Refer to part 3 and now assume that the tax rate is 30%. How many units would need to be sold each month for an after-tax target ofit of $95,400? (Round the final answer to the nearest whole number.) Unit sales required Refer to the original data. Compute the company's margin of safety in both dollar and percentage terms. (Round your percentage swer to 2 decimal places.) Margin of safety Show Transcribed Text Dollars units CM ratio Monthly operating income increases by Percentage What is the company's CM ratio? If sales increase by $53,000 per month and there is no change in fixed expenses, by how much ould you expect monthly net operating income to increase? (Round your percentage answer to 2 decimal places and other answer the nearest whole dollar amount.) %

Refer to part 3 and now assume that the tax rate is 30%. How many units would need to be sold each month for an after-tax target ofit of $95,400? (Round the final answer to the nearest whole number.) Unit sales required Refer to the original data. Compute the company's margin of safety in both dollar and percentage terms. (Round your percentage swer to 2 decimal places.) Margin of safety Show Transcribed Text Dollars units CM ratio Monthly operating income increases by Percentage What is the company's CM ratio? If sales increase by $53,000 per month and there is no change in fixed expenses, by how much ould you expect monthly net operating income to increase? (Round your percentage answer to 2 decimal places and other answer the nearest whole dollar amount.) %

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 4PB: West Island distributes a single product. The companys sales and expenses for the month of June are...

Related questions

Question

please answer 4, 5 and 6 and if you can answer all it will be very good

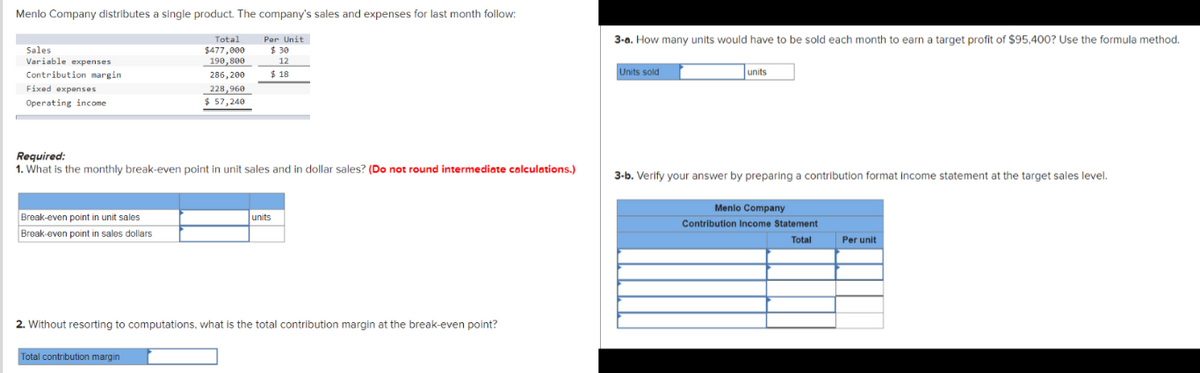

Transcribed Image Text:Menlo Company distributes a single product. The company's sales and expenses for last month follow:

Total

$477,000

190,800

Per Unit

$ 30

12

286,200

$18

228,960

$ 57,240

Sales

Variable expenses

Contribution margin

Fixed expenses

Operating income

Required:

1. What is the monthly break-even point in unit sales and in dollar sales? (Do not round intermediate calculations.)

Break-even point in unit sales

Break-even point in sales dollars

units

2. Without resorting to computations, what is the total contribution margin at the break-even point?

Total contribution margin

3-a. How many units would have to be sold each month to earn a target profit of $95,400? Use the formula method.

Units sold

units

3-b. Verify your answer by preparing a contribution format income statement at the target sales level.

Menlo Company

Contribution Income Statement

Total

Per unit

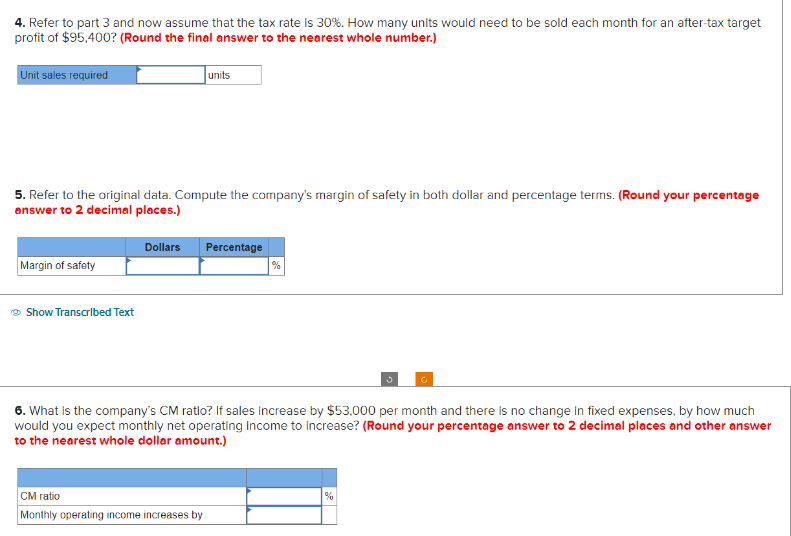

Transcribed Image Text:4. Refer to part 3 and now assume that the tax rate is 30%. How many units would need to be sold each month for an after-tax target

profit of $95,400? (Round the final answer to the nearest whole number.)

Unit sales required

5. Refer to the original data. Compute the company's margin of safety in both dollar and percentage terms. (Round your percentage

answer to 2 decimal places.)

Margin of safety

Show Transcribed Text

Dollars

units

CM ratio

Monthly operating income increases by

Percentage

%

6. What is the company's CM ratio? If sales increase by $53,000 per month and there is no change in fixed expenses, by how much

would you expect monthly net operating income to Increase? (Round your percentage answer to 2 decimal places and other answer

to the nearest whole dollar amount.)

C

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,