Sheridan Inc. (SI) has a short-term working capital loan to help finance its working capital. The terms of the loan enable Sl to borrow an amount of up to 35% of its inventory balance and 55% of its accounts receivable. One of the loan covenants requires that Si maintain a current ratio greater than 2. Information related to Sl's current assets and current liabilities is shown in the following table: In thousands Cash Accounts receivable Inventory Other current assets Accounts payable Short-term bank loan Other current liabilities (a) Current ratio SI S 2023 $160 $225 2,004 1,228 2,332 Does Sl satisfy the loan covenant in both years? (Round answers to 2 decimal places, eg. 18.45) क 2024 1,366 333 391 1,381 1,339 558 278 56 113 2024 times V the loan covenant in 2024. the loan covenant in 2023 2023 times

Sheridan Inc. (SI) has a short-term working capital loan to help finance its working capital. The terms of the loan enable Sl to borrow an amount of up to 35% of its inventory balance and 55% of its accounts receivable. One of the loan covenants requires that Si maintain a current ratio greater than 2. Information related to Sl's current assets and current liabilities is shown in the following table: In thousands Cash Accounts receivable Inventory Other current assets Accounts payable Short-term bank loan Other current liabilities (a) Current ratio SI S 2023 $160 $225 2,004 1,228 2,332 Does Sl satisfy the loan covenant in both years? (Round answers to 2 decimal places, eg. 18.45) क 2024 1,366 333 391 1,381 1,339 558 278 56 113 2024 times V the loan covenant in 2024. the loan covenant in 2023 2023 times

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 16P

Related questions

Question

Please do not give image format

Transcribed Image Text:Current Attempt in Progress

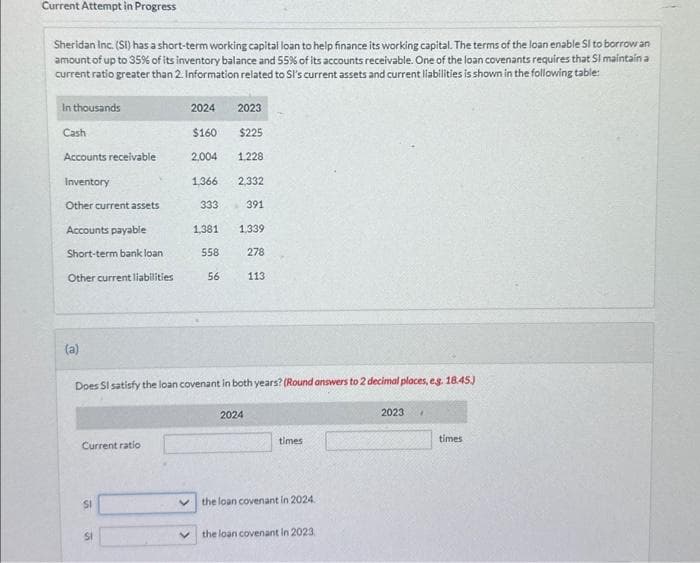

Sheridan Inc. (SI) has a short-term working capital loan to help finance its working capital. The terms of the loan enable Sl to borrow an

amount of up to 35% of its inventory balance and 55% of its accounts receivable. One of the loan covenants requires that SI maintain a

current ratio greater than 2. Information related to Si's current assets and current liabilities is shown in the following table:

In thousands

Cash

Accounts receivable

Inventory

Other current assets

Accounts payable

Short-term bank loan.

Other current liabilities

(a)

Current ratio.

2024

SI

2023

$160

$225

2,004 1,228

2,332

1,366

333

1,381 1,339

558 278

113

56

Does Sl satisfy the loan covenant in both years? (Round answers to 2 decimal places, eg. 18.45)

391

2024

times

the loan covenant in 2024.

V the loan covenant in 2023

2023

times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning