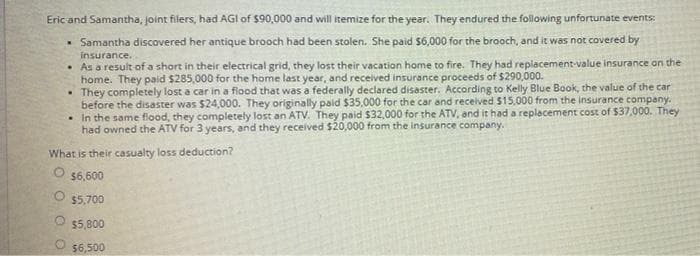

Eric and Samantha, joint filers, had AGI of $90,000 and will itemize for the year. They endured the following unfortunate events: • Samantha discovered her antique brooch had been stolen. She paid $6,000 for the brooch, and it was not covered by insurance. • As a result of a short in their electrical grid, they lost their vacation home to fire. They had replacement-value insurance aon the home. They paid $285,000 for the home last year, and received insurance proceeds of $290,000. They completely lost a car in a flood that was a federally declared disaster. According to Kelly Blue Book, the value of the car before the disaster was $24,000. They originally paid $35,000 for the car and received $15,000 from the insurance company. • In the same flood, they completely lost an ATV. They paid $32,000 for the ATV, and it had a replacement cost of $37,000. They had owned the ATV for 3 years, and they received $20,000 from the insurance company. What is their casualty loss deduction?

Eric and Samantha, joint filers, had AGI of $90,000 and will itemize for the year. They endured the following unfortunate events: • Samantha discovered her antique brooch had been stolen. She paid $6,000 for the brooch, and it was not covered by insurance. • As a result of a short in their electrical grid, they lost their vacation home to fire. They had replacement-value insurance aon the home. They paid $285,000 for the home last year, and received insurance proceeds of $290,000. They completely lost a car in a flood that was a federally declared disaster. According to Kelly Blue Book, the value of the car before the disaster was $24,000. They originally paid $35,000 for the car and received $15,000 from the insurance company. • In the same flood, they completely lost an ATV. They paid $32,000 for the ATV, and it had a replacement cost of $37,000. They had owned the ATV for 3 years, and they received $20,000 from the insurance company. What is their casualty loss deduction?

Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 66P

Related questions

Question

1

2021 tax year

Transcribed Image Text:Eric and Samantha, joint filers, had AGI of $90,000 and will itemize for the year. They endured the following unfortunate events:

• Samantha discovered her antique brooch had been stolen. She paid $6,000 for the brooch, and it was not covered by

insurance.

• As a result of a short in their electrical grid, they lost their vacation home to fire. They had replacement-value insurance on the

home. They paid $285,000 for the home last year, and recelved insurance proceeds of $290,000.

They completely lost a car in a flood that was a federally declared disaster. According to Kelly Blue Book, the value of the car

before the disaster was $24,000. They originally paid $35,000 for the car and received $15,000 from the insurance company.

• In the same flood, they completely lost an ATv. They paid $32,000 for the ATV, and it had a replacement cost of $37,000. They

had owned the ATV for 3 years, and they received $20,000 from the insurance company.

What is their casualty loss deduction?

$6,600

$5,700

O 55,800

$6,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT