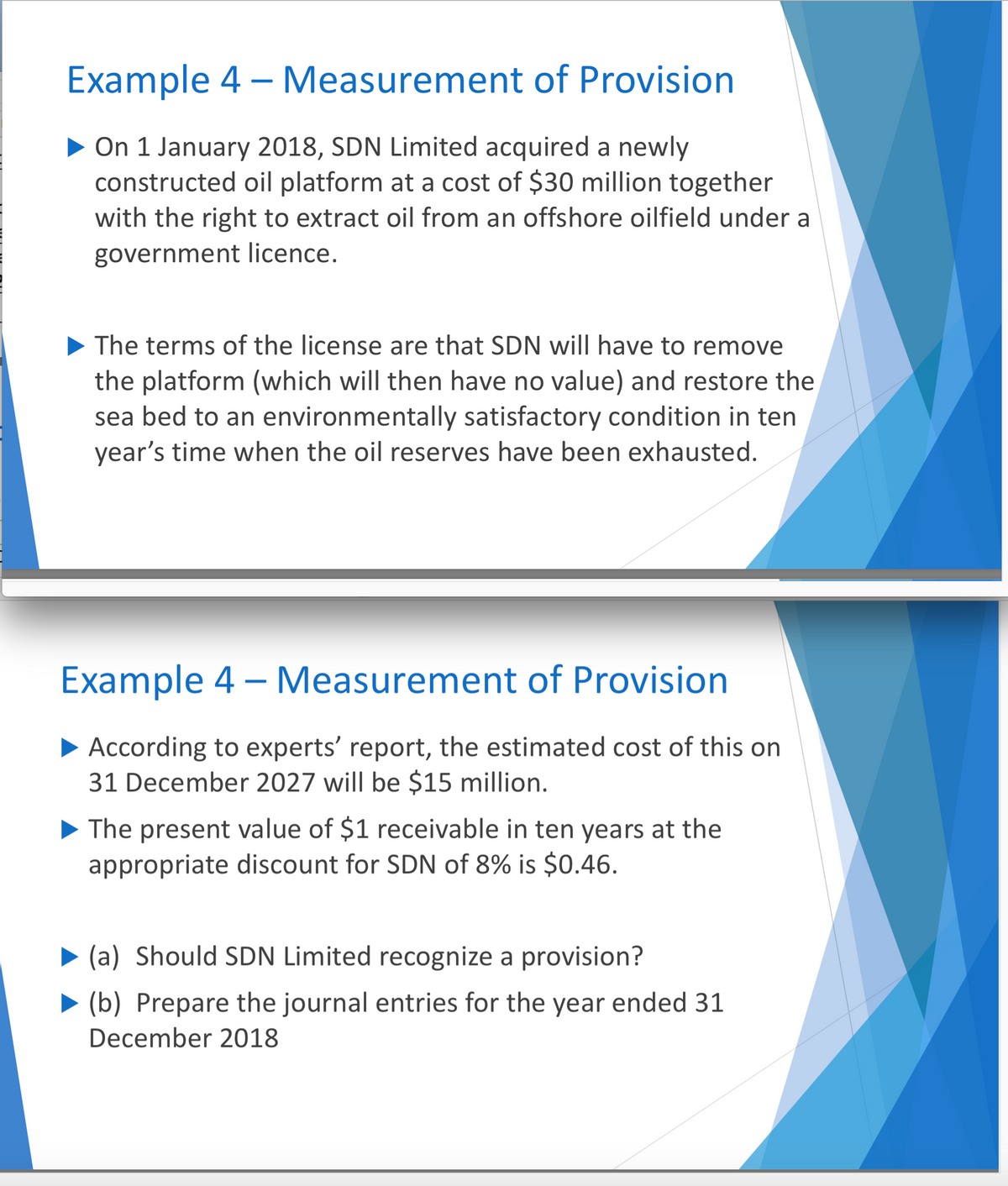

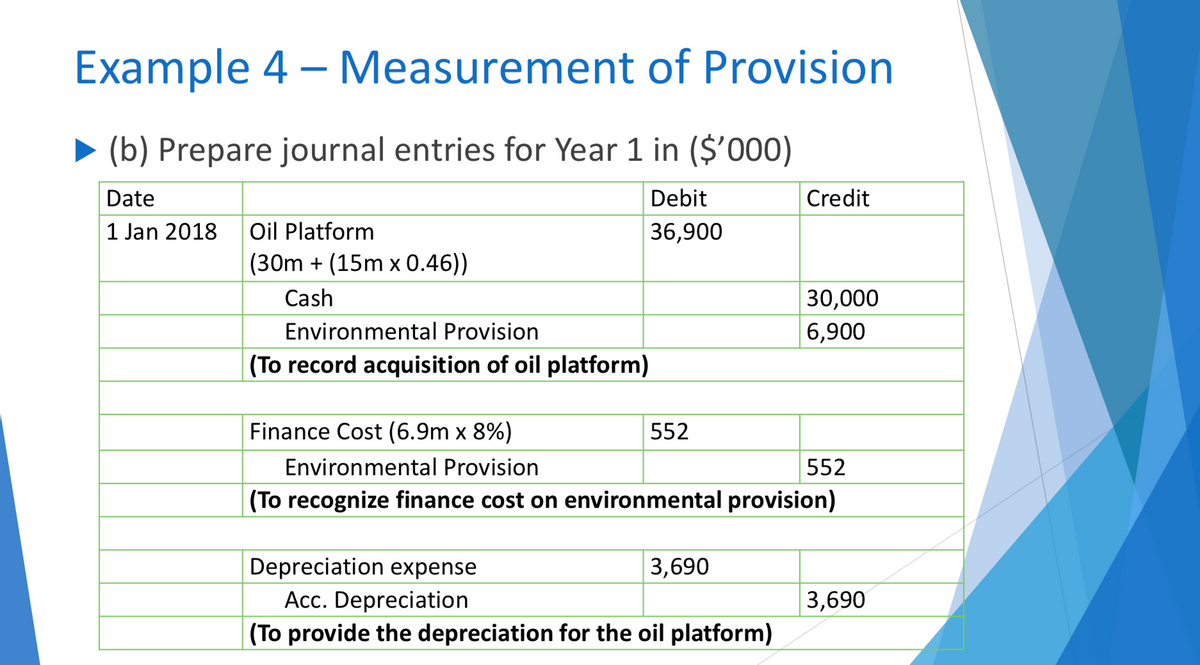

Example 4 - Measurement of Provision ▶ On 1 January 2018, SDN Limited acquired a newly constructed oil platform at a cost of $30 million together with the right to extract oil from an offshore oilfield under a government licence. ▶ The terms of the license are that SDN will have to remove the platform (which will then have no value) and restore the sea bed to an environmentally satisfactory condition in ten year's time when the oil reserves have been exhausted. Example 4 - Measurement of Provision ► According to experts' report, the estimated cost of this on 31 December 2027 will be $15 million. The present value of $1 receivable in ten years at the appropriate discount for SDN of 8% is $0.46. (a) Should SDN Limited recognize a provision? (b) Prepare the journal entries for the year ended 31 December 2018 Example 4 - Measurement of Provision (b) Prepare journal entries for Year 1 in ($'000) Date 1 Jan 2018 Oil Platform (30m (15m x 0.46)) Cash Environmental Provision (To record acquisition of oil platform) Finance Cost (6.9m x 8%) Environmental Provision Debit 36,900 Credit 30,000 6,900 552 552 (To recognize finance cost on environmental provision) Depreciation expense Acc. Depreciation 3,690 (To provide the depreciation for the oil platform) 3,690

Example 4 - Measurement of Provision ▶ On 1 January 2018, SDN Limited acquired a newly constructed oil platform at a cost of $30 million together with the right to extract oil from an offshore oilfield under a government licence. ▶ The terms of the license are that SDN will have to remove the platform (which will then have no value) and restore the sea bed to an environmentally satisfactory condition in ten year's time when the oil reserves have been exhausted. Example 4 - Measurement of Provision ► According to experts' report, the estimated cost of this on 31 December 2027 will be $15 million. The present value of $1 receivable in ten years at the appropriate discount for SDN of 8% is $0.46. (a) Should SDN Limited recognize a provision? (b) Prepare the journal entries for the year ended 31 December 2018 Example 4 - Measurement of Provision (b) Prepare journal entries for Year 1 in ($'000) Date 1 Jan 2018 Oil Platform (30m (15m x 0.46)) Cash Environmental Provision (To record acquisition of oil platform) Finance Cost (6.9m x 8%) Environmental Provision Debit 36,900 Credit 30,000 6,900 552 552 (To recognize finance cost on environmental provision) Depreciation expense Acc. Depreciation 3,690 (To provide the depreciation for the oil platform) 3,690

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 14RE: (Appendix 11.1) Auburn Company purchased an asset on January 1, Year 1, for 150,000. The asset has a...

Related questions

Question

what is the 0.46 means? Why 15m need to times the 0.46? What is the answer means?

What is the 552 means? Why it need to times the 6.9m with 8%?

Transcribed Image Text:Example 4 - Measurement of Provision

▶ On 1 January 2018, SDN Limited acquired a newly

constructed oil platform at a cost of $30 million together

with the right to extract oil from an offshore oilfield under a

government licence.

▶ The terms of the license are that SDN will have to remove

the platform (which will then have no value) and restore the

sea bed to an environmentally satisfactory condition in ten

year's time when the oil reserves have been exhausted.

Example 4 - Measurement of Provision

► According to experts' report, the estimated cost of this on

31 December 2027 will be $15 million.

The present value of $1 receivable in ten years at the

appropriate discount for SDN of 8% is $0.46.

(a) Should SDN Limited recognize a provision?

(b) Prepare the journal entries for the year ended 31

December 2018

Transcribed Image Text:Example 4 - Measurement of Provision

(b) Prepare journal entries for Year 1 in ($'000)

Date

1 Jan 2018 Oil Platform

(30m (15m x 0.46))

Cash

Environmental Provision

(To record acquisition of oil platform)

Finance Cost (6.9m x 8%)

Environmental Provision

Debit

36,900

Credit

30,000

6,900

552

552

(To recognize finance cost on environmental provision)

Depreciation expense

Acc. Depreciation

3,690

(To provide the depreciation for the oil platform)

3,690

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning