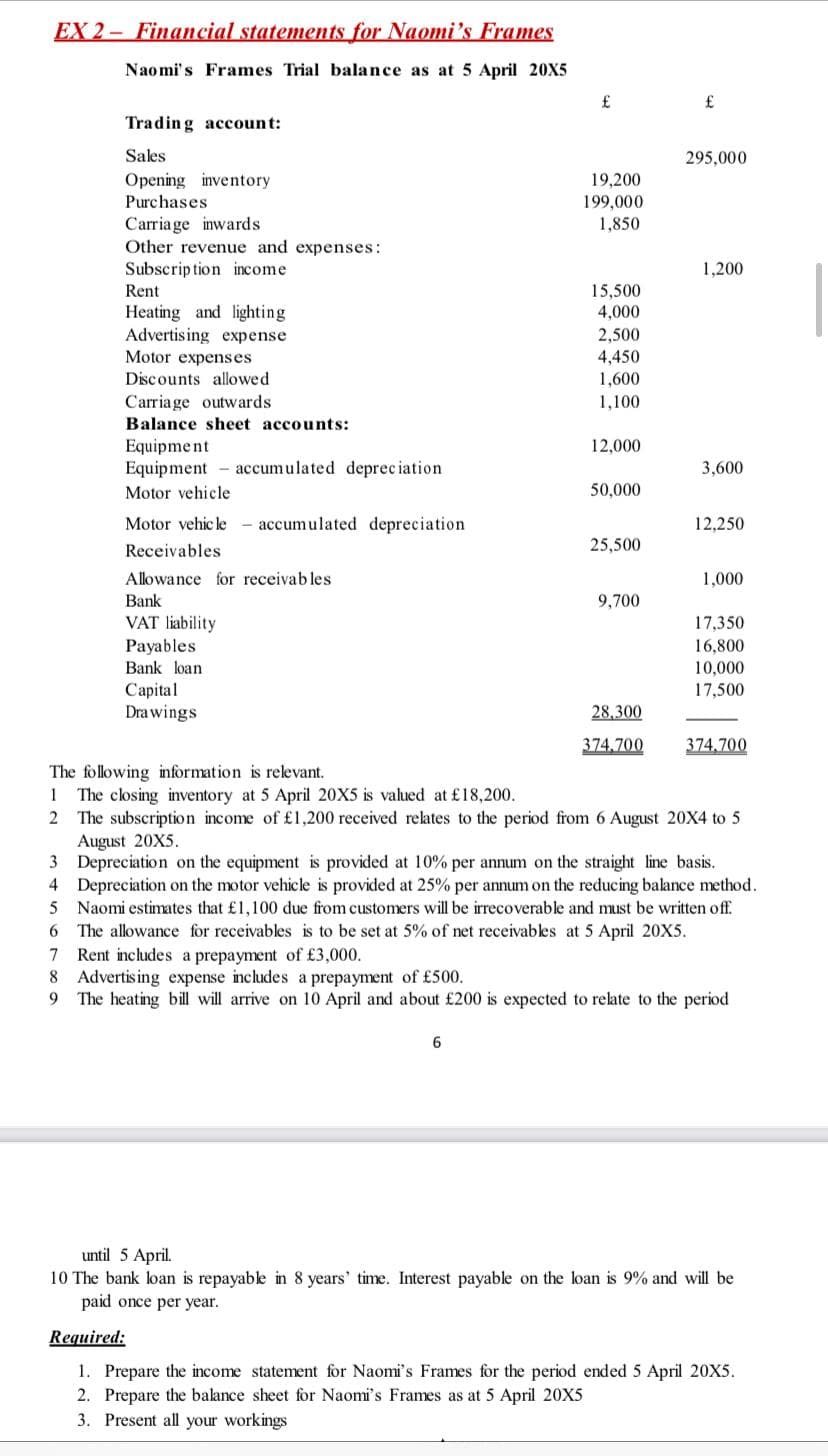

EX 2 - Financial statements for Naomi's Frames Naomi's Frames Trial balance as at 5 April 20X5 £ Trading account: Sales 295,000 Opening inventory 19,200 199,000 1,850 Purchases Carriage inwards Other revenue and expenses: Subscrip tion income Rent 1,200 15,500 4,000 Heating and lighting Advertising expense 2,500 4,450 1,600 Motor expenses Discounts allowed Carria ge outwards 1,100 Balance sheet accounts: Equipme nt Equipment - accumulated deprec iation 12,000 3,600 Motor vehicle 50,000 Motor vehic le - accumulated depreciation 12,250 Receivables 25,500 Allowance for receivab les 1,000 Bank 9,700 VAT liability Payables 17,350 16,800 10,000 17,500 Bank loan Capital Drawings 28,300 374.700 374,700 The following information is relevant. The closing inventory at 5 April 20X5 is valued at £18,200. 2 The subscription income of £1,200 received relates to the period from 6 August 20X4 to 5 August 20X5. 3 Depreciation on the equipment is provided at 10% per annum on the straight line basis. 4 Depreciation on the mot 1 vehicle is provided at 25% per annum on the reducing balance method. Naomi estimates that £1,100 due from customers will be irrecoverable and must be written off. 6 The allowance for receivables is to be set at 5% of net receivables at 5 April 20X5. Rent includes a prepayment of £3,000. 8 Advertising expense includes a prepayment of £500. The heating bill will arrive on 10 April and about £200 is expected to relate to the period 7 6 until 5 April. 10 The bank loan is repayable in 8 years' time. Interest payable on the loan is 9% and will be paid once per year. Required: 1. Prepare the income statement for Naomi's Frames for the period ended 5 April 20X5. 2. Prepare the balance sheet for Naomi's Frames as at 5 April 20X5 3. Present all your workings

EX 2 - Financial statements for Naomi's Frames Naomi's Frames Trial balance as at 5 April 20X5 £ Trading account: Sales 295,000 Opening inventory 19,200 199,000 1,850 Purchases Carriage inwards Other revenue and expenses: Subscrip tion income Rent 1,200 15,500 4,000 Heating and lighting Advertising expense 2,500 4,450 1,600 Motor expenses Discounts allowed Carria ge outwards 1,100 Balance sheet accounts: Equipme nt Equipment - accumulated deprec iation 12,000 3,600 Motor vehicle 50,000 Motor vehic le - accumulated depreciation 12,250 Receivables 25,500 Allowance for receivab les 1,000 Bank 9,700 VAT liability Payables 17,350 16,800 10,000 17,500 Bank loan Capital Drawings 28,300 374.700 374,700 The following information is relevant. The closing inventory at 5 April 20X5 is valued at £18,200. 2 The subscription income of £1,200 received relates to the period from 6 August 20X4 to 5 August 20X5. 3 Depreciation on the equipment is provided at 10% per annum on the straight line basis. 4 Depreciation on the mot 1 vehicle is provided at 25% per annum on the reducing balance method. Naomi estimates that £1,100 due from customers will be irrecoverable and must be written off. 6 The allowance for receivables is to be set at 5% of net receivables at 5 April 20X5. Rent includes a prepayment of £3,000. 8 Advertising expense includes a prepayment of £500. The heating bill will arrive on 10 April and about £200 is expected to relate to the period 7 6 until 5 April. 10 The bank loan is repayable in 8 years' time. Interest payable on the loan is 9% and will be paid once per year. Required: 1. Prepare the income statement for Naomi's Frames for the period ended 5 April 20X5. 2. Prepare the balance sheet for Naomi's Frames as at 5 April 20X5 3. Present all your workings

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter5: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5.6APR: Single-step income statement and balance sheet Selected accounts and related amounts for Clairemont...

Related questions

Topic Video

Question

Transcribed Image Text:EX 2 - Financial statements for Naomi's Frames

Naomi's Frames Trial balance as at 5 April 20X5

Trading account:

Sales

295,000

Opening inventory

19,200

Purchases

199,000

Carria ge inwards

Other revenue and expenses:

1,850

Subscrip tion income

1,200

Rent

15,500

4,000

Heating and lighting

Advertising expense

Motor expenses

2,500

4,450

Discounts allowed

1,600

Carriage outwards

1,100

Balance sheet accounts:

Equipme nt

Equipment - accumulated deprec iation

12,000

3,600

Motor vehicle

50,000

Motor vehic le

- accumulated depreciation

12,250

Receivables

25,500

Allowance for receivab les

1,000

Bank

9,700

VAT liability

Payables

17,350

16,800

10,000

Bank loan

Capital

Drawings

17,500

28,300

374,700

374,700

The following information is relevant.

The closing inventory at 5 April 20X5 is valued at £18,200.

The subscription income of £1,200 received relates to the period from 6 August 20X4 to 5

August 20X5.

3 Depreciation on the equipment is provided at 10% per annum on the straight line basis.

4 Depreciation on the motor vehicle is provided at 25% per annum on the reducing balance method.

1

2

Naomi estimates that £1,100 due from customers will be irrecoverable and must be written off.

The allowance for receivables is to be set at 5% of net receivables at 5 April 20X5.

Rent includes a prepayment of £3,000.

8 Advertis ing expense includes a prepayment of £500.

The heating bill will arrive on 10 April and about £200 is expected to relate to the period

7

9

6

until 5 April.

10 The bank loan is repayable in 8 years' time. Interest payable on the loan is 9% and will be

paid once per year.

Required:

1. Prepare the income statement for Naomi's Frames for the period ended 5 April 20X5.

2. Prepare the balance sheet foòr Naomi's Frames as at 5 April 20X5

3. Present all your workings

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning