entury Foods, a producer of frozen meat products, is considering a new plant near Essen, Germany, for its sausage rolls and frozen meat pies. The company has estimates of production costs and selling prices in the first year. It expects the real value of perating costs per unit to fall because of improved operating methods. It also expects competitive pressures to cause the real value of product prices to fall. The following data are available. Answer parts (a) through (d). Century Food Plant Data Output price in 2021 (E/unit) 21 16.5 Operating cost in 2021 (€/unit) Planned output rate (boxes/year) Fall in real output price Fall in real operating cost per box First cost in 2020 (€) Study period Current euro MARR before tax 279,000 1.5% per year 1% per year 7,300,000 10 years 20% Accume there is zero inflatio 2020 of the project? LIse spreadsheet to find the nresent worth oresent worth

entury Foods, a producer of frozen meat products, is considering a new plant near Essen, Germany, for its sausage rolls and frozen meat pies. The company has estimates of production costs and selling prices in the first year. It expects the real value of perating costs per unit to fall because of improved operating methods. It also expects competitive pressures to cause the real value of product prices to fall. The following data are available. Answer parts (a) through (d). Century Food Plant Data Output price in 2021 (E/unit) 21 16.5 Operating cost in 2021 (€/unit) Planned output rate (boxes/year) Fall in real output price Fall in real operating cost per box First cost in 2020 (€) Study period Current euro MARR before tax 279,000 1.5% per year 1% per year 7,300,000 10 years 20% Accume there is zero inflatio 2020 of the project? LIse spreadsheet to find the nresent worth oresent worth

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 3E

Related questions

Question

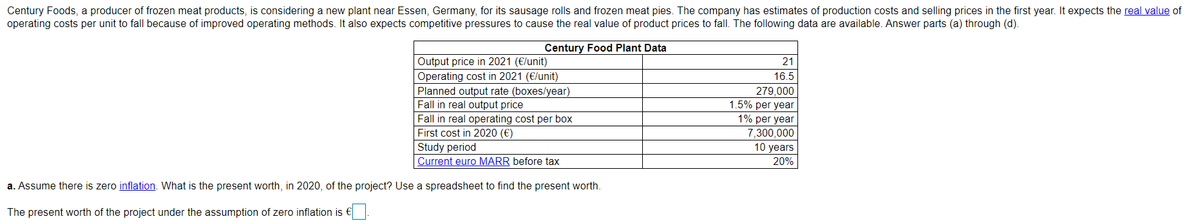

Transcribed Image Text:Century Foods, a producer of frozen meat products, is considering a new plant near Essen, Germany, for its sausage rolls and frozen meat pies. The company has estimates of production costs and selling prices in the first year. It expects the real value of

operating costs per unit to fall because of improved operating methods. It also expects competitive pressures to cause the real value of product prices to fall. The following data are available. Answer parts (a) through (d).

Century Food Plant Data

Output price in 2021 (€/unit)

21

Operating cost in 2021 (€/unit)

16.5

Planned output rate (boxes/year)

Fall in real output price

279,000

1.5% per year

Fall in real operating cost per box

First cost in 2020 (€)

1% per year

7,300,000

10 years

Study period

Current euro MARR before tax

20%

a. Assume there is zero inflation. What is the present worth, in 2020, of the project? Use a spreadsheet to find the present worth.

The present worth of the project under the assumption of zero inflation is €

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning