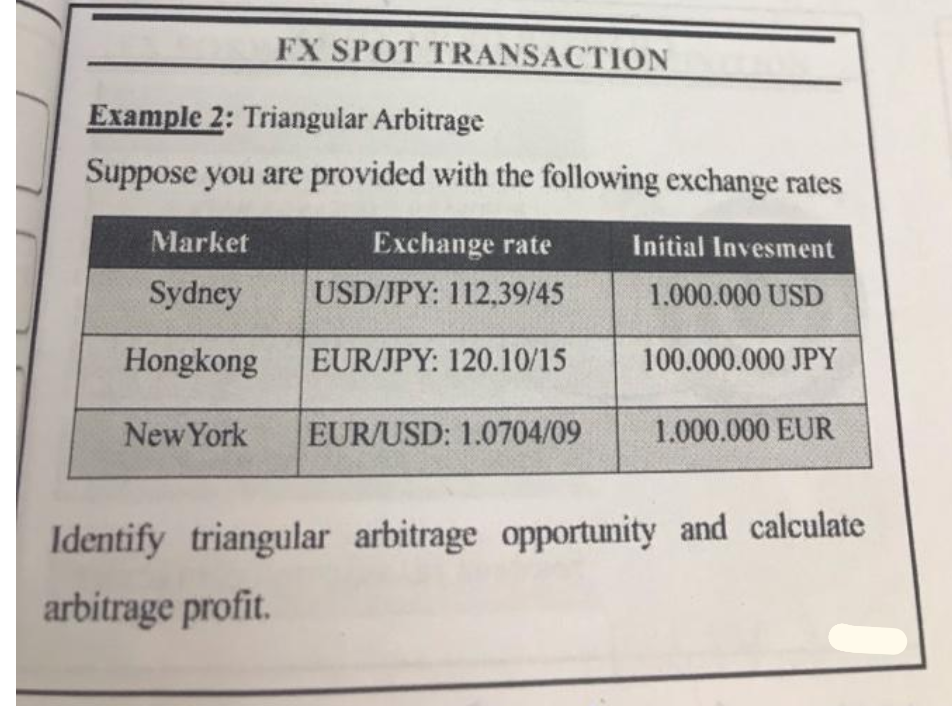

Example 2: Triangular Arbitrage Suppose you are provided with the following exchange rates Market Exchange rate Initial Invesment Sydney USD/JPY: 112,39/45 1.000.000 USD Hongkong EUR/JPY: 120.10/15 100.000.000 JPY New York EUR/USD: 1.0704/09 1.000.000 EUR Identify triangular arbitrage opportunity and calculate arbitrage profit.

Example 2: Triangular Arbitrage Suppose you are provided with the following exchange rates Market Exchange rate Initial Invesment Sydney USD/JPY: 112,39/45 1.000.000 USD Hongkong EUR/JPY: 120.10/15 100.000.000 JPY New York EUR/USD: 1.0704/09 1.000.000 EUR Identify triangular arbitrage opportunity and calculate arbitrage profit.

Chapter8: Relationships Among Inflation, Interest Rates, And Exchange Rates

Section: Chapter Questions

Problem 32QA

Related questions

Question

Transcribed Image Text:FX SPOT TRANSACTION

Example 2: Triangular Arbitrage

Suppose you are provided with the following exchange rates

Market

Exchange rate

Initial Invesment

Sydney

USD/JPY: 112,39/45

1.000.000 USD

Hongkong

EUR/JPY: 120.10/15

100.000.000 JPY

New York

EUR/USD: 1.0704/09

1.000.000 EUR

Identify triangular arbitrage opportunity and calculate

arbitrage profit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you