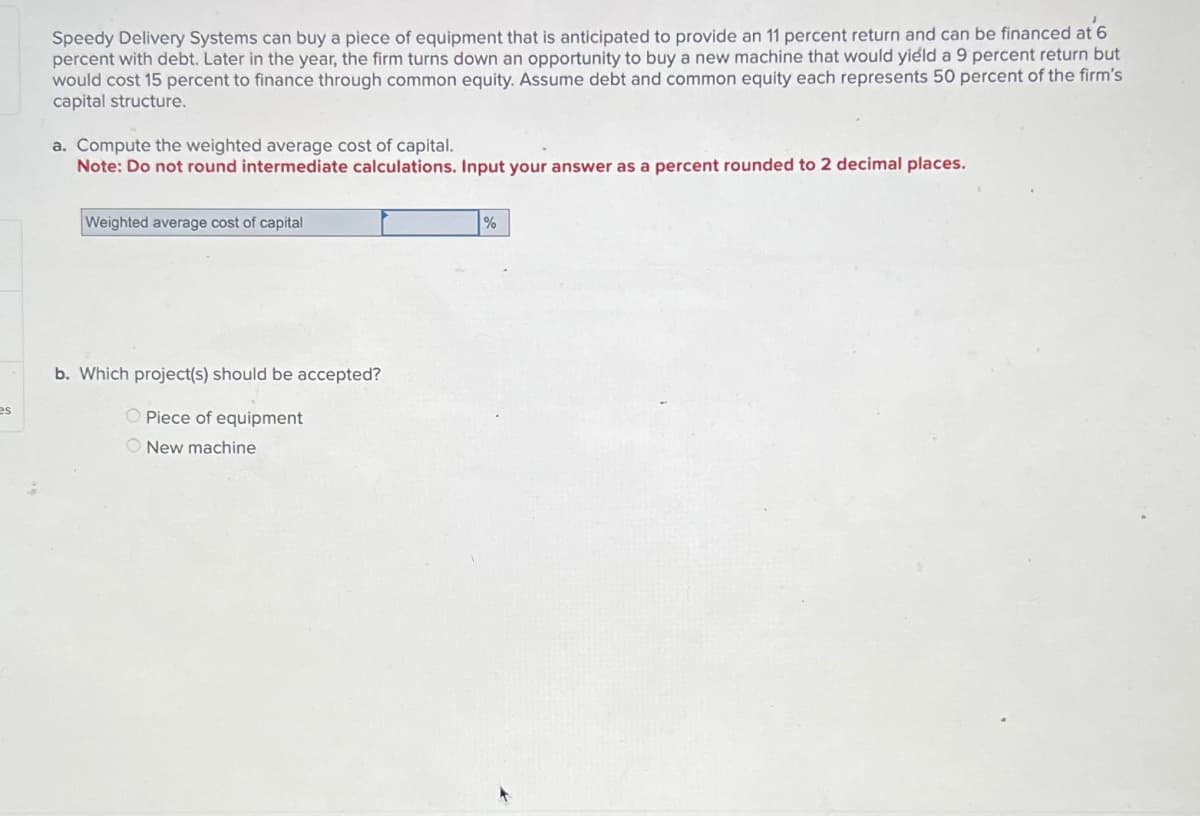

es Speedy Delivery Systems can buy a piece of equipment that is anticipated to provide an 11 percent return and can be financed at 6 percent with debt. Later in the year, the firm turns down an opportunity to buy a new machine that would yield a 9 percent return but would cost 15 percent to finance through common equity. Assume debt and common equity each represents 50 percent of the firm's capital structure. a. Compute the weighted average cost of capital. Note: Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places. Weighted average cost of capital % b. Which project(s) should be accepted? Piece of equipment New machine

es Speedy Delivery Systems can buy a piece of equipment that is anticipated to provide an 11 percent return and can be financed at 6 percent with debt. Later in the year, the firm turns down an opportunity to buy a new machine that would yield a 9 percent return but would cost 15 percent to finance through common equity. Assume debt and common equity each represents 50 percent of the firm's capital structure. a. Compute the weighted average cost of capital. Note: Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places. Weighted average cost of capital % b. Which project(s) should be accepted? Piece of equipment New machine

Chapter12: The Cost Of Capital

Section: Chapter Questions

Problem 7P

Related questions

Question

Transcribed Image Text:es

Speedy Delivery Systems can buy a piece of equipment that is anticipated to provide an 11 percent return and can be financed at 6

percent with debt. Later in the year, the firm turns down an opportunity to buy a new machine that would yield a 9 percent return but

would cost 15 percent to finance through common equity. Assume debt and common equity each represents 50 percent of the firm's

capital structure.

a. Compute the weighted average cost of capital.

Note: Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.

Weighted average cost of capital

%

b. Which project(s) should be accepted?

Piece of equipment

New machine

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning