er of a large crude-oil refinery. As part of the refining process, a certain must be replaced every year. The replacement and downtime cost in the ar for five years (.e. until the EOY 6), at which time this particular heat much could you afford to spend for a higher quality heat exchanger so to view the interest and annuity table for discrete compounding when i to view the interest and annuity table for discrete compounding when

er of a large crude-oil refinery. As part of the refining process, a certain must be replaced every year. The replacement and downtime cost in the ar for five years (.e. until the EOY 6), at which time this particular heat much could you afford to spend for a higher quality heat exchanger so to view the interest and annuity table for discrete compounding when i to view the interest and annuity table for discrete compounding when

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 15E: Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided...

Related questions

Question

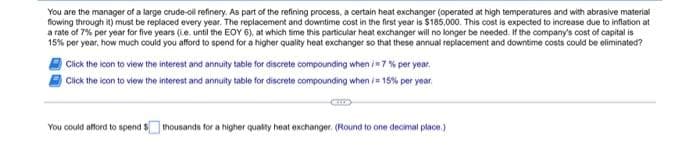

Transcribed Image Text:You are the manager of a large crude-oll refinery. As part of the refining process, a certain heat exchanger (operated at high temperatures and with abrasive material

flowing through it) must be replaced every year. The replacement and downtime cost in the first year is $185,000. This cost is expected to increase due to inflation at

a rate of 7% per year for five years (ie. until the EOY 6), at which time this particular heat exchanger will no longer be needed. If the company's cost of capital is

15% per year, how much could you afford to spend for a higher quality heat exchanger so that these annual replacement and downtime costs could be eliminated?

Click the icon to view the interest and annuity table for discrete compounding when i=7% per year.

Click the icon to view the interest and annuity table for discrete compounding when /= 15% per year.

CD

You could afford to spend thousands for a higher quality heat exchanger. (Round to one decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College