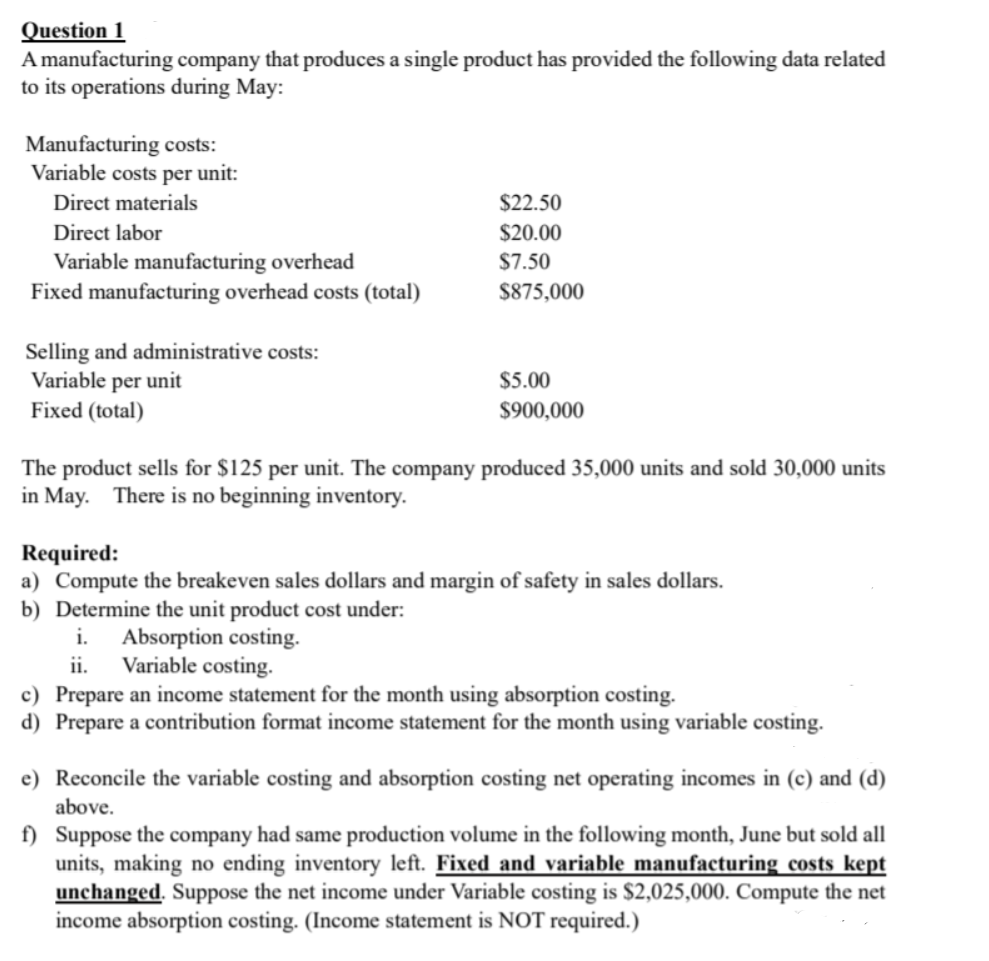

Question 1 A manufacturing company that produces a single product has provided the following data related to its operations during May: Manufacturing costs: Variable costs per unit: Direct materials $22.50 Direct labor $20.00 Variable manufacturing overhead Fixed manufacturing overhead costs (total) $7.50 $875,000 Selling and administrative costs: Variable per unit Fixed (total) $5.00 $900,000 The product sells for $125 per unit. The company produced 35,000 units and sold 30,000 units in May. There is no beginning inventory. Required: a) Compute the breakeven sales dollars and margin of safety in sales dollars. b) Determine the unit product cost under: i. Absorption costing. Variable costing. ii. c) Prepare an income statement for the month using absorption costing. d) Prepare a contribution format income statement for the month using variable costing. e) Reconcile the variable costing and absorption costing net operating incomes in (c) and (d) above. f) Suppose the company had same production volume in the following month, June but sold all units, making no ending inventory left. Fixed and variable manufacturing costs kept unchanged. Suppose the net income under Variable costing is $2,025,000. Compute the net income absorption costing. (Income statement is NOT required.)

Question 1 A manufacturing company that produces a single product has provided the following data related to its operations during May: Manufacturing costs: Variable costs per unit: Direct materials $22.50 Direct labor $20.00 Variable manufacturing overhead Fixed manufacturing overhead costs (total) $7.50 $875,000 Selling and administrative costs: Variable per unit Fixed (total) $5.00 $900,000 The product sells for $125 per unit. The company produced 35,000 units and sold 30,000 units in May. There is no beginning inventory. Required: a) Compute the breakeven sales dollars and margin of safety in sales dollars. b) Determine the unit product cost under: i. Absorption costing. Variable costing. ii. c) Prepare an income statement for the month using absorption costing. d) Prepare a contribution format income statement for the month using variable costing. e) Reconcile the variable costing and absorption costing net operating incomes in (c) and (d) above. f) Suppose the company had same production volume in the following month, June but sold all units, making no ending inventory left. Fixed and variable manufacturing costs kept unchanged. Suppose the net income under Variable costing is $2,025,000. Compute the net income absorption costing. (Income statement is NOT required.)

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter21: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 21.28EX: Appendix Absorption costing income statement On June 30, the end of the first month of operations,...

Related questions

Question

Transcribed Image Text:Question 1

A manufacturing company that produces a single product has provided the following data related

to its operations during May:

Manufacturing costs:

Variable costs per unit:

Direct materials

$22.50

Direct labor

$20.00

Variable manufacturing overhead

Fixed manufacturing overhead costs (total)

$7.50

$875,000

Selling and administrative costs:

Variable per unit

Fixed (total)

$5.00

$900,000

The product sells for $125 per unit. The company produced 35,000 units and sold 30,000 units

in May. There is no beginning inventory.

Required:

a) Compute the breakeven sales dollars and margin of safety in sales dollars.

b) Determine the unit product cost under:

i.

Absorption costing.

Variable costing.

ii.

c) Prepare an income statement for the month using absorption costing.

d) Prepare a contribution format income statement for the month using variable costing.

e) Reconcile the variable costing and absorption costing net operating incomes in (c) and (d)

above.

f) Suppose the company had same production volume in the following month, June but sold all

units, making no ending inventory left. Fixed and variable manufacturing costs kept

unchanged. Suppose the net income under Variable costing is $2,025,000. Compute the net

income absorption costing. (Income statement is NOT required.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,