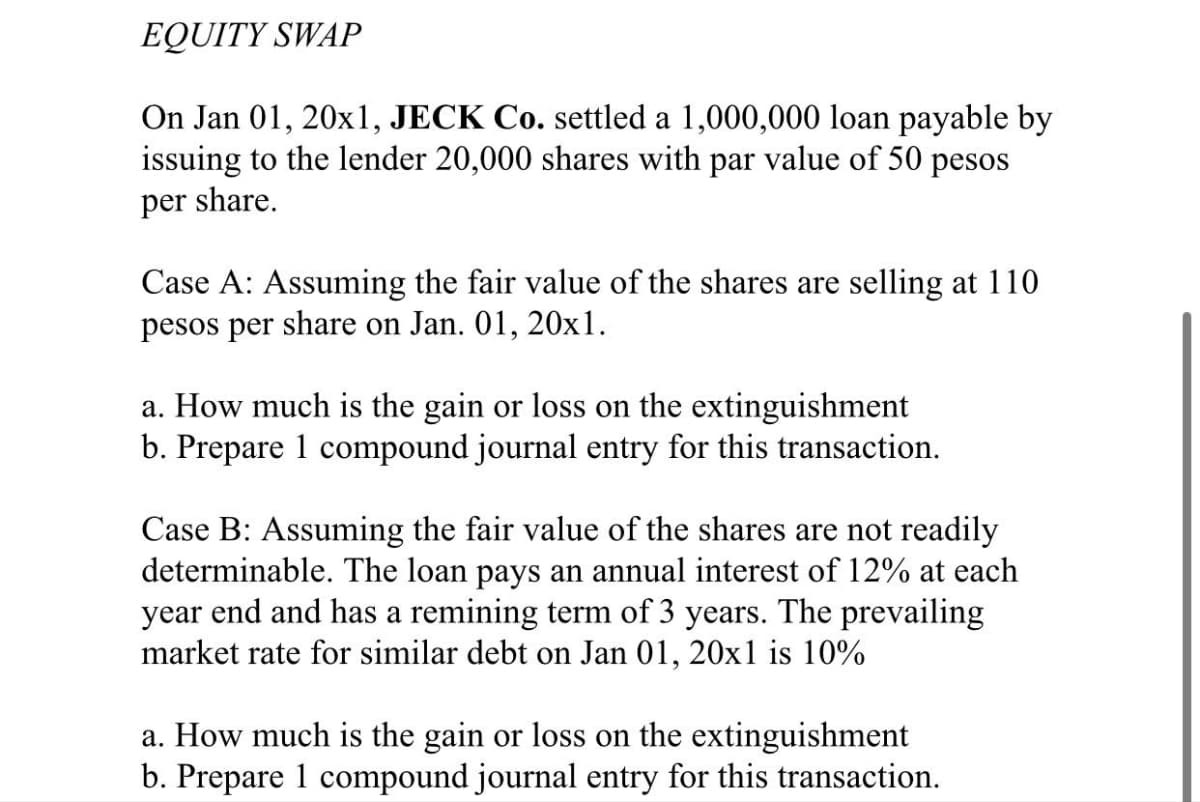

EQUITY SWAP On Jan 01, 20x1, JECK Co. settled a 1,000,000 loan payable by issuing to the lender 20,000 shares with par value of 50 pesos per share. Case A: Assuming the fair value of the shares are selling at 110 pesos per share on Jan. 01, 20x1. a. How much is the gain or loss on the extinguishment b. Prepare 1 compound journal entry for this transaction. Case B: Assuming the fair value of the shares are not readily determinable. The loan pays an annual interest of 12% at each year end and has a remining term of 3 years. The prevailing market rate for similar debt on Jan 01, 20x1 is 10% a. How much is the gain or loss on the extinguishment b. Prepare 1 compound journal entry for this transaction.

EQUITY SWAP On Jan 01, 20x1, JECK Co. settled a 1,000,000 loan payable by issuing to the lender 20,000 shares with par value of 50 pesos per share. Case A: Assuming the fair value of the shares are selling at 110 pesos per share on Jan. 01, 20x1. a. How much is the gain or loss on the extinguishment b. Prepare 1 compound journal entry for this transaction. Case B: Assuming the fair value of the shares are not readily determinable. The loan pays an annual interest of 12% at each year end and has a remining term of 3 years. The prevailing market rate for similar debt on Jan 01, 20x1 is 10% a. How much is the gain or loss on the extinguishment b. Prepare 1 compound journal entry for this transaction.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter15: Shareholders’ Equity: Capital Contributions And Distributions

Section: Chapter Questions

Problem 21E

Related questions

Question

Please do not give image format and solve all required

Transcribed Image Text:EQUITY SWAP

On Jan 01, 20x1, JECK Co. settled a 1,000,000 loan payable by

issuing to the lender 20,000 shares with par value of 50 pesos

per share.

Case A: Assuming the fair value of the shares are selling at 110

pesos per share on Jan. 01, 20x1.

a. How much is the gain or loss on the extinguishment

b. Prepare 1 compound journal entry for this transaction.

Case B: Assuming the fair value of the shares are not readily

determinable. The loan pays an annual interest of 12% at each

year end and has a remining term of 3 years. The prevailing

market rate for similar debt on Jan 01, 20x1 is 10%

a. How much is the gain or loss on the extinguishment

b. Prepare 1 compound journal entry for this transaction.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you