that was originally purchased for $999,000 on 1 January 2020. The economic life is 9 years. On 31 December 2022, the plant was revalued to $987,000. The upward revaluation was recognised as other comprehensive incom and recorded in the revaluation reserve as a surplus. On 31 December 2023, the recoverable amount of the plant was estimated at only $424,000. REQUIRED: According to the accounting standards, prepare the relevant journal entries related to the impairment loss on 31 December 2023.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter2: Asset And Liability Valuation And Income Recognition

Section: Chapter Questions

Problem 6QE

Related questions

Question

Fill according to the calendar dates in the journal entry section. Please put the date beside your answer.

Follow exactly according to the above journal entries, inputting answers to each and every one of the blanks.

Note:-

• Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

• Answer completely.

• You will get up vote for sure.

Transcribed Image Text:QUESTION 5

Entity A is a listed company in Hong Kong. Entity A owns a plant that was originally purchased for $999,000 on 1 January 2020. The

economic life is 9 years.

On 31 December 2022, the plant was revalued to $987,000. The upward revaluation was recognised as other comprehensive income

and recorded in the revaluation reserve as a surplus.

On 31 December 2023, the recoverable amount of the plant was estimated at only $424,000.

REQUIRED:

According to the accounting standards, prepare the relevant journal entries related to the impairment loss on 31 December 2023.

ACCOUNTS FOR INPUT:

| Plant | Motor van | Machine | Land | Building | Bank | Payable | Receivable | No entry |

| Retained earnings | Other income | Other expense |Interest expense | Interest revenue |

| Depreciation | Accum. depreciation | Impairment loss | Reversal of impairment loss |

| Restoration liability | Loss on disposal | Gain on disposal | Revaluation surplus | Revaluation deficit |

| Reversal of revaluation surplus | Reversal of revaluation deficit |

ANSWERS:

Journal Entries:

Date

31-Dec-23

31-Dec-23

31-Dec-23

Account Name

Debit ($)

Credit ($)

Hints For Sequence

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning