estors opened Company Inc. on May 1, 2020. During the first month of operations, the following transactions occurred May 1 Stockholders invested $50,000 cash in the business and received common stock. May 2 Pre-paid $7,000 in cash for May rent. May 4 $25,000 was borrowed from the bank and signed a note payable. May 8 Office supplies were purchased on account, $7,000. May 8 Paid cash $17,000 for furniture. May 12 Performed a service on account for $9,800. May 15 Paid $5,900 of the account payable from May 4. May 24 Received cash on account, $7,300 (related to transaction from May 12). May 26 Paid the following cash expenses: (1) Promotion, $5500; (2) Utilities, $5600. 1. Prepare the income statement, statement of retained earnings, and balance sheet. 2. Transactions must be posted to T-accounts with ending balances showing and total the amounts. 3. Form the trial balance of SOC, Inc., on May 30, 2022.

estors opened Company Inc. on May 1, 2020. During the first month of operations, the following transactions occurred May 1 Stockholders invested $50,000 cash in the business and received common stock. May 2 Pre-paid $7,000 in cash for May rent. May 4 $25,000 was borrowed from the bank and signed a note payable. May 8 Office supplies were purchased on account, $7,000. May 8 Paid cash $17,000 for furniture. May 12 Performed a service on account for $9,800. May 15 Paid $5,900 of the account payable from May 4. May 24 Received cash on account, $7,300 (related to transaction from May 12). May 26 Paid the following cash expenses: (1) Promotion, $5500; (2) Utilities, $5600. 1. Prepare the income statement, statement of retained earnings, and balance sheet. 2. Transactions must be posted to T-accounts with ending balances showing and total the amounts. 3. Form the trial balance of SOC, Inc., on May 30, 2022.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 17PA: Prepare journal entries to record the following transactions for the month of November: A. on first...

Related questions

Question

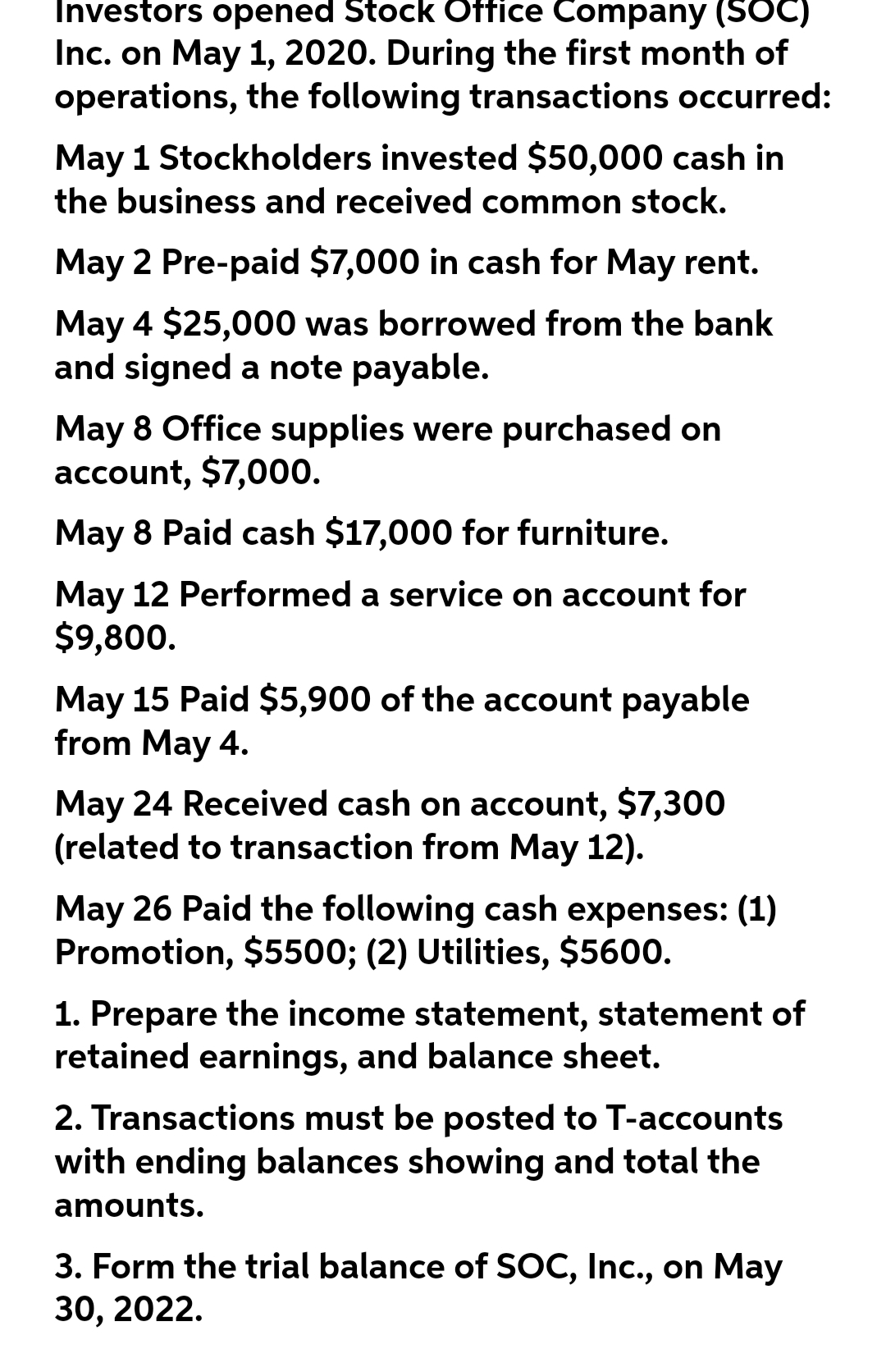

Transcribed Image Text:Investors opened Stock Office Company (SOC)

Inc. on May 1, 2020. During the first month of

operations, the following transactions occurred:

May 1 Stockholders invested $50,000 cash in

the business and received common stock.

May 2 Pre-paid $7,000 in cash for May rent.

May 4 $25,000 was borrowed from the bank

and signed a note payable.

May 8 Office supplies were purchased on

account, $7,000.

May 8 Paid cash $17,000 for furniture.

May 12 Performed a service on account for

$9,800.

May 15 Paid $5,900 of the account payable

from May 4.

May 24 Received cash on account, $7,300

(related to transaction from May 12).

May 26 Paid the following cash expenses: (1)

Promotion, $5500; (2) Utilities, $5600.

1. Prepare the income statement, statement of

retained earnings, and balance sheet.

2. Transactions must be posted to T-accounts

with ending balances showing and total the

amounts.

3. Form the trial balance of SOC, Inc., on May

30, 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 5 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage