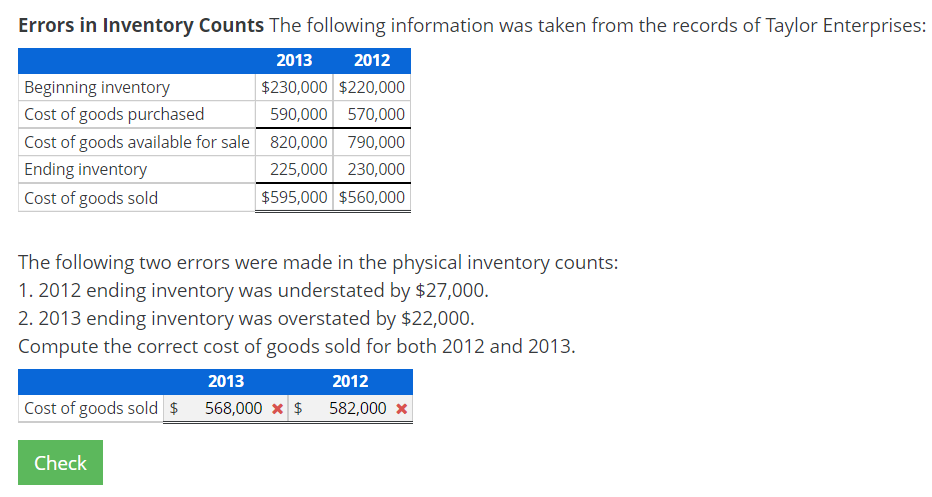

Errors in Inventory Counts The following information was taken from the records of Taylor Enterprises: 2013 2012 Beginning inventory $230,000 $220,000 Cost of goods purchased 590,000 570,000 Cost of goods available for sale 820,000 790,000 225,000 230,000 $595,000 $560,000 Ending inventory Cost of goods sold The following two errors were made in the physical inventory counts: 1. 2012 ending inventory was understated by $27,000. 2. 2013 ending inventory was overstated by $22,000. Compute the correct cost of goods sold for both 2012 and 2013. 2013 2012 Cost of goods sold $ 568,000 x $ 582,000 x

Errors in Inventory Counts The following information was taken from the records of Taylor Enterprises: 2013 2012 Beginning inventory $230,000 $220,000 Cost of goods purchased 590,000 570,000 Cost of goods available for sale 820,000 790,000 225,000 230,000 $595,000 $560,000 Ending inventory Cost of goods sold The following two errors were made in the physical inventory counts: 1. 2012 ending inventory was understated by $27,000. 2. 2013 ending inventory was overstated by $22,000. Compute the correct cost of goods sold for both 2012 and 2013. 2013 2012 Cost of goods sold $ 568,000 x $ 582,000 x

Chapter10: Inventory

Section: Chapter Questions

Problem 13EA: If a group of inventory items costing $15,000 had been omitted from the year-end inventory count,...

Related questions

Question

I don't quite understand why I did wrong. Thank you for your clarification!

Transcribed Image Text:Errors in Inventory Counts The following information was taken from the records of Taylor Enterprises:

2013

2012

Beginning inventory

$230,000 $220,000

Cost of goods purchased

590,000 570,000

Cost of goods available for sale 820,000 790,000

Ending inventory

225,000 230,000

Cost of goods sold

$595,000 $560,000

The following two errors were made in the physical inventory counts:

1. 2012 ending inventory was understated by $27,000.

2. 2013 ending inventory was overstated by $22,000.

Compute the correct cost of goods sold for both 2012 and 2013.

2013

2012

Cost of goods sold $

568,000 x $ 582,000 x

Check

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning