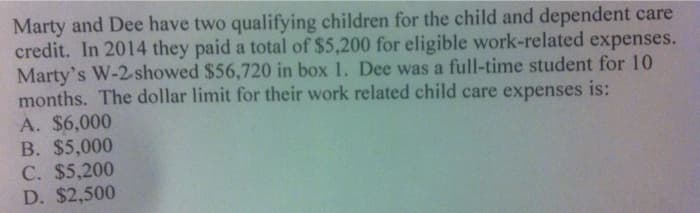

Marty and Dee have two qualifying children for the child and dependent credit. In 2014 they paid a total of $5,200 for eligible work-related expenses. Marty's W-2-showed $56,720 in box 1. Dee was a full-time student for 10 months. The dollar limit for their work related child care expenses is: A. $6,000 B. $5,000 C. $5,200 D. $2,500

Marty and Dee have two qualifying children for the child and dependent credit. In 2014 they paid a total of $5,200 for eligible work-related expenses. Marty's W-2-showed $56,720 in box 1. Dee was a full-time student for 10 months. The dollar limit for their work related child care expenses is: A. $6,000 B. $5,000 C. $5,200 D. $2,500

Chapter6: Business Expenses

Section: Chapter Questions

Problem 67P

Related questions

Question

Subject - account

Please help me.

Thankyou.

Transcribed Image Text:Marty and Dee have two qualifying children for the child and dependent care

credit. In 2014 they paid a total of $5,200 for eligible work-related expenses.

Marty's W-2-showed $56,720 in box 1. Dee was a full-time student for 10

months. The dollar limit for their work related child care expenses is:

A. $6,000

B. $5,000

C. $5,200

D. $2,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT