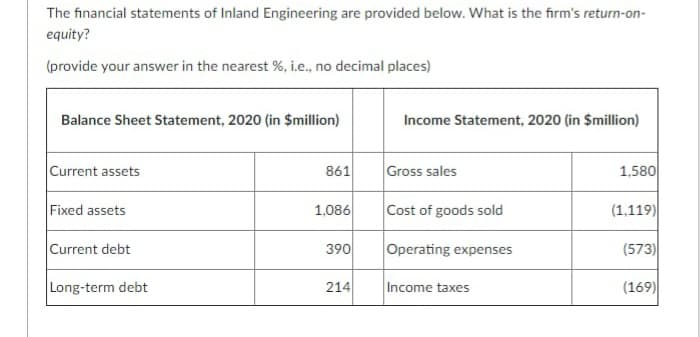

equity? (provide your answer in the nearest %, i.e., no decimal places) Balance Sheet Statement, 2020 (in $million) Income Statement, 2020 (in $million) Current assets 861 Gross sales 1,580 Fixed assets 1,086 Cost of goods sold (1,119) Current debt 390 Operating expenses (573) Long-term debt 214 Income taxes (169)

Q: On a balance sheet, a corporation’s economic obligations to nonowners are called a. Owners’ equity…

A: The properties belonging to an enterprise or financial body is asset. To create money, that is…

Q: Flora's Flower Shop bought a new van for $35,000. Today, the market price of this van is $20,000.…

A: Option D is right answer Floras Brought New van =$35,000 Market price this van =$2,000 Economic…

Q: Advanced Questions 16. The largest tax break for most Americans is the mortgage interest tax…

A: * ANSWER :- (16)

Q: Required information A company that makes several different types of skateboards, Jennings Outdoors,…

A: Interest expense (IP) is $1,200,000 per year. Initial received payment (RP) is $19,000,000. Face…

Q: A firm is planning to manufacture a new product. As the selling price is increased, the quantity…

A: P=$350-0.20 where P-selling price per unit; Q-quantity sold per year. They estimate C= $40Q+$20,000…

Q: 2. An asset is purchased for $500,000. The salvage value in 25 years is $100,000 and the Straight…

A: Value of an asset=$500,000Salvage value in 25 years=$100,000Thus,Value depreciated in 25…

Q: Qno1 On January 1, the total market value of the Tysseland Company was $60 million. During the…

A: 1. Investment required = $30000000 Total Capital = $60000000 %age financed through equity =…

Q: Compensation of employees (household) 230 Depreciation 27 Rents 14 Interest 13 Indirect Business…

A: As per given information, If we calculate national income (NNPFC ) by Income Method then green…

Q: Business combinations are common feature of today's economies. This type of transactions can result…

A: Consolidated Financial Statements are defined as the financial statements of an entity with a number…

Q: A computer machine initially worth P 50,000 depreciates in value each year by 20% of its value at…

A: Given : Initial price=P50,000 rate=-20%(depreciating) time=9 yrs. Formula used : Final price…

Q: Exercise 5 (Cost of goods manufactured and sold) Compute cost of goods manufactured and cost of…

A: Here we calculate the cost of goods manufactured and cost of goods sold by the following method as…

Q: The tax rates for a particular year are shown below: Taxable Income Tax Rate $0 – 50,000 15 % 50,001…

A: The average tax rate is the total amount of tax divided by total income. Here, we calculate the…

Q: Show the complete solution for the following: 1. The Saudi Arabian Oil Refinery developed an oil at…

A: Half million barrel = 500000 barrels of oil Initial cost = $500,000,000 Oil contain in refinery…

Q: achine worth 800,000 is brought from china, freight charges amount to 200,000. If the scrap value of…

A: Given machine cost = 800000 Freight charges = 200000 Total cost of machine = 800000 + 200000 =…

Q: Zippy works for Zips Company and received the following amounts. For each item, indicate how much is…

A: Taxes are usually set to a certain percentage and are categorised into various slabs. For example,…

Q: Juan DeBaptist purchased $10,000 in corporate stock on June 1 and sold the stock when its value…

A: In the US, there is a capital gain tax which is the profit or the additional income earned when a…

Q: An insurance company is covered by occurrence reinsurance with a layer of 750 and an attachment of…

A: The insurance company is covered by occurrence reinsurance of 750. The insurance company is also…

Q: Assume Lavender Corporation has a market value of $4 billion of equity and a market value of $19.8…

A: Given information Market Value of equity = $4 billion Market value of debt = $19.8

Q: Mrs. B is engaged in both sales of goods and sales of services. She incurred a total of P9,000…

A: Calculation of EAR is given below

Q: 9s. 6 Suppose that you placed a commercial building (warehouse) in service in January. The cost of…

A: Information given :- Cost of the property = $300,000 Value Included in the cost land = $100,000…

Q: Problem 11: Hick's Furniture Company (not a real company) sells industrial furniture for office…

A: Given Cost of goods sold = 1650000 $ Beginning inventory = 2750000 $ Closing inventory = 3825000 $

Q: If the corporation is a domestic corporation and it opts to claim the tax paid abroad as deductions…

A: Income tax payable is :- Amount Gross income $4,000,000 Less:- Deductions -$2,500,000…

Q: Prepare a 2020 income statement for Oriole Corporation based on the following information: Cost of…

A: The balance sheet and the profit and loss account are the other two major financial statements used…

Q: What is the basic difference between cash flow after taxes (CFAT) and net operating profit after…

A: The cash flow after taxes (CFAT) is a measure which is widely used in order to calculate and examine…

Q: In March 2021, Tamara Mines Co. purchased a coal mine for $6,000,000. Removable coal is estimated at…

A: Due to depletion, the amount of natural resources accessible will decrease over time. Depletion…

Q: During a particular year, a corporation has $18.6 million in revenue, $2.4 million of operating…

A: Federal tax is a tax which is collected by the united nation from its resident on their profit…

Q: A corporation in 2018 expects a gross income of $430,000, total operating expenses of $330,000, and…

A: The U.S. government personal expense is a duty required by the Internal Revenue Service (IRS) on the…

Q: Compensation of employees (household) Depreciation 223 27 Rents 14 Interest 13 Indirect Business…

A: Gross Domestic Product refers to the market value of the goods and services within a country during…

Q: A company's second year operations can be summarized as follows: Revenues: $110 000 Expenses (except…

A:

Q: Which of the following assets is not subject to depreciation? O Office equipment O Computer unit O…

A: Depreciation is a process of deducting the cost of an asset over its useful life.

Q: Rotana Construction, Inc., has operated for the last 21 years in a northern U.S. state where the…

A: Answer: Given that: Rotana Construction, Inc., has operated for the last 21 years in a northern…

Q: On May 1, 2018, Karina purchased 100 shares of Gold stock at a total cost of $2,000. She received a…

A: The marginal tax rate is the amount of additional tax paid for every additional dollar earned as…

Q: Malu Luigi Company makes an internal policy that for every new machine purchased, the annual…

A: Given: The price of new machine = P 500000 Depreciation cost = 15% of the first cost So,…

Q: JA) term given to a fall in a company's stock price. B) name given to how accountants calculate the…

A: Economic depreciation is a measure of an asset's market value depreciating over time as a result of…

Q: Question 13 An asset with an 8-year ADR class life costs $50,000 and was purchased on January 1,…

A: Calculate the depreciation each year D1 = 50,000 * 14.29% = 7,145 D2 = 50,000 * 24.49% = 12,245 D3…

Q: Economics Blue Tune Saloon had a gross income of $150,000 with $95,000 in expenses and $15,000 in…

A: 151,000*21/100=31,710

Q: Corporate tax is included while calculating profit True/False

A: The reward which an entrepreneur receives for the contribution which has put in the production of…

Q: depreciation expense of $51178, and additions to retained eanings of $69054. The firm currently has…

A: Times interest earned or interest coverage ratio is a measure of a company's ability to honor its…

Q: A firm has net income of $134,502. There are 136.088 shares of stock outstanding at a price per…

A: The price-to-earnings (P/E) ratio relates a company's share price to its earnings per share. here we…

Q: In tax year 1, an electronics-packaging firm hada gross income of $35,000,000, $6,000,000 in…

A: Gross income is the income earned by a business enterprise after deducting all direct expenses such…

Q: storage systems in the United States, China, and internationally. The company operates in two…

A: Tesla is the highest valued automobile comany in the world.Tesla is not really into carmaking but…

Q: Question 6 Listen> For questions 6 - 9, YOU MUST set out the amount owing in numbers, only, without…

A: Answer (6): The firm should pay only the amount that it owes since it paid the last paycheck to…

Q: This year, FCF Inc, has earnings before interest and taxes of $10,440,000, depreciation expenses of…

A: Introduction Free cash flow will help the company for her operating decisions. When a company…

Q: Question 4Calculate the gross value added : Sale - 400 Changein stock -(-20) Depreciation - 30Net…

A: Use the below formulas: Value of output = Sale + Change in stockGross Value added at MP = Value of…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Howard Bowen is a large-scale cotton farmer. The land and machinery he owns has a current market value of $10 million. Bowen owes his local bank $7 million. Last year Bowen sold $9 million worth of cotton. His variable operating costs were $7 million; accounting depreciation was $40,000, although the actual decline in value of Bowen's machinery was $60,000 last year. Bowen paid himself a salary of $50,000, which is not considered part of his variable operating costs. Interest on his bank loan was $400,000. If Bowen worked for another farmer or a local manufacturer, his annual income would be about $30,000. Bowen can invest any funds that would be derived if the farm were sold to earn 10% annually. (Ignore taxes.) What is Bowen's accounting profit? $1,210,000.00 $1,550,000 $1,560,000 $1,220,000.00 What is Bowen's economic profit? $1,210,000.00 $1,560,000 $1,550,000 $1,220,000.00Howard Bowen is a large-scale cotton farmer. The land and machinery he owns has a current market value of $4 million. Bowen owes his local bank $3 million. Last year Bowen sold $5 million worth of cotton. His variable operating costs were $4.5 million; accounting depreciation was $40,000, although the actual decline in value of Bowen's machinery was $60,000 last year. Bowen paid himself a salary of $50,000, which is not considered part of his variable operating costs. Interest on his bank loan was $400,000. If Bowen worked for another farmer or a local manufacturer, his annual income would be about $30,000. Bowen can invest any funds that would be derived if the farm were sold to earn 10 percent annualy. (ignore taxes.) a. Compute Bowen's accounting profits. b. Compute Bowen's econnomic profits.The following data regarding Atlas Construction Company are available:Current assets $300,000Current liabilities 200,000Long-term liabilities 500,000Total net worth 200,000What is the value of the company’s fixed assets?

- An insurance company is covered by occurrence reinsurance with a layer of 750 and an attachment of 250. In a given year, it experiences individual loss occurrences of 50, 850, 300, and 2,100. What are the annual aggregate gross and net loss amounts for the company?Calculate Lopez Enterprises' gross profit at a CFAT of $2.5 million, $900,000 in expenses, $900,000 in depreciation costs, and a 26.4% effective tax rate.17.7 Rotana Construction, Inc., has operated for the last 21 years in a northern U.S. state where the state income tax on corporate revenue is 6% per year. Rotana pays an average federal tax of 23% and reports taxable income of $7 million. Because of pressing labor cost increases, liability insurance premium increases, and other cost increases, the president wants to move to another state to reduce the total tax burden. The new state may have to be willing to offer tax allowances or an interest-free grant for the first couple of years in order to attract the company. You are an engineer with the company and are asked to do the following. (a) Determine the effective tax rate for Rotana. (b) Estimate the state tax rate that would be necessary to reduce the overall effective tax rate by 10% per year. (c) Determine what the new state would have to do financially for Rotana to move there and to reduce its effective tax rate to 22% per year.

- On its tax return at the end of the current year Webnet Inc. has $6 million of tax depreciation in excess of depreciation in its income statement. A disclosure note reveals that $1 million of the $6 million difference will reverse itself next year, and the remainder will reverse over the next 4 years. In the absence of other temporary differences, in the balance sheet at the end of the current year Webnet would report ?f the following financial information related to XYZ Company. Total Revenues last year $970, depreciation expenses $50, costs of goods sold $450, and interest expenses $55. At the end of the year, current assets were $121 and current liabilities were $107. The company has an average tax rate of 35%. Calculate the net income for XYZ Company by setting up an income statement.A Civil Engineer is considering establishing his own company. An investment of $4,000,000 will berequired, which will be recovered in 15 years.It is estimated that revenue will be $8,000,000 per year and that operating expenses will be as follows:Materials $1,600,000 per yearLabor $2,800,000 per yearOverhead $400,000 + 10% of the yearly revenueOther expenses $600,000 per yearThe engineer will give up his regular job paying $2,160,000 per year and devote his time fulltime to theoperation of the business; this will result in decreasing labor costs by $400,000 per year, material costs by$280,000 per year and overhead cost by $320,000 per year. If the man expects to earn at least 20% ofhis capital, should he invest? NOTE: Use Annual Worth Method.

- A Civil Engineer is considering establishing his own company. An investment of $4,000,000 will berequired, which will be recovered in 15 years.It is estimated that revenue will be $8,000,000 per year and that operating expenses will be as follows:Materials $1,600,000 per yearLabor $2,800,000 per yearOverhead $400,000 + 10% of the yearly revenueOther expenses $600,000 per yearThe engineer will give up his regular job paying $2,160,000 per year and devote his time fulltime to theoperation of the business; this will result in decreasing labor costs by $400,000 per year, material costs by$280,000 per year and overhead cost by $320,000 per year. If the man expects to earn at least 20% ofhis capital, should he invest? NOTE: Use Future Worth Method.Sam, Inc. has current assets of $5,300, net fixed assets of $24,900, current liabilities of $4,600, and long-term debt of $10,300. What is the value of shareholder’s equity? Group of answer choices a. Cannot be determined without knowing the value of Common Stock b. $17,680 c. $60,030 d. $15,300 e. Cannot be determined without knowing the value of Retained EarningsH5 Printing World thinks it may need a new colour printing press. The press will cost $470,000 but will substantially reduce annual operating costs by $232,000 a year, before tax. The press has a 35% CCA rate and will be in its own asset pool. The first CCA deduction is made in year 0. The press will operate for 4 years and then be worthless. The cost of equity for Printing World is 11%, the cost of debt is 8%, and the company’s target debt-equity ratio is 1.00. The company’s tax rate is 35%. a. What is the NPV of buying the press? (Do not round intermediate calculations. Round your answer to the nearest dollar.) b. The equipment manufacturer is offering to lease the press for $115,000 a year, for 4 years, payable in advance. Should Printing World accept the offer?