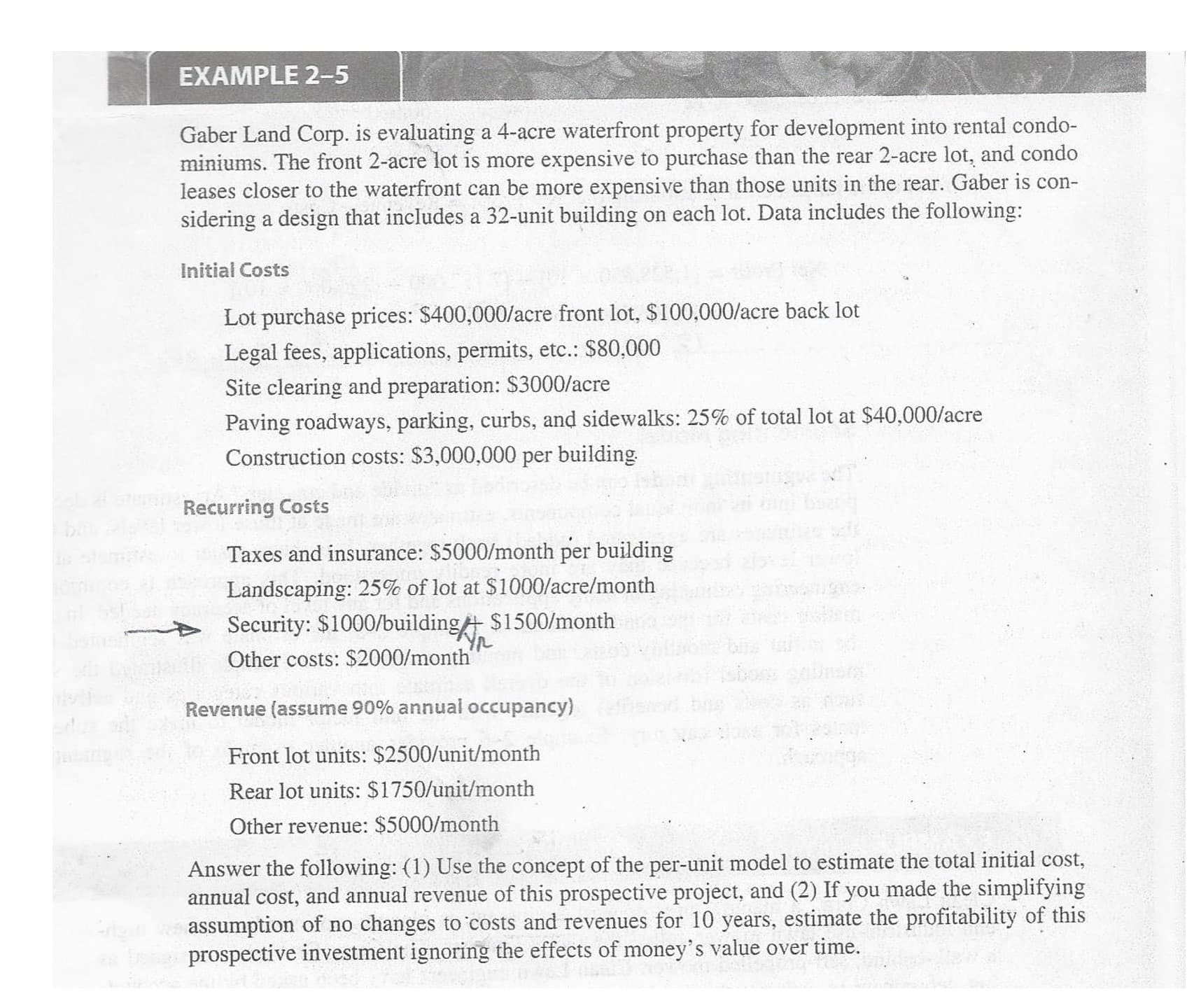

EXAMPLE 2-5 Gaber Land Corp. is evaluating a 4-acre waterfront property for development into rental condo- miniums. The front 2-acre lot is more expensive to purchase than the rear 2-acre lot, and condo leases closer to the waterfront can be more expensive than those units in the rear. Gaber is con- sidering a design that includes a 32-unit building on each lot. Data includes the following: Initial Costs Lot purchase prices: $400,000/acre front lot, $100,000/acre back lot Legal fees, applications, permits, etc.: $80,000 Site clearing and preparation: $3000/acre Paving roadways, parking, curbs, and sidewalks: 25% of total lot at $40,000/acre Construction costs: $3,000,000 per building. Recurring Costs Taxes and insurance: $5000/month per building Landscaping: 25% of lot at $1000/acre/month Security: $1000/building $1500/month Other costs: $2000/month' Revenue (assume 90% annual occupancy) Front lot units: $2500/unit/month Rear lot units: $1750/unit/month Other revenue: $5000/month Answer the following: (1) Use the concept of the per-unit model to estimate the total initial cost, annual cost, and annual revenue of this prospective project, and (2) If you made the simplifying assumption of no changes to costs and revenues for 10 years, estimate the profitability of this prospective investment ignoring the effects of money's value over time.

EXAMPLE 2-5 Gaber Land Corp. is evaluating a 4-acre waterfront property for development into rental condo- miniums. The front 2-acre lot is more expensive to purchase than the rear 2-acre lot, and condo leases closer to the waterfront can be more expensive than those units in the rear. Gaber is con- sidering a design that includes a 32-unit building on each lot. Data includes the following: Initial Costs Lot purchase prices: $400,000/acre front lot, $100,000/acre back lot Legal fees, applications, permits, etc.: $80,000 Site clearing and preparation: $3000/acre Paving roadways, parking, curbs, and sidewalks: 25% of total lot at $40,000/acre Construction costs: $3,000,000 per building. Recurring Costs Taxes and insurance: $5000/month per building Landscaping: 25% of lot at $1000/acre/month Security: $1000/building $1500/month Other costs: $2000/month' Revenue (assume 90% annual occupancy) Front lot units: $2500/unit/month Rear lot units: $1750/unit/month Other revenue: $5000/month Answer the following: (1) Use the concept of the per-unit model to estimate the total initial cost, annual cost, and annual revenue of this prospective project, and (2) If you made the simplifying assumption of no changes to costs and revenues for 10 years, estimate the profitability of this prospective investment ignoring the effects of money's value over time.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 10E

Related questions

Question

please help.

Transcribed Image Text:EXAMPLE 2-5

Gaber Land Corp. is evaluating a 4-acre waterfront property for development into rental condo-

miniums. The front 2-acre lot is more expensive to purchase than the rear 2-acre lot, and condo

leases closer to the waterfront can be more expensive than those units in the rear. Gaber is con-

sidering a design that includes a 32-unit building on each lot. Data includes the following:

Initial Costs

Lot purchase prices: $400,000/acre front lot, $100,000/acre back lot

Legal fees, applications, permits, etc.: $80,000

Site clearing and preparation: $3000/acre

Paving roadways, parking, curbs, and sidewalks: 25% of total lot at $40,000/acre

Construction costs: $3,000,000 per building.

Recurring Costs

Taxes and insurance: $5000/month per building

Landscaping: 25% of lot at $1000/acre/month

Security: $1000/building $1500/month

Other costs: $2000/month'

Revenue (assume 90% annual occupancy)

Front lot units: $2500/unit/month

Rear lot units: $1750/unit/month

Other revenue: $5000/month

Answer the following: (1) Use the concept of the per-unit model to estimate the total initial cost,

annual cost, and annual revenue of this prospective project, and (2) If you made the simplifying

assumption of no changes to costs and revenues for 10 years, estimate the profitability of this

prospective investment ignoring the effects of money's value over time.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning