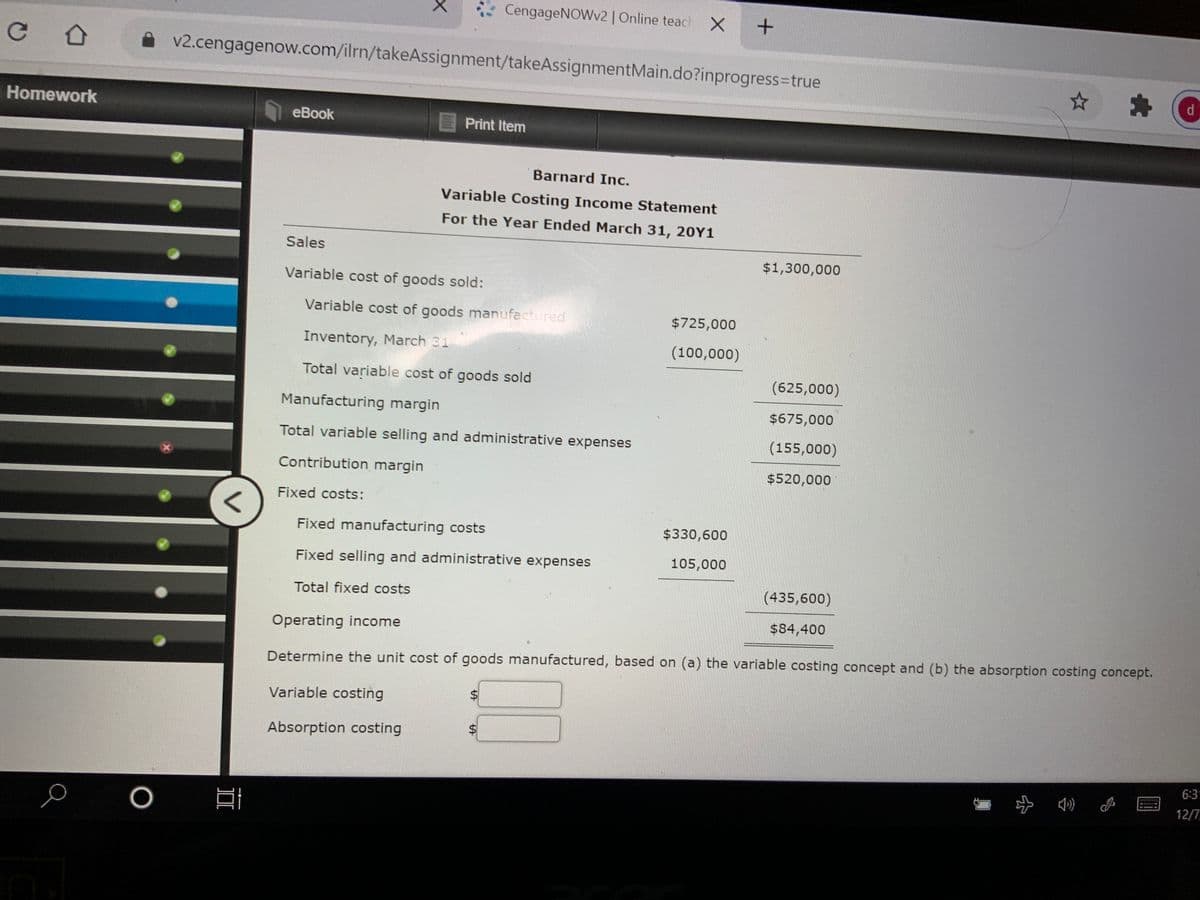

еВook Print Item Barnard Inc. Variable Costing Income Statement For the Year Ended March 31, 20Y1 Sales $1,300,000 Variable cost of goods sold: Variable cost of goods manufectured $725,000 Inventory, March 31 (100,000) Total variable cost of goods sold (625,000) Manufacturing margin $675,000 Total variable selling and administrative expenses (155,000) Contribution margin $520,000 Fixed costs: Fixed manufacturing costs $330,600 Fixed selling and administrative expenses 105,000 Total fixed costs (435,600) $84,400 Operating income Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept. Variable costing Absorption costing

еВook Print Item Barnard Inc. Variable Costing Income Statement For the Year Ended March 31, 20Y1 Sales $1,300,000 Variable cost of goods sold: Variable cost of goods manufectured $725,000 Inventory, March 31 (100,000) Total variable cost of goods sold (625,000) Manufacturing margin $675,000 Total variable selling and administrative expenses (155,000) Contribution margin $520,000 Fixed costs: Fixed manufacturing costs $330,600 Fixed selling and administrative expenses 105,000 Total fixed costs (435,600) $84,400 Operating income Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept. Variable costing Absorption costing

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 4CE: Refer to Cornerstone Exercise 18.3. Required: 1. Calculate the cost of each unit using variable...

Related questions

Question

How to calculate variable and absorption cost?

Transcribed Image Text:CengageNOWv2| Online teach X

v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?inprogress=Dtrue

Homework

еВook

Print Item

Barnard Inc.

Variable Costing Income Statement

For the Year Ended March 31, 20Y1

Sales

$1,300,000

Variable cost of goods sold:

Variable cost of goods manufactured

$725,000

Inventory, March 31

(100,000)

Total variable cost of goods sold

(625,000)

Manufacturing margin

$675,000

Total variable selling and administrative expenses

(155,000)

Contribution margin

$520,000

Fixed costs:

Fixed manufacturing costs

$330,600

Fixed selling and administrative expenses

105,000

Total fixed costs

(435,600)

$84,400

Operating income

Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept.

Variable costing

Absorption costing

$4

6:3

分 )

12/7

O

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning