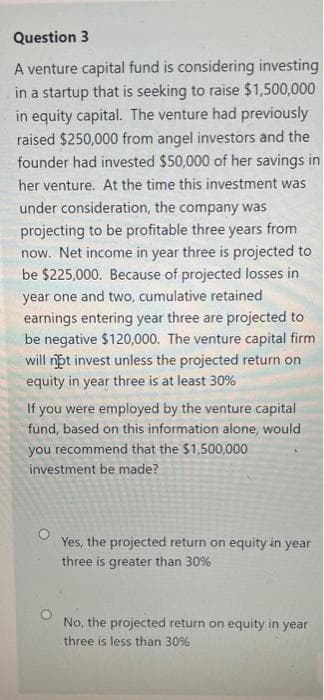

If you were employed by the venture capital fund, based on this information alone, would you recommend that the $1,500,000 investment be made? Yes, the projected return on equity in year three is greater than 30% No, the projected return on equity in year three is less than 30%

Q: Between Absorption Costing and Variable Costing method, which one do you think is more practical to…

A: Absorption costing considers fixed manufacturing overheads and variable overheads together to find…

Q: Question: Under the fair value model, what is the amount reported in the 2022 profit or loss?…

A: Fair Value model Under the fair value model, the value of the investment property is remeasured at…

Q: Sales 270000 Variable Expenses 180000 € Contribution Margin 90000 € Fixed Expenses 36000 € Net…

A: Formula: Margin of safety = Current sales - Break even sales

Q: Retailers need merchandise to make sales. In fact, a retailer’s inventory is its biggest asset. Not…

A: Stock turnover rate is the rate which a business computes in order to determine and know about how…

Q: Raw material purchased OMR150000,closing stock raw material OMR 53000, Paid freight charges OMR 7000…

A: Formula: Raw material consumed = Beginning raw materials + Purchases during the period + Freight…

Q: inventory of raw materials at 50% of the coming month's budgeted production needs. Each unit of…

A: To Determine the quantity of raw materials that are required to be purchased for June, the following…

Q: Charges for water services rendered$ 1,800,000 Charges for sewer services rendered2,000,000…

A: Operating Revenues: Revenue generated by a business from its primary business activities are called…

Q: d industry target?

A: From the cash budget, it is explained as,

Q: what if your company is being targeted by a SPAC would that be a good thing or a bad thing? What…

A: Here discuss about the importance of the Special Purpose Acqusition company (SPAC) which are…

Q: The glue is not a significant cost, so it is treated as indirect materials (factory overhead). a.…

A: Job costing is a way of accounting that allows you to keep track of the costs of different projects…

Q: aal ovehead cot are pectedto be S00.000 and direct abor costs are pected to be 1.000.000, hen…

A: There are two type of costs that are being incurred in business. One is direct costs and indirect…

Q: Mr Adam wants to sell his car, which he purchased at RM 85,000 after using it for three years. The…

A: The formula for calculating depreciation value using declining balance method is Depreciation per…

Q: Jennifer Corporation has issued 300,000 shares of $3 par value common stock. It authorized 600,000…

A: Introduction : The source of a company's assets, the owners' remaining claim on a company's assets…

Q: Design a salary slip for the month of December 2021 with information given below. Fixed vs variable…

A: Salary Slip For the salary slip it comes the details of basic salary with the HRA and DA and travel…

Q: ries which has low rate of tax collection, what will be its e

A: Tax collection are the important source of income for any government and government spending depends…

Q: Let there be $100 new deposit in a bank. a) Calculate the money multiplier for a reserve requirement…

A: The required reserve is the percentage of deposit that Bank hold as a deserve and it is required to…

Q: Consider a personal project or a project that you have been involved with at work. Provide the ROI…

A: Return on investment (ROI) is a performance statistic that is used to assess the profitability of an…

Q: What do you think would be some of the effects to advertising companies if Congress enacted…

A: Assuming Congress enacted legislation to capitalize advertising costs with amortization for 20…

Q: Halcyon Company just completed job number 10-B. See details below. Direct materials cost: $5,900…

A: The cost per unit of the finished product can be calculated by dividing the total cost of finished…

Q: Dr. Roger Jones is a successful dentist but is experiencing recurring financial difficulties.…

A: There are two scenarios in front of Dr. Jones. Dr. Jones should increase revenue or he should…

Q: MC12 Mega Company and its subsidiaries have a provided you with a list of property items they own:…

A: S. No. Particulars Amount (P) 1 Land held by Mega for undetermined future use 10 million 2…

Q: Suppose the following information was taken from the 2022 fınancial statements of FedEx Corporation,…

A: Account receivable turnover indicates the rate of collection of accounts receivable in a year.

Q: fiscal year end is November 30. Accounts Payable-$3,500, Accounts Receivable-$2,300, Cash-$5000,…

A: Balance sheet is considered to be important part of financial statement which shows the entities…

Q: Tvalent unit nits in endir nth, 7,200 un

A: Given:

Q: Integrative: Complete ratio analysis Given the following financial statements E, historical ratios,…

A: Ratio analysis is one of the important technique of management accounting. Current ratio and Quick…

Q: Based on your accounting experience, advanced knowledge and practical experience with concepts…

A: A bank reconciliation memorandum aligns an organization's bank account with its financial documents…

Q: Why might be these journal entries considered fraudulent or suspicious? Explain the reasons for each…

A: First Quarter PROPERTY PLANT AND EQUIPMENT (PPE ACCOUNT HAS BEEN DEBITED WITH A COST OF 97,639 &…

Q: A furniture manufacturing company has two main processes. Process Alpha that makes dinning table and…

A: Answer:- False Explanation:- Process beta should be selected for the very large production volume…

Q: Allison Manufacturing produces a subassembly used in the production of jet aircraft engines.The…

A: "Since you have posted a question with multiple subparts, we will solve the first three subparts for…

Q: Compute the cost of the ending inventory and the cost of goods sold under FIFO and LIFO. FIFO LIFO…

A: Inventory is one of the important current asset of the business. It includes inventory of raw…

Q: April 12, 2022 and is listed on the IDX. GOTO released 40,615,056,000 shares at a selling price of…

A: when the shares are offer to public for the first time it is called initial public offer by the…

Q: If a company fails to make an adjusting entry to record insurance expense, then equity will be…

A: Let's understand some basics An adjusting journal entry is an entry in a company's general ledger…

Q: Healthy Meal completed the following selected transactions. i (Click here to see the transactions.)…

A: Journal entry - It refers to the process where the business transactions are recorded in the books…

Q: Payback, Accounting Rate of Return, Present Value, Net PresentValue, Internal Rate of ReturnAll…

A: The overall calculation is shown below,

Q: Classical Homes is a family-owned business. You are the management accountant of the entity and have…

A: A cash budget is a statement that shows the estimated inflows and outflows of cash into and from the…

Q: Legend Service Center just purchased an automobile hoist for $33,900. The hoist has an 8-year life…

A: The question is based on the concept of Financial Accounting.

Q: The inventory profit for 2020 and 2021 is given below, Consideration transferred Add: Non…

A: In this question, student has ask that how the value of cost price that is $193,750 is calculated,…

Q: 0 $/unit). The company wanted to explore the possibi creasing its profits, so it decided to spend…

A: Profit of the company depends on the variable cost and fixed cost and the amount of sales and the…

Q: for November. Variable Actual Fixed Element Element per Total for per Month Well Serviced November…

A: A spending variance seems to be the difference between the estimated cost and the real cost of an…

Q: Journey Company entered into agreement with its creditor to exchange its equity instrument and land…

A: Liability: Liability is an amount which a company has to reimburse after a certain period of time.…

Q: Write a concise answer between 350 to 400 words for each question.

A: Audit refers to the process of checking the financial records of a company. The process of auditing…

Q: The balance in the supplies account on June 1 was $7,000, supplies purchased during June were…

A: Consumption of supplies = Opening balance+Purchases-Closing balance

Q: Round "Current ratio" answer to two decimal places. A. Working capital B. Current ratio

A: Solution:- A)Calculation of Working capital as follows under:- Working capital:- Working capital is…

Q: A 35-year old woman has $310,090.00 in an IRA account. Due to medical concerns of a family member,…

A: The account value at retirement can be calculated with the help of future value function.

Q: When taxpayer receive distribution from qualified retirement plans, how many time is allowed to roll…

A: As per IRS, If taxpayer receives distribution from qualified retirement plans then he can deposit…

Q: During December, Moulding Corporation incurred $86,000 of actual Manufacturing Ooverhead costs.…

A: Under applied (overapplied) manufacturing overhead costs = Actual manufacturing overhead costs -…

Q: The objective of profit maximization should be constrained by the requirement thatprofits be…

A: The ultimate purpose of any firm is to raise profits, which can lead to profit-motivation conflicts…

Q: Late in December 2021, XYZ Corp. (XYZ), a publicly traded company, completed the manufacture of 600…

A: Journal entry A journal entry refers to the recording of the transactions in the books of accounts.…

Q: Concord Distribution markets CDs of the performing artist Fishe. At the beginning of October,…

A: Weighted average cost per unit = Total cost of goods available for sale / Total no. of units…

Q: ratios listed on table a for each year (2020 & 2021): a. For each ratio includes the formula with…

A: The answers have been mentioned below.

Step by step

Solved in 2 steps

- Question 3 Part A Ria recently started working at a financial institution. She has been advised of the importance of saving and the benefits of diversifying her investments. As such, she is considering investing in shares of Ohio Inc. Ohio Inc. just paid an annual dividend of $4.10 and has pledged to increase its dividend by 2.4% annually over the next five years. Thereafter it will maintain a constant 2.5% dividend growth rate annually. Ria’s required return is 15%. Required: Compute the price Ria should pay for a share of this stock today. Part B Securities issued by Corporations are classified as either debt or equity securities. What are bonds classified as? and What is the main difference between debt and equity?Rapid Home Testing (RHT) is a publicly traded all-equity financed firm. RHT's cost of capital is 11.85%. Its current earnings per share is $5.26. This EPS is expected to continue indefinitely. RHT has been paying out all its earnings as dividends It is now year 0, and RHT has just identified a new opportunity to expand its business. This new opportunity allows RHT to invest all of its earnings for 3 years (from year 1 to year 3), starting next year (year 1). Each dollar of new investment will yield a perpetual earnings of 16.04%, starting the following year. (E.g., investing $1 in year 1 will yield payoffs of $0.1604 from year 2 on.) After these 3 years, the competition catches up, driving the return on future investments down to 11.85%, the same as the cost of capital. As a result, RHT will stop making new investments and pay out all its earnings. All cash flows occur at the year end. Use the above information to answer questions (A) – (E). What is RHT's share price without the new…A high growth company raised $10,000,000.00 in capital from a venture capital firm in the early growth stage of funding.The pre-money valuation of the company at the time the capital was raised $20,000,000.00.The terms of the investment also had an annual dividend of 8% and an exit preference of 1.2X upon a liquidity event.Based on these facts please answer the following questions. After the closing of the capital funding what was the post money valuation and the venture capitalist’s percentage of ownership. Presuming the company sells for $100,000,000.00 what would the venture capitalist receive in proceeds? Presuming the company sells for $27,000,000.00 what would the owners (company) receive in proceeds. Presuming the company sells for $100,000,000.00 but also has $10,000,000.00 of debt on the balance sheet, what will the owners receive in proceeds? this is based on the facts provided. there is no more information to give.

- A high growth company raised $10,000,000.00 in capital from a venture capital firm in the early growth stage of funding. The pre-money valuation of the company at the time the capital was raised $20,000,000.00. The terms of the investment also had an annual dividend of 8% and an exit preference of 1.2X upon a liquidity event. Based on these facts please answer the following questions. After the closing of the capital funding what was the post money valuation and the venture capitalist’s percentage of ownership. Presuming the company sells for $100,000,000.00 what would the venture capitalist receive in proceeds? Presuming the company sells for $27,000,000.00 what would the owners (company) receive in proceeds. Presuming the company sells for $100,000,000.00 but also has $10,000,000.00 of debt on the balance sheet, what will the owners receive in proceeds?23-4: Suppose venture capital firm GSB partners raised $50 million of committed capital. Each year over the 12-year life of thefund, 1.5% of this committed capital will be used to pay GSB’smanagement fee. As is typical in the venture capital industry,GSB will only invest $41 million (committed capital less lifetimemanagement fees). At the end of 12 years, the investments madeby the fund are worth $550 million. GSB also charges 30% carriedinterest on the profits of the fund (net of management fees). b. Of course, as an investor or limited partner, you are more interested in your own IRR—that is, the IRR including all fees paid.Assuming that investors gave GSB partners the full $50 millionup front, what is the IRR for GSB’s limited partners (that is, theIRR net of all fees paid). How should that formula be understood to calculate the IRR ? I usually did it with Excel, but i cant get the same numberMaxwell Private equity investor is considering making an investment capital firm. The investor values the firm at $1.5 mn (present value of exit value) following $300,000 capital investment by the investor. Calculate the venture capital firm's pre- money valuation and investor's proportional ownership.

- Management Accounting and Finance 3B Case study 02 - Cost of capital Makhado Limited has a target capital structure of 60% equity and 40% debt. The before-tax cost of debt is 7.64% and the cost of new equity is 13%. The finance manager is currently considering a project with an expected return of 12% which will be financed from the issue of ordinary shares as all retained income is already budgeted for in more profitable projects. The company recently issued debentures and, as a result, the present capital is more heavily weighted towards debt. The company tax rate is 28%. 2.1 Calculate the weighted average cost of capital by making use of target capital structure.2.2 Briefly explain (giving reasons) whether the project under consideration should be accepted or not. 2.3 List the three steps used to calculate the weighted average cost of capital.2.4 Outline the fundamental assumptions of weighted average cost of capital.Expected Yearly Dividends ACGL (ARCH CAPITAL GROUP) 4% EVR (EVERCORE INC) 6% LEU (CENTRUS ENERGY CORP) 2% You plan to invest a total of $ 11,000 in the three funds shown above, with equal amounts invested in ACGL and LEU. You want to earn a total of $480 in yearly dividends. How much should you invest in each of the three funds? $_____in ACGL $_____in EVR $_____in LEUQuestion 4 Global Internet company is looking to expand their operations. They are evaluating their cost of capital based on various financing options. Investment bankers informed them that they can issue new debt in the form of bonds at a cost of 8%, and issue new preferred stocks for the price of $25 per share paying $2.5 dividends per share. Their common stock is currently selling for $20 per share and will pay a dividend of $1.5 per share next year. They expect a growth rate in dividends of 5% per year, and their marginal tax rate is 35%. a) If Global raises capital using 45% debt, 5% preferred stock, and 50% common stock what is their cost of capital? b) If Global raises capital using 30% debt, 5% preferred stock, and 65% common stock what is their cost of capital? c) Evaluate the two finance options and identify which one they should choose? Assess the advantages and disadvantages of your choice?

- Question 3 You have been asked to value Best Bank, a publicly traded bank that generated $100 million in net income in the most recent year on a regulatory capital base of $1billion (you can assume that this is also the book value of equity) with one billion shares outstanding. Over the next three years, you expect net income to grow 10% a year and regulatory capital (and book equity) to increase 5% a year. a) Estimate the FCFE each year for the next three years. b) At the end of year 3, you expect the bank to be in stable growth, growing 3% a year, while maintaining the return on equity it generated in year 3. If the cost of equity is 8%, estimate the value of equity at the end of year 3 c) What is the intrinsic value of the equity per share?D3) Finance Killer burgers capital structure consist of 30% debt 20% preferred stock and 50% common stock if killer raises new capital it's after-tax cost of debt will be 2.5% its cost of preferred stock will be 9% its cost of retained earnings will be 12.8% and it's cost of new common equity will be 13.8% killer must raise $180,000 if management expects the firm to generate $85,000 and retain earnings this year what is killers marginal cost of capital to raise the needed funds round your answer to two decimal places placesAbdullah has OMR 5000 to invest in a small business venture. His partner has promised to pay him back OMR 8200 in five years. What is the return earned on this investment? Select one: a. None of these b. 10.39 % c. 12.40 % d. 10.75 % e. 14.50 % Gross working capital refer to the Select one: a. Firms liabilities in total current assets of the enterprise b. Firms investment in total fixed assets of the enterprise c. Firms investment in total Equity of the enterprise d. Firms investment in total current assets of the enterprise e. None of the options