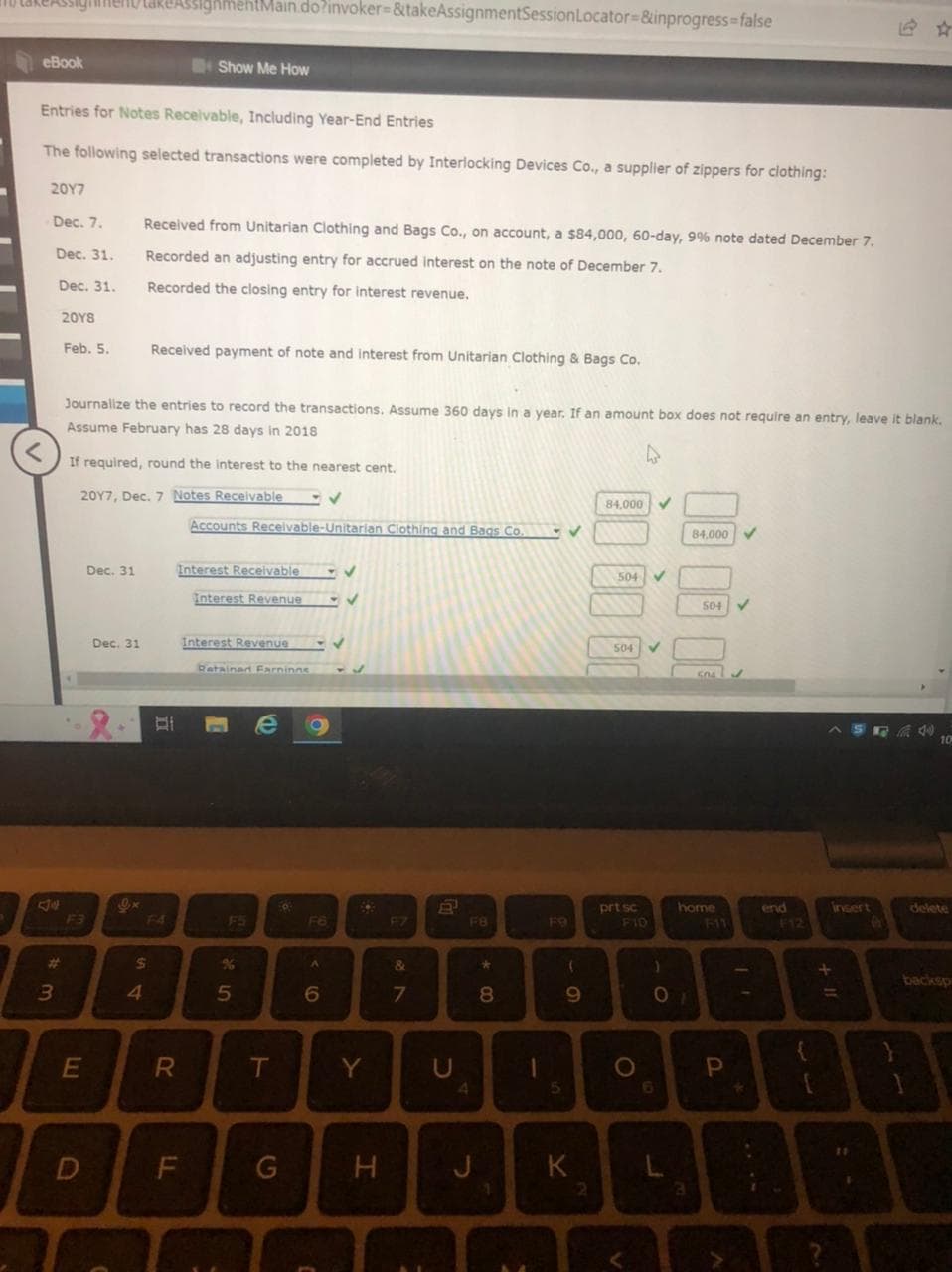

Entries for Notes Receivable, Including Year-End Entries The following selected transactions were completed by Interlocking Devices Co., a supplier of zippers for clothing: 2017 - Dec. 7. Dec. 31. Dec. 31. 2018 Feb. 5. Received from Unitarian Clothing and Bags Co., on account, a $84,000, 60-day, 9% note dated December 7. Recorded an adjusting entry for accrued interest on the note of December 7. Recorded the closing entry for interest revenue. Received payment of note and interest from Unitarian Clothing & Bags Co.

Entries for Notes Receivable, Including Year-End Entries The following selected transactions were completed by Interlocking Devices Co., a supplier of zippers for clothing: 2017 - Dec. 7. Dec. 31. Dec. 31. 2018 Feb. 5. Received from Unitarian Clothing and Bags Co., on account, a $84,000, 60-day, 9% note dated December 7. Recorded an adjusting entry for accrued interest on the note of December 7. Recorded the closing entry for interest revenue. Received payment of note and interest from Unitarian Clothing & Bags Co.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 8SPB: UNCOLLECTIBLE ACCOUNTSALLOWANCE METHOD Lewis Warehouse used the allowance method to record the...

Related questions

Question

Transcribed Image Text:takeAssignment Care AssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false

eBook

Entries for Notes Receivable, Including Year-End Entries

The following selected transactions were completed by Interlocking Devices Co., a supplier of zippers for clothing:

<

2017

- Dec. 7.

Dec. 31.

Dec. 31.

3

20Y8

#

Feb. 5.

Dec. 31

E

D

Journalize the entries to record the transactions. Assume 360 days in a year. If an amount box does not require an entry, leave it blank.

Assume February has 28 days in 2018

If required, round the interest to the nearest cent.

2017, Dec. 7 Notes Receivable

Dec. 31

Ox

Received from Unitarian Clothing and Bags Co., on account, a $84,000, 60-day, 9% note dated December 7.

Recorded an adjusting entry for accrued interest on the note of December 7.

Recorded the closing entry for interest revenue.

4

$

Show Me How

Received payment of note and interest from Unitarian Clothing & Bags Co.

F4

R

LL

Accounts Receivable-Unitarian Clothing and Bags Co.

Interest Receivable

Interest Revenue

Interest Revenue

Retained Earnings

5

e O

T

O

G

F6

A

6

C

✓

32

Y

H

F7

&

7

2

10

U

F8

4

*

8

1

1

F9

5

✓

(

9

K

00 00 0

2

84,000 ✓

504

504

prt sc

F10

O

)

01

L

84,000

3

504

home

F11

GO4

P

end

B

*

F12

{

ASRA 40

44

+ 11

insert

10

delete

backsp

Transcribed Image Text:ON

2

W

S

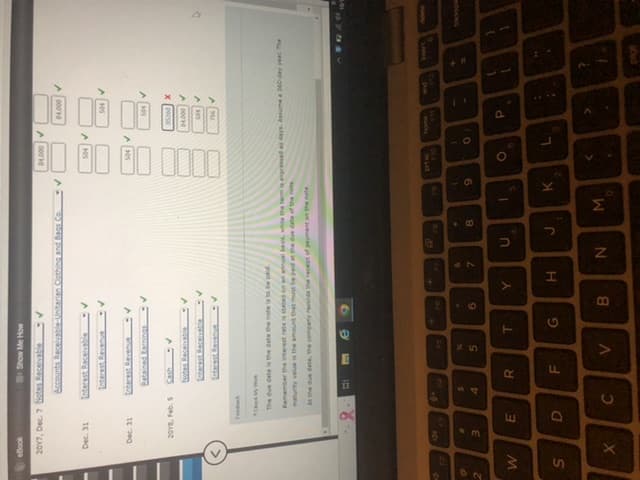

2017, Dec. 7 Notes Receivable

Dec. 31

Dec. 31

de

X

2018, Feb. 5

3

O

E

Feedback

Accounts Receivable-Unitarian Clothing and Bags Co.

Interest Receivable -V

Interest Revenue

-V

D

Show Me How

Interest Revenue

Check My Work

The due date is the date the note is to be paid

Retained Earnings

$

4

C

Notes Receivable

Interest Revenue

R

F

Remember the interest rate is stated on an annual basis, while the term is expressed as days. Assume a 360-day year The

maturity value is the amount that must be paid at the due date of the note

At the due date, the company records the receipt of payment on the note

FS

N

5

V

T

G

9

A

6

B

W

Y

&

7

H

B

U

N

8

J

1

✓

M

9

$4,000 ✓

K

00

100 00

0000

110

)

84,000 ✓

O

L

504 ✓

85260 X

04.000 ✓

504 ✓

756

P

:

+

U

page

D

Grospe

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning